Bitcoin (BTC) began the recently of October with a welcome rebound; can BTC cost action cancel its dip from all-time highs?

-

Bitcoin reached $114,500 for the weekly close as bulls staged a much-needed return, however numerous traders stayed skeptical.

-

FOMC week started with stocks breathing a sigh of relief on lowered US-China tariff chances.

-

Continuous rate cuts might enhance BTC cost action by default, according to research study, as AI forecasts a go back to $125,000.

-

” Uptober” 2025 for Bitcoin might prevent getting the well-known title of “worst October ever.”

-

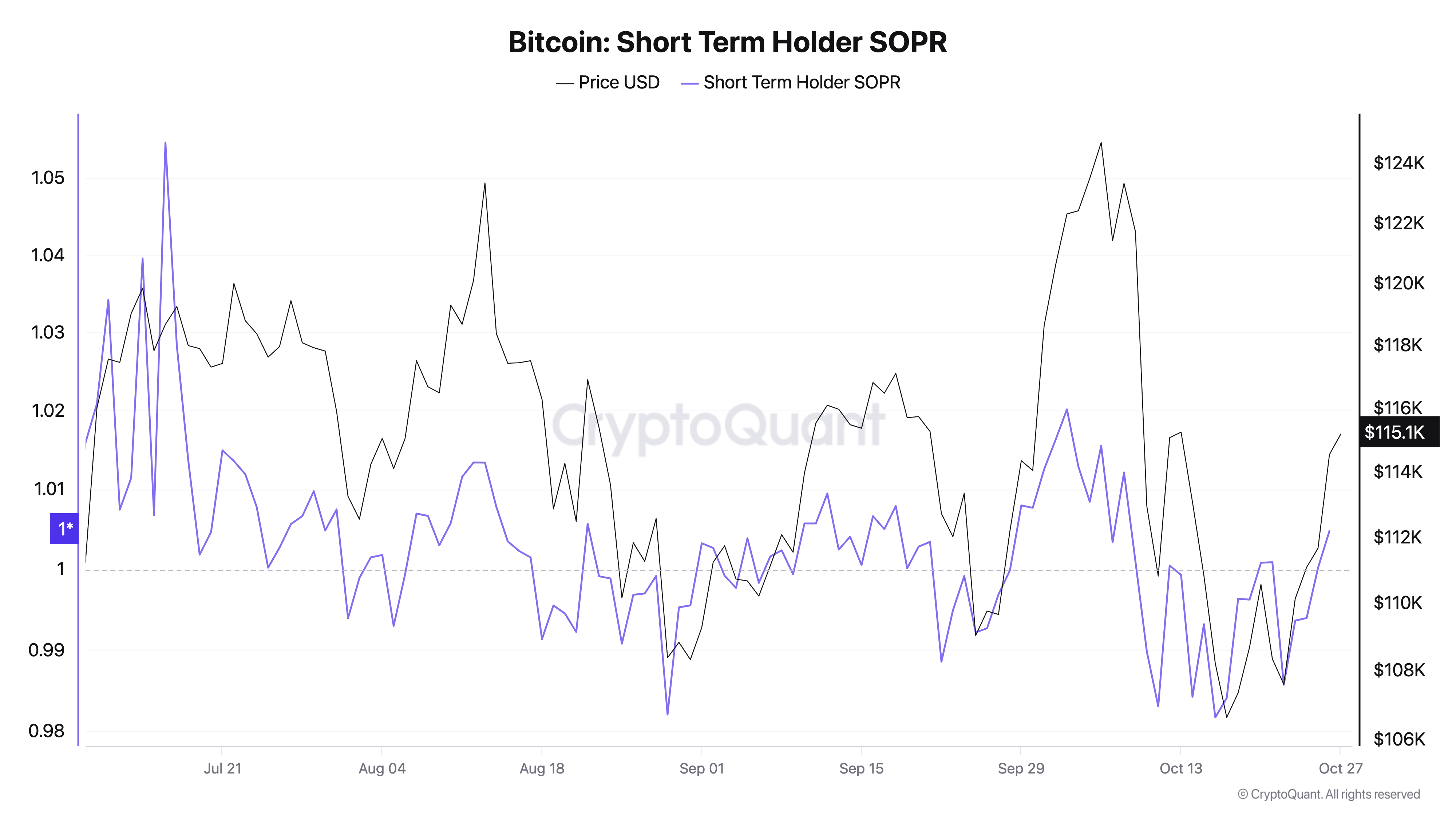

Short-term holders are back in revenue, with space to grow previously striking traditional retracement levels.

Bitcoin cost difficulties remain as $115,000 returns

Bitcoin provided for the bulls into the weekly close.

