Bottom line:

-

Bitcoin reaches $116,000 once again as volatility increases into the United States trading session.

-

Traders diverge on short-term BTC rate action, with targets consisting of $117,000 before Wednesday’s Federal Reserve interest-rates choice.

-

The current CME futures space gains appeal as a disadvantage target.

Bitcoin (BTC) passed $116,000 after Tuesday’s Wall Street open as crypto declined to stop its Uptober return.

FOMC conference injects BTC rate volatility

Information from Cointelegraph Markets Pro and TradingView tracked 1.6% day-to-day BTC rate upside taking BTC/USD to $116,077 on Bitstamp.

In a relocation that traders discovered significantly unexpected, Bitcoin even bucked the pattern of dropping prior to significant United States inflation occasions– in this case, the Federal Reserve interest-rates choice.

The Federal Free Market Committee (FOMC) was extensively anticipated to cut rates by 0.25% Wednesday, with markets likewise enjoying Fed Chair Jerome Powell’s language for tips over future policy trajectory throughout the subsequent interview.

” Up until now, so great on Bitcoin. It’s well holding up here and doing a small retest after this crypto trader, expert and business owner Michaël van de Poppe responded on X.

” I would presume that we’re bottoming here today which we begin the uptrend in the rest of the week.”

In a different post, Van de Poppe argued that an inverted connection in between Bitcoin and gold was assisting sustain the uptick. The previous dropped to $3,886 per ounce on the day, its most affordable because Oct. 6.

” Gold boiling down and combining is greatly bullish for risk-on properties, consisting of Altcoins,” he composed.

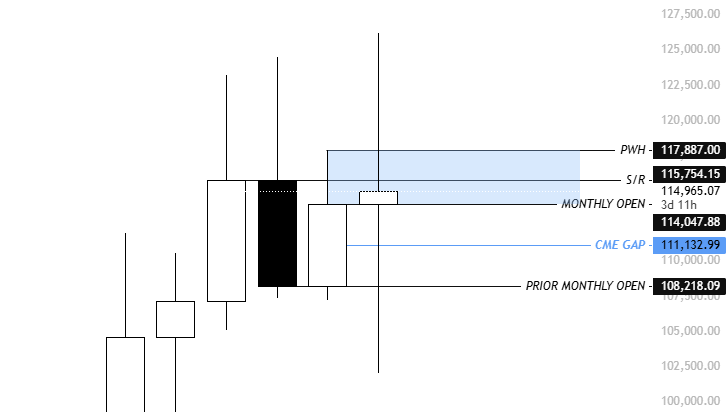

Trader Killa, on the other hand, had $117,000 in mind as part of a pre-FOMC regional top before rate returned lower to fill the current weekend space in CME Group’s Bitcoin futures market near $111,000.

Your welcome. My LTF strategy playing out completely. Bullish story into FOMC. https://t.co/BIGR5q8kR9 pic.twitter.com/U2nsYJUrtv

— Killa (@KillaXBT) October 28, 2025

” CME space as you can see is not that far & & I believe breaking above this blue barrier is going to be a difficulty,” he composed.

” That stated, we have a high possibility of re-visiting 111.2 K.”

$ 111,000 CME space looms big

Lots of market point of views still saw a BTC rate dip at some time before the Fed occasion.

Related: Bitcoin ‘too costly’ for retail, threatens to end booming market cycle

Trader BitBull flagged 2 locations of interest– $106,000 and $110,000– before BTC/USD headed to brand-new all-time highs.

” I’m still anticipating the BTC top is not in, and there’s one huge upper hand left,” he informed X fans.

As Cointelegraph reported, issues over an absence of trading volume and bearish leading indication divergences continue to raise doubts about whether the booming market can continue– or produce fresh all-time highs.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.