Bitcoin (BTC) miners have actually raised $11 billion in convertible financial obligation– business financial obligation that is convertible to stocks– over the in 2015, in the middle of a pivot into expert system information centers.

Miners finished 18 convertible bond offers following the April 2024 Bitcoin halving that slashed the block benefit by 50%, according to TheMinerMag.

The typical convertible bond problem more than doubled, with mining business MARA, Cipher Mining, IREN and TeraWulf each raising $1 billion through single bond concerns. Some offerings have actually included vouchers as low as 0%, indicating financiers’ desire to waive interest payments in exchange for prospective equity benefit.

On the other hand, the majority of convertible bonds released by Bitcoin miners the preceding year varied from $200 million to $400 million.

The mining market diversified into AI information centers to attend to income shortages following the April 2024 halving. Miners continue to fight with a difficult service design, which is impacted by tokenomics, trade policies, supply chain concerns, and increasing energy expenses.

Related: Bitcoin miners construct on gains after Jane Street divulges stakes

Miners brace for hashrate war and energy-hungry AI operations

Miner financial obligation has actually risen by 500% over the in 2015, amounting to $12.7 billion, according to a current report from financial investment supervisor VanEck.

Nevertheless, VanEck experts Nathan Frankovitz and Matthew Sigel kept in mind that these financial obligation levels show a basic issue in the mining market– heavy capital investment on mining hardware that should be updated each year in many cases.

” Historically, miners depend on equity markets, not financial obligation, to money these high capex expenses,” they composed, and called the considerable hardware expenses to stay competitive a “melting ice.”

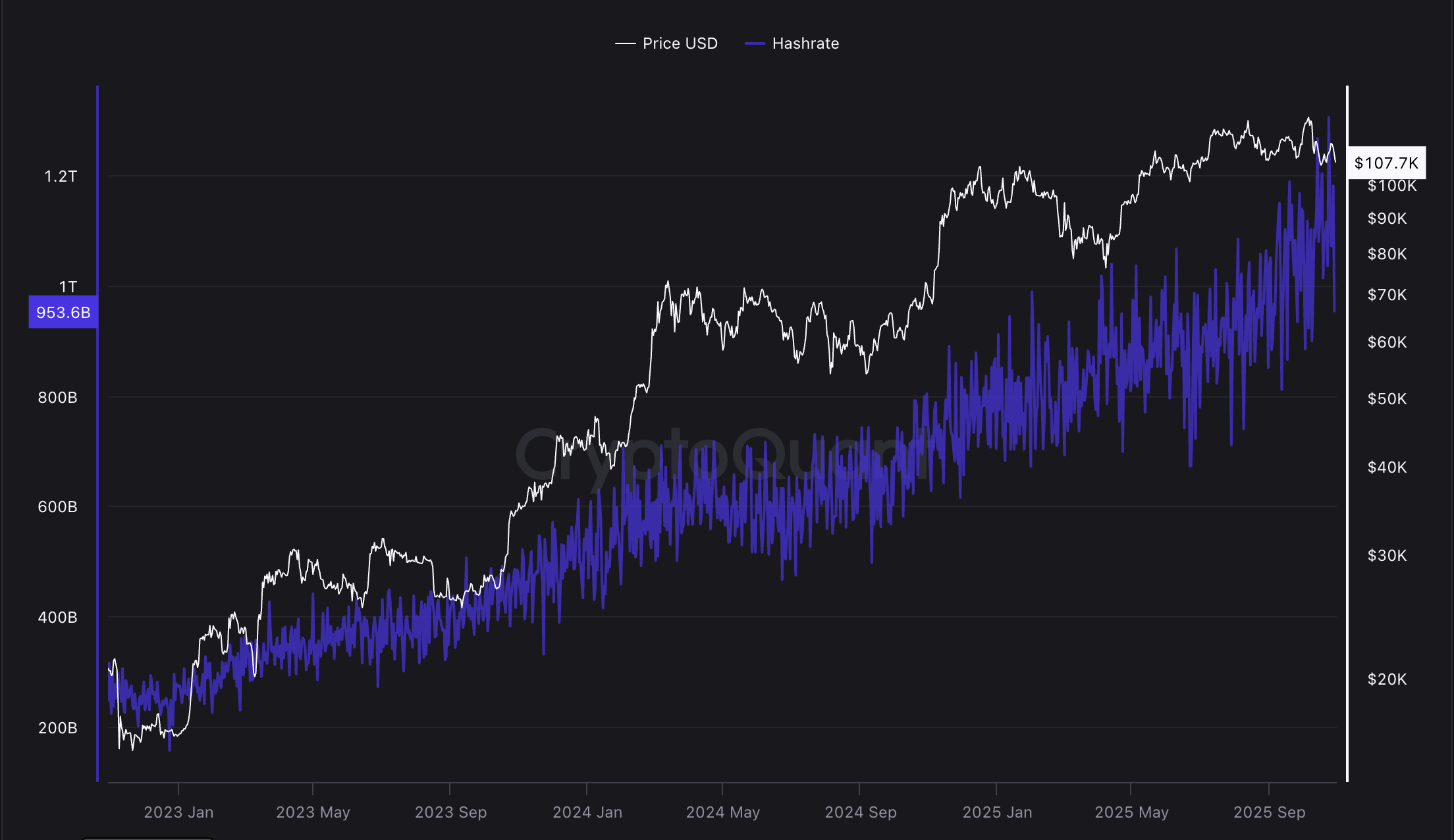

The increasing Bitcoin mining hashrate, the overall quantity of calculating power protecting the Bitcoin network, likewise continues to increase, requiring miners to use up ever-greater computing and energy resources as time goes on.

In October, United States Energy Secretary Chris Wright proposed a regulative modification to the Federal Energy Regulatory Commission (FERC) that would permit information centers and miners to link straight to energy grids.

This would permit these energy-intensive applications to please their energy requires while they function as manageable load resources for the energy grid, balancing and supporting the electrical facilities throughout times of peak need and cutting excess energy throughout low need.

Publication: 7 reasons that Bitcoin mining is an awful service concept