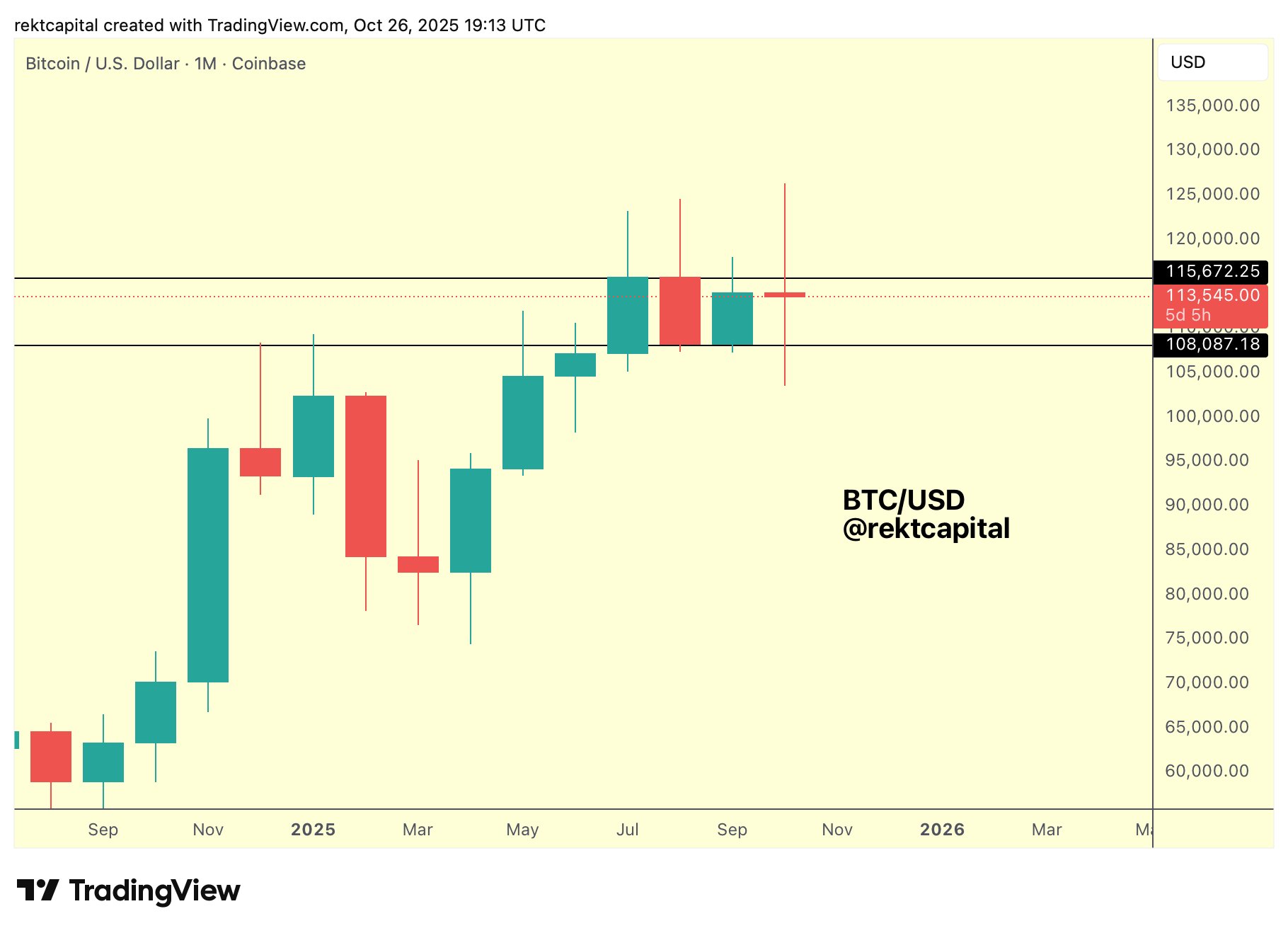

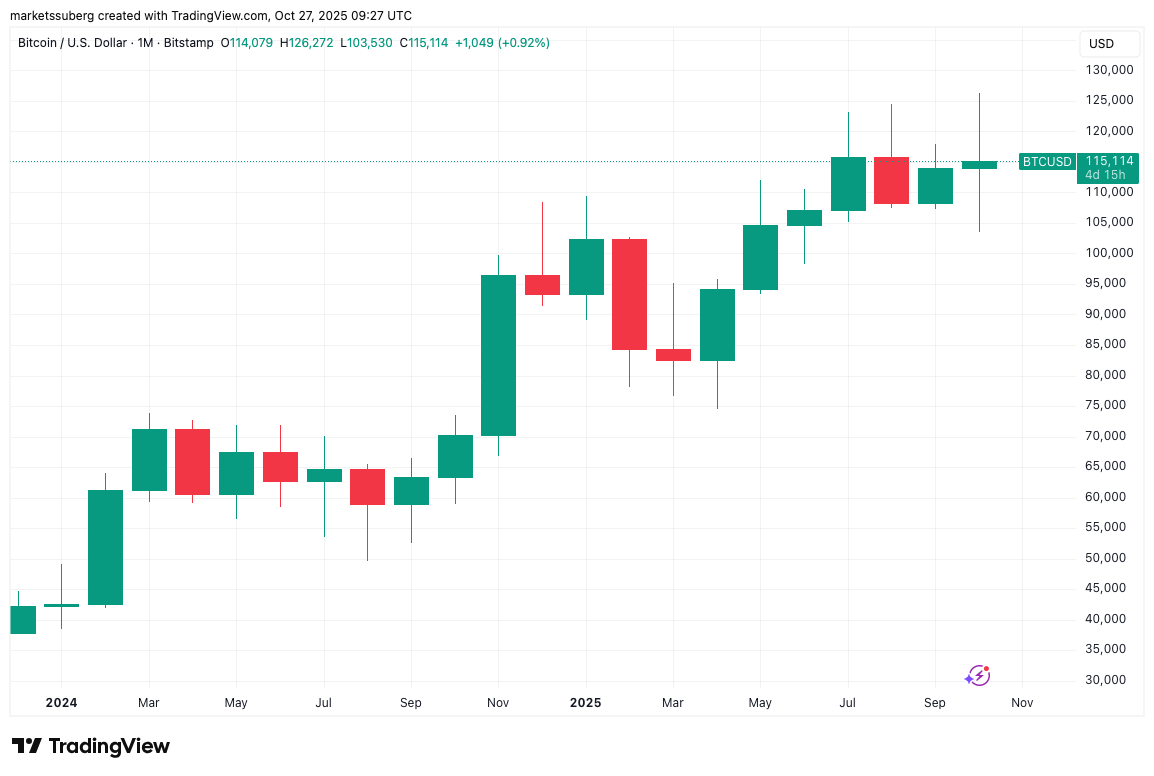

Information from Cointelegraph Markets Pro and TradingView reveals BTC/USD sealing a rebound to $114,500 and recovering the 21-week rapid moving average (EMA).

At the weekend, trader and expert Rekt Capital flagged that pattern line as an essential level to hold moving forward.

Bitcoin is placed for a favorable Weekly Close above the 21-week EMA (green)

The current breakout from the Ascending Triangle on the Daily timeframe has actually allowed this favorable position on the Weekly timeframe$BTC #Crypto #Bitcoin https://t.co/T7WJgk9Uyw pic.twitter.com/4u42pdGTX9

— Rekt Capital (@rektcapital) October 26, 2025

” Bitcoin is taking pleasure in a strong rebound from the Macro Variety Low,” he composed in a post on X Sunday.

” Still simply Macro combining inside this Month-to-month Variety. In reality, Bitcoin has a possibility to turn the September Month-to-month Highs into brand-new assistance by the end of the month.”

Regardless of its excellent healing, Bitcoin still had a hard time to encourage numerous market individuals that the booming market was back.

Amongst them, trader Roman repeated weak point on greater amount of time, low volume and bearish divergences on Bitcoin’s relative strength index (RSI).

” Expecting this prospective HTF Head & & Shoulders bearish turnaround setup. Verifies on a break listed below 109k neck line,” he informed X fans Monday along with the one-week chart.

” I have actually been really determined that HTF is tired and I’m not anticipating greater. We will see if this becomes a turnaround or more combination for greater.”

Trading account HTL-NL positioned BTC/USD in a broadening triangle, arguing that the general circumstance had actually not altered after the uptick.

GM$BTC Still very little to include. Quickly we will see how strong this relocation is, or if we require another down. https://t.co/AOCt5Naqyb pic.twitter.com/nXancsSDzY

