Secret takeaways:

-

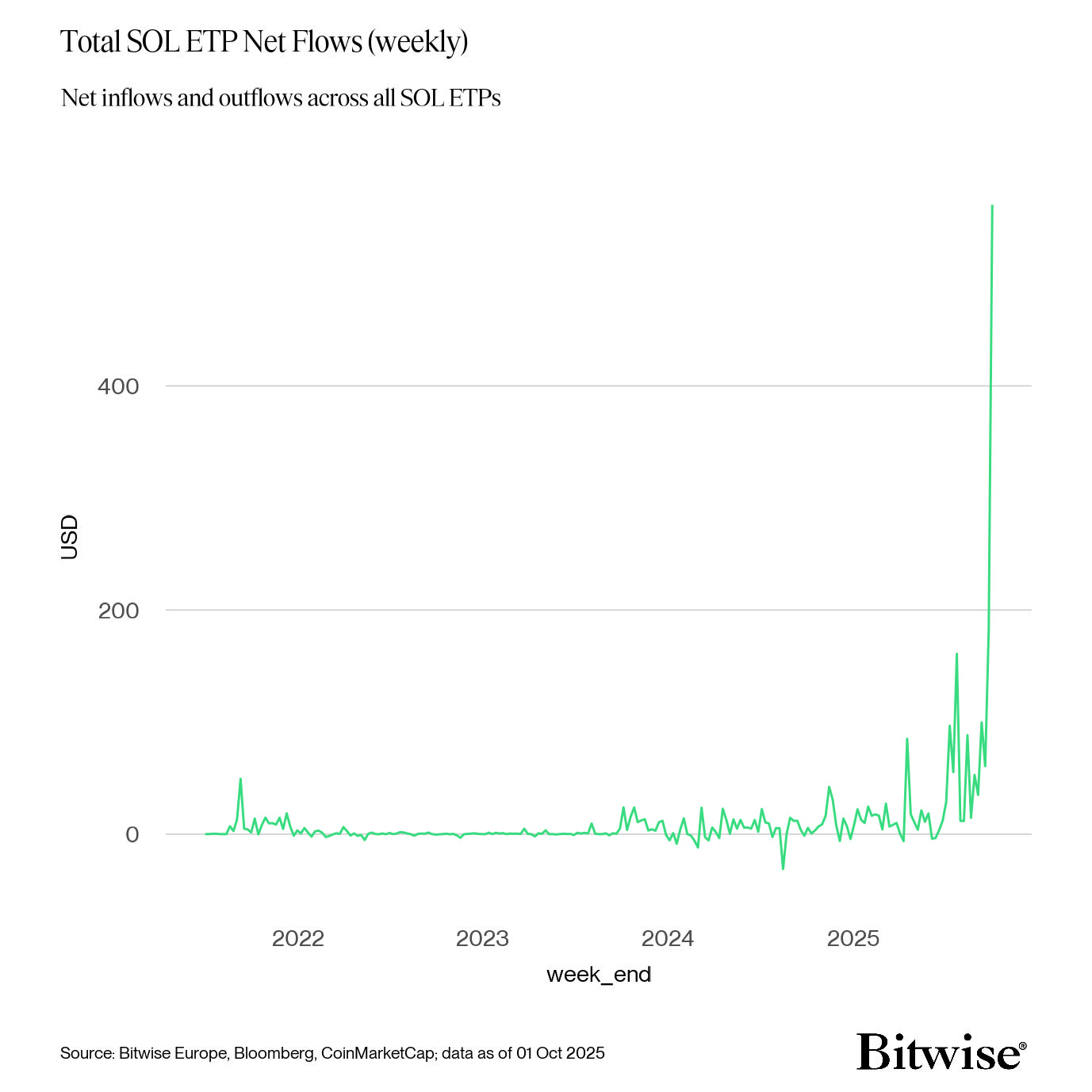

The area Solana ETFs begin strong by drawing over $400 million in weekly inflows.

-

SOL broke its 211-day uptrend, slipping listed below crucial moving averages.

-

Failure to hold $155 might send out SOL cost into the $120–$ 100 variety.

Area Solana (SOL) exchange-traded funds (ETFs) begin their trading journey with strength, publishing record favorable inflows that highlighted institutional need for the network’s native possession.

On Monday, area SOL ETFs taped an everyday high of $70 million in inflows, the greatest considering that launch, taking the overall area ETF inflows to $269 million considering that its launching on Oct. 28.

Information from Bitwise suggested that 2 Solana ETFs, Bitwise’s BSOL United States Equity and Grayscale’s GSOL United States Equity, jointly drew in $199.2 million in net inflows (leaving out seed capital) throughout their very first week.

Bitwise’s BSOL ETF led the charge, collecting $401 million in properties under management (AUM) by Oct. 31. That figure represented over 9% of overall worldwide SOL ETP AUM and 91% of worldwide SOL ETP streams recently. On the other hand, Grayscale’s GSOL United States Equity drew just $2.18 million, representing approximately 1% of overall ETP circulations.

Worldwide, weekly net inflows into Solana ETPs exceeded $400 million, marking the second-highest weekly inflow on record. Bitwise’s Solana Staking ETF (BSOL) was likewise the top-performing crypto ETP internationally, ranking 16th amongst all ETPs throughout possession classes for the week.

Presently, the overall Solana ETP AUM stands at $4.37 billion, with US-listed items representing most of brand-new financial investment. According to Bitwise’s quotes, a $1 billion net inflow might represent a possible 34% boost in SOL’s cost, presuming a beta level of sensitivity of 1.5.

Related: Solana treasury Forward Industries licenses $1B share repurchase

Solana cost breaks crucial sag: Will it drop another 20%?

In spite of the record inflows, SOL’s cost action turned dramatically bearish today, tipping over 16%, dropping to $148.11 on Tuesday, its least expensive level considering that July 9. The correction likewise broke a 211-day uptrend that started on April 7, with the $95 level working as the annual low.

Solana is presently evaluating an everyday order block in between $170 and $156, a location with minimal assistance. The recession has actually pressed the cost listed below the 50-day, 100-day, and 200-day EMAs, signifying possible bearish verification on the everyday chart.

With liquidity lows around $155 now being checked, SOL might stage a mean reversion healing if purchasers protect this zone, specifically as the relative strength index (RSI) strikes its least expensive level considering that March 2025.

Nevertheless, approval listed below $160 and a failure to hold $155 might expose the next drawback target in between $120 and $100, marking a much deeper correction stage unless a short-term rebound emerges quickly.

Related: Hawkish Fed activates $360M in crypto outflows as Solana ETFs buck pattern

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.