Bitcoin is ending up being progressively unattainable for typical financiers, raising concerns about whether the existing booming market can sustain its momentum beyond the conventional four-year cycle.

Crypto market intelligence business 10x Research study recommended Bitcoin (BTC) is ending up being too pricey for continual retail purchases, an advancement that might threaten the forecasted extension of the existing booming market cycle.

In spite of various require a prolonged market cycle, making use of the conclusions of the 4 previous market cycles is “extremely doubtful,” according to 10x.

” Bitcoin is experiencing reducing returns,” the business specified in a Tuesday report, including:

” While lots of view this as a natural indication of maturity, it raises much deeper concerns about the credibility of the so-called Bitcoin cycle theory.”

Thinking About that Bitcoin is just a 16-year-old property, drawing “firm analytical conclusions” from this brief time is “extremely doubtful,” included 10X Research study.

Related: Arthur Hayes requires $1M Bitcoin as brand-new Japan PM orders financial stimulus

Bitcoin might see $125,000 cycle top, regardless of stock-to-flow design forecasting $1 million BTC

In spite of various forecasting designs, such as the popular stock-to-flow design, which has actually been commonly pointed out as anticipating a Bitcoin rise to $1 million, 10x Research study’s method predicted a cycle top of $125,000 for completion of the year.

The research study company utilized a comparable method to properly anticipate the bearish market bottom that took place in October 2022.

Related: Crypto treasuries siphon $800B from altcoins, and it may be ‘permanently’

10x’s rate target is modest compared to forecasts from other market experts.

Basic Chartered’s worldwide head of digital properties research study, Geoff Kendrick, forecasted a Bitcoin rate of $200,000 for completion of 2025, as the record $19 billion liquidation occasion might become a purchasing chance for financiers, he informed Cointelegraph throughout the 2025 European Blockchain Convention in Barcelona.

In a February interview, Kendrick forecasted that Bitcoin might rise to $500,000 by the time Trump concludes his 2nd term in 2028, Cointelegraph reported.

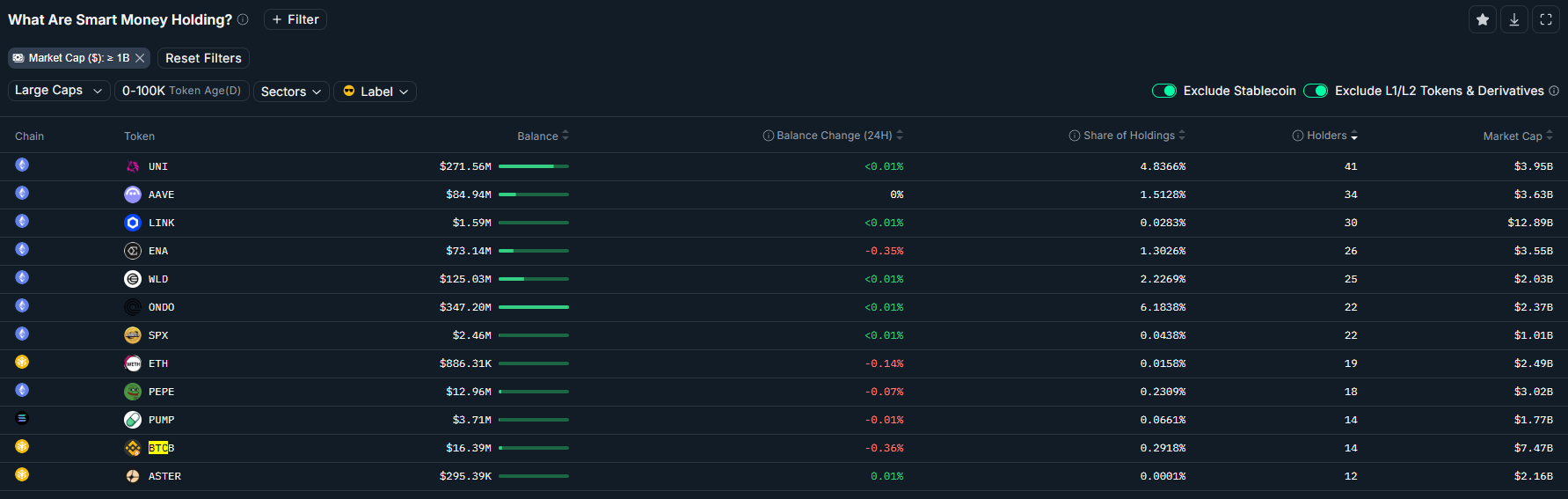

The market’s most effective traders, tracked as “wise cash” traders on Nansen’s blockchain intelligence platform, are likewise looking for increasing Bitcoin direct exposure.

Binance-native Bitcoin (BTCB) was the 11th most-held token by wise cash traders on Tuesday, following some more speculative memecoin holdings such as the Pump.fun (PUMP) token and the Pepe (PEPE) memecoin, information from Nansen programs.

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure develops