— HTL-NL (@htltimor) October 27, 2025

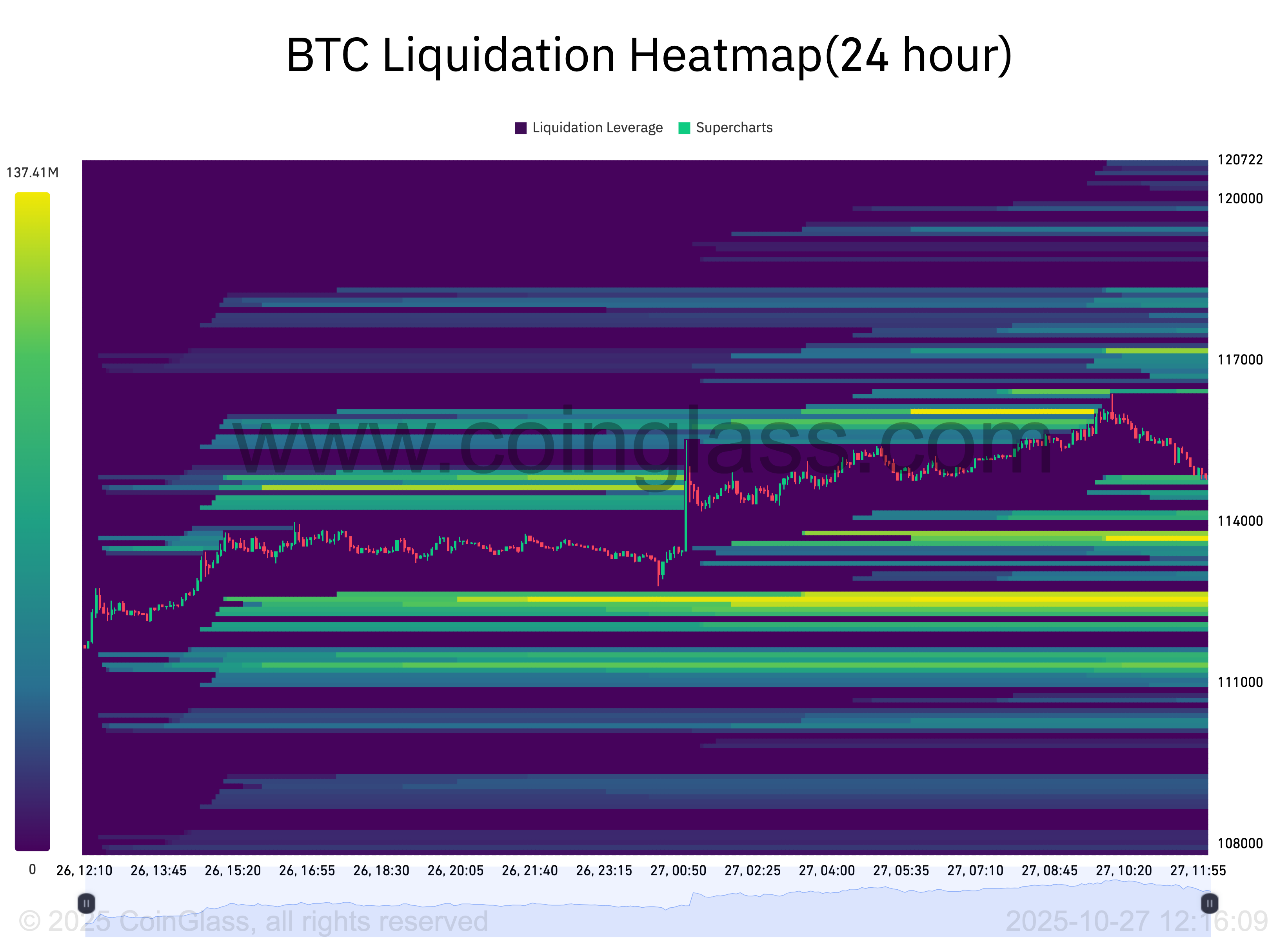

Information from keeping track of resource CoinGlass revealed cost slicing through liquidation levels both above and listed below as volatility returned.

Fed rate cut anticipated as stocks rise

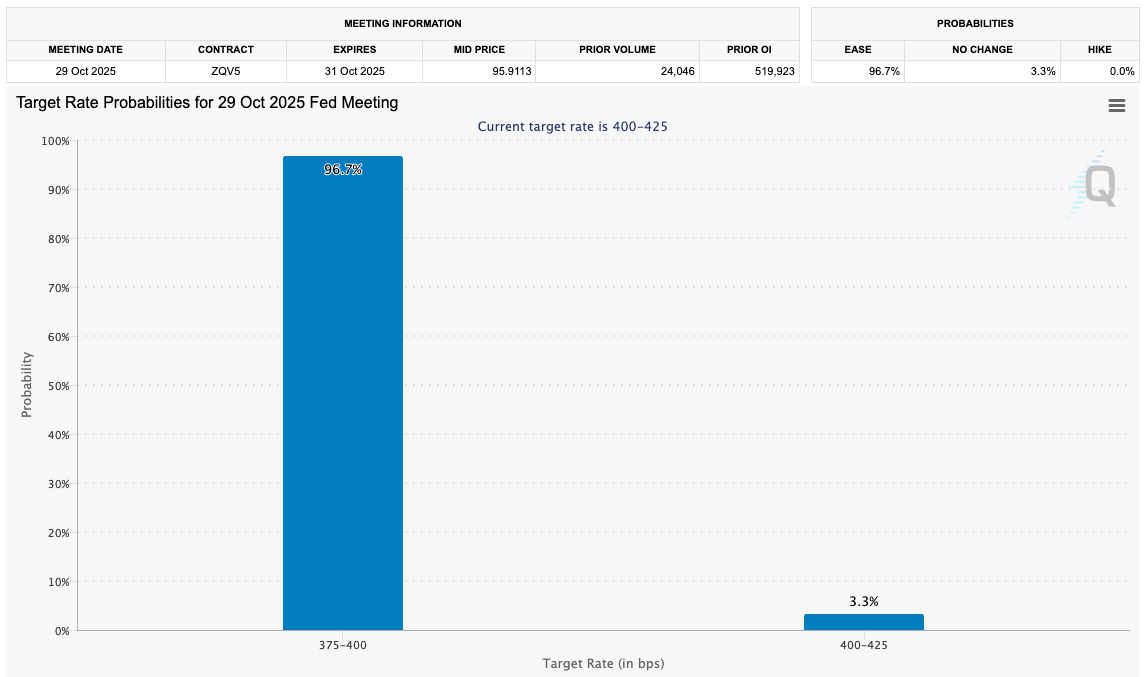

Wednesday’s Federal Reserve interest-rate choice takes spotlight in macroeconomic news today, and markets are banking on favorable results.

Amidst a lack of inflation information due to the federal government shutdown, the Fed has less to go on than normal when it pertains to rates.

That stated, markets are positive that the Federal Free Market Committee (FOMC) will choose a 0.25% cut; information from CME Group’s FedWatch Tool puts the chances at over 95%.

The sole information print that was launched, recently’s Customer Rate Index (CPI), advanced the risk-asset bull case by revealing inflation listed below expectations.

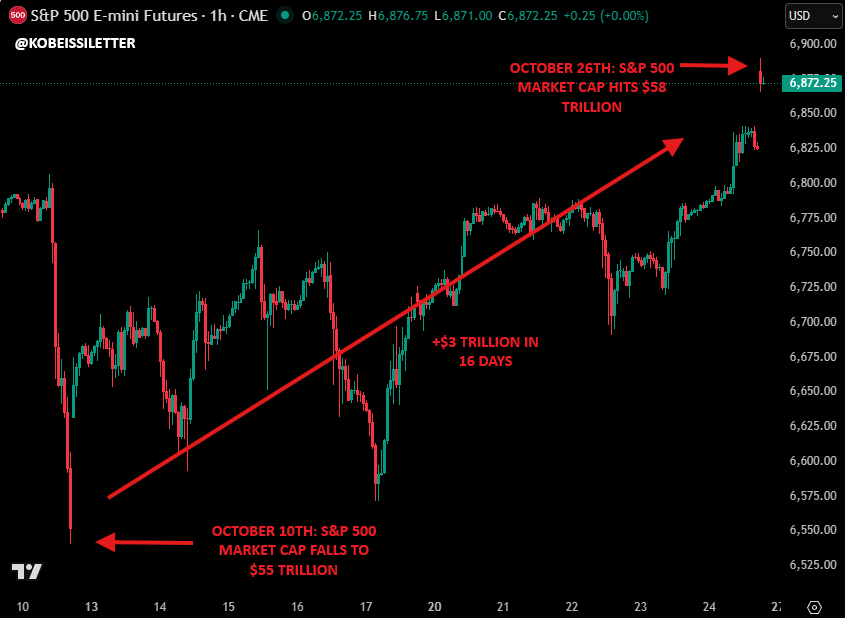

” We have a big week ahead,” trading resource The Kobeissi Letter summed up.

Kobeissi kept in mind that considerable business revenues would contribute to the capacity for market volatility in the coming days, with Microsoft, Meta, Amazon and more due to report.

Another crucial subject on the radar is the US-China trade offer. The danger of tariffs sent out crypto and stocks toppling previously this month, while over the weekend, Washington revealed that an offer was near conclusion.

United States President Donald Trump will meet China’s Xi Jinping Thursday.

Stocks futures rose at the start of the week in action to the news, which eliminated a significant obstacle to the extension of the booming market.

” The S&P 500 has actually now included +$ 3 TRILLION considering that its October 10th low after PresidenTrump’s’s 100% China tariff was revealed,” Kobeissi included.

” This is the most rewarding market of perpetuity.”

AI sees all-time highs possible this month

Advancing the subject of rates of interest, network economic expert Timothy Peterson had more “hopium” for Bitcoin bulls today.

Bitcoin cost cycles, he argued, are straight affected by rate policy; cutting cycles can hence just be an increase to the bull case.

” Rates of interest still expensive, however QE coming,” he anticipated, describing a central-bank liquidity injection technique referred to as quantitative easing (QE).

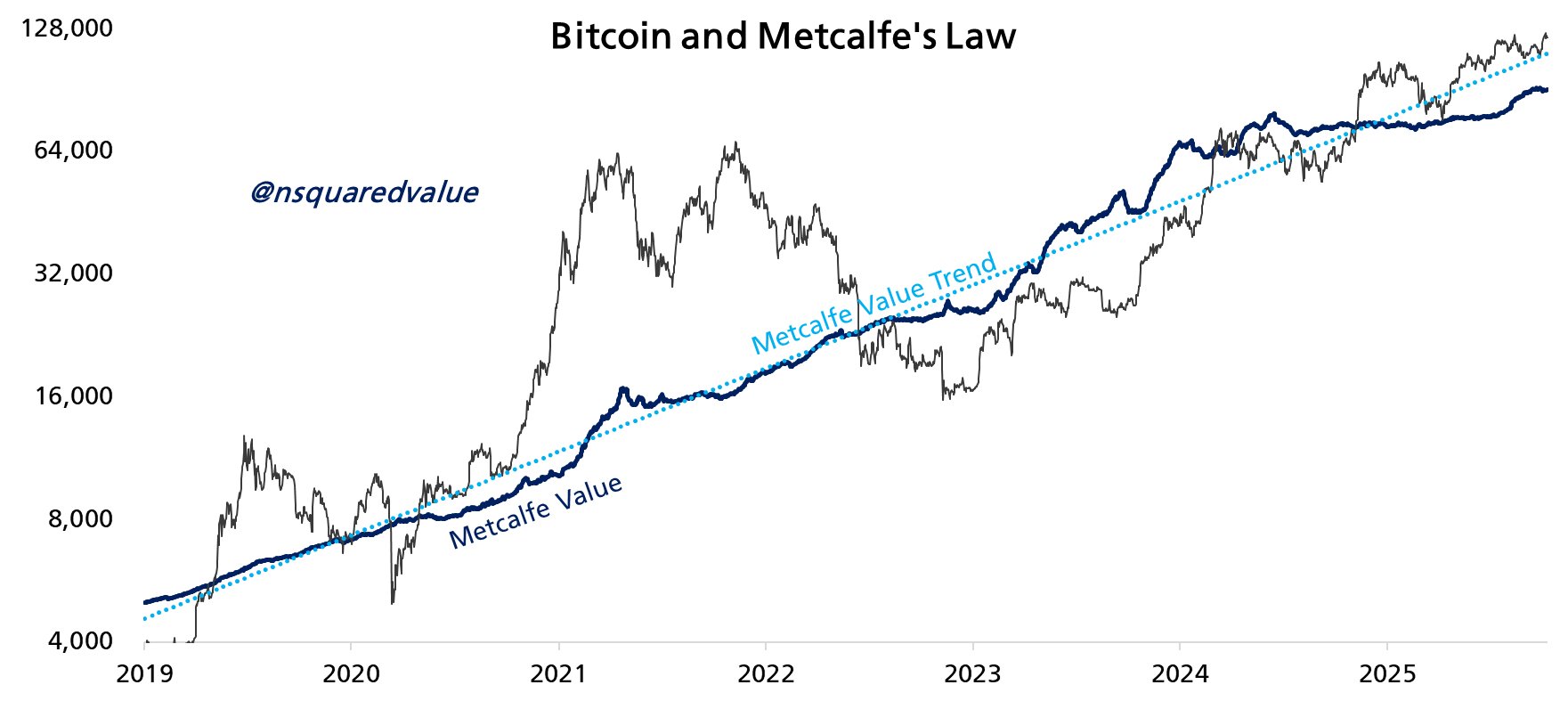

Peterson has actually gotten appeal for his research study into BTC cost development and Metcalfe’s law, connecting the Bitcoin network’s growth to long-lasting cost floorings.

” Addresses/Metcalfe’s Law is how Bitcoin is valued,” he continued.

” This pattern is up. There is no bubble. All dips short-lived, we ultimately go higher.”

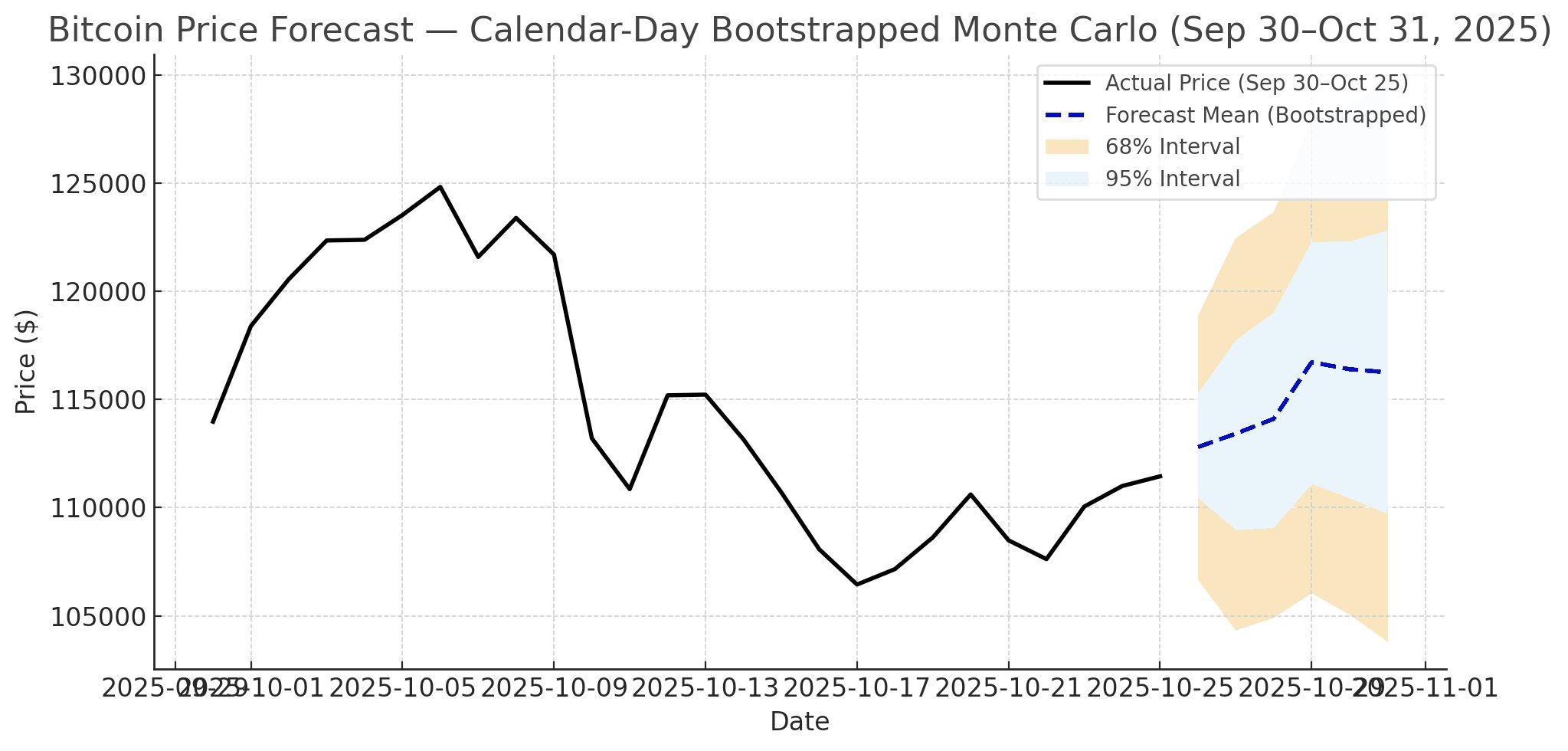

Exposing the current readings from an AI simulation of how BTC cost action might form up in the near term, Peterson set $115,000 as the brand-new centerpiece.

$ 125,000 is on the table as a reputable target before completion of October.

The design’s readings have actually lowered just somewhat as an outcome of the current drawback, which saw BTC/USD briefly touch $102,000 on Binance.

Uptober lastly turns back to “green”

With cost volatility still high, Bitcoin’s 2025 “Uptober” still hangs in the balance.

At $115,000, BTC/USD has to do with 1% greater than its October opening level, assisting prevent a “red” month at the most unforeseen time.

Regardless Of that, this year’s October efficiency is still far from ideal– as Cointelegraph reported, typical gains have actually been 20% considering that 2013.

Market individuals are hence concentrating on a significant return next month.

Uptober was … fascinating.

However we still have Growvember!!!

— Kyle Chassé/ DD (@kyle_chasse) October 27, 2025

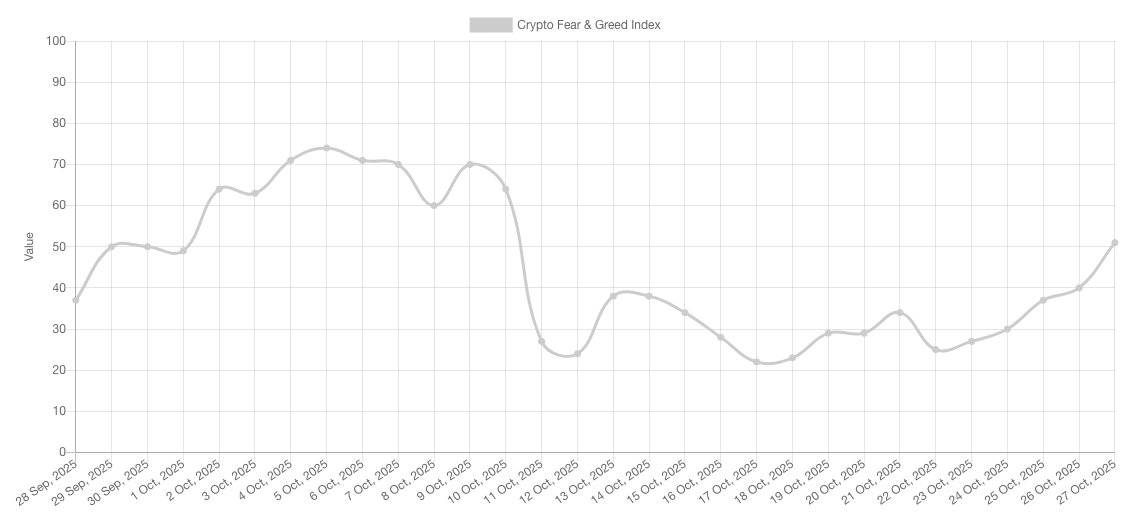

Trader Daan Crypto Trades anticipated an “fascinating” regular monthly close, with belief in both September and October opposing cost action.

” On the other hand, Bitcoin’s cost has actually opened & & closed within a little 8% cost variety throughout the previous 4 months,” he informed X fans.

” A larger relocation is coming at some point. I’m presuming completion of 2025 is going to be more unpredictable than the previous couple of months.”

Information from the Crypto Worry & & Greed Index presently shows that the crypto market belief remains in “neutral” area.

The one-month chart, on the other hand, reveals a fresh record in the making. At $115,750, BTC/USD will accomplish its greatest regular monthly close in history.

Short-term holders back in the black

Out of all the Bitcoin hodlers, current purchasers are probably breathing the most significant sigh of relief today.

Related: Bitcoin flashing ‘unusual’ leading signal, Hayes ideas $1M BTC: Hodler’s Digest, Oct. 19– 25

Short-term holders (STHs)– entities that have actually purchased within the last 6 months– are now back above their aggregate expense basis, near $113,000.

Information from onchain analytics platform CryptoQuant verifies that the Short-Term Holder Revenue Ratio (SOPR) is back above 1, reaching its greatest levels considering that Oct. 8.

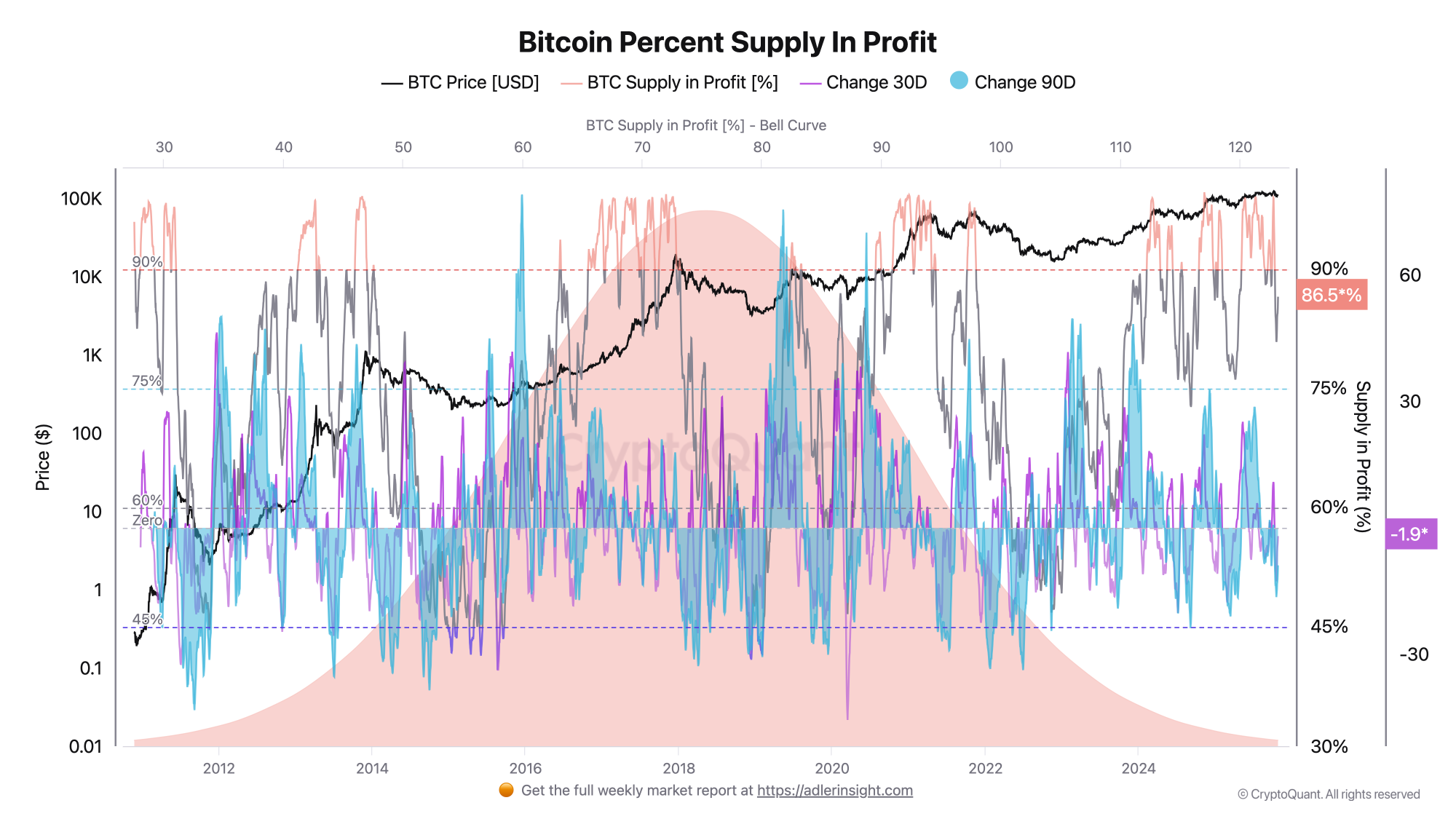

CryptoQuant research study exposes that just recently, general supply in revenue tends to reach 95% before a regional correction.

” These corrections frequently discover a bottom around the 75% limit. More exactly we have actually got 73% on September 2024: 73%, 76% on April 2024 and just recently 81%,” factor Darkfost composed in among its Quicktake post Sunday.

” Now, the portion of supply in revenue is gradually increasing once again, presently around 83.6%, a level that can be translated as motivating, recommending that financiers are as soon as again going to hold their BTC while anticipating more benefit.”

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.