Viewpoint by: Thomas Chen, CEO of Function

Bitcoin exchange-traded funds (ETFs) have actually fixed the gain access to problem however stay passive. What is required now are reputable, auditable, institutional-grade paths to transform Bitcoin direct exposure into scalable yield.

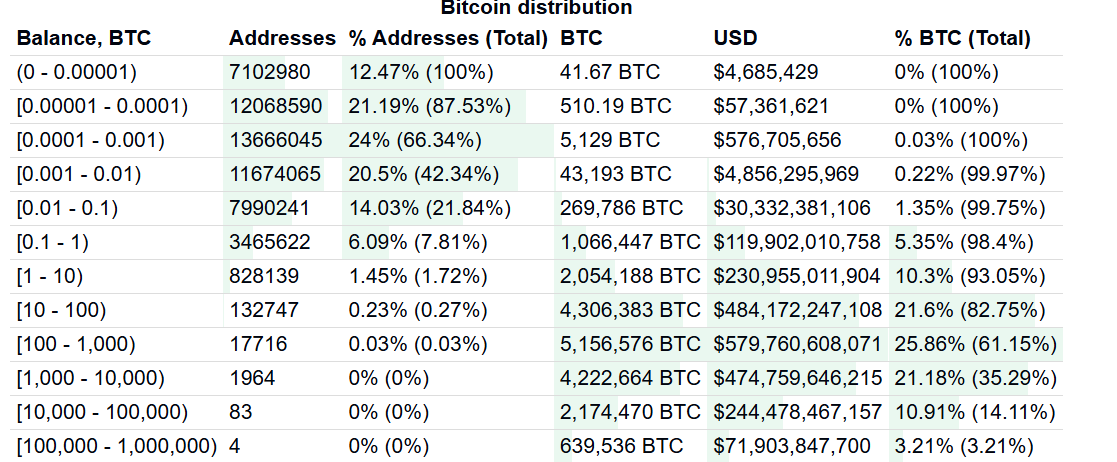

Bitcoin is progressing from a digital shop of worth into a type of efficient capital. Continuing to deal with Bitcoin (BTC) like digital gold– saving it for gratitude over the long term– misses its real chance as a reserve property for the digital age.

Bitcoin isn’t just a shop of worth; it is programmable security. It is efficient capital. It is the base layer for institutional involvement in onchain financing.

The liquidation occasion of Oct. 10 happened due to the failure to perform a core risk-management function effectively. On the other hand, this occasion likewise showed that Bitcoin yield jobs highlighting security and simpleness will win through. As volatility increased, Bitcoin yield jobs saw a boost in arbitrage chances in the market as spreads expanded. Market-neutral methods that didn’t handle a great deal of utilize had the ability to weather and really outshine as they benefited on the marketplace dislocation.

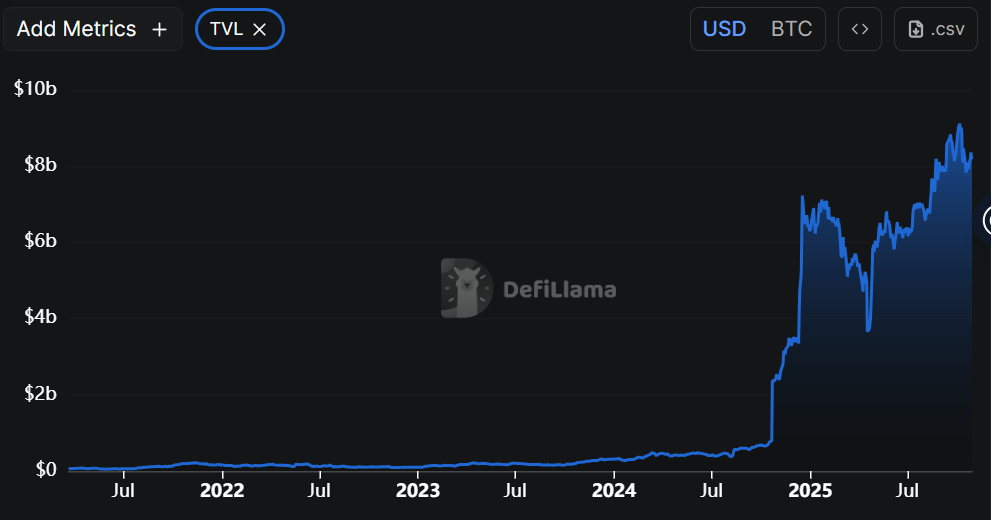

Composable, capital-efficient facilities has actually developed, and transparent and auditable yield paths now exist. Institutional release structures have actually developed, both in technical and legal methods. Yet the majority of the Bitcoin held by organizations has the possible to provide far greater yields.

Bitcoin as efficient capital

Method’s management group has actually had the ability to economically craft BTC acquisition with skill. The very same might not hold for other BTC digital property treasuries. Copytrading Method is not a technique. Ultimately, the BTC build-up stage will pertain to an end, and the BTC release stage will start.

In conventional financing (TradFi) markets, allocators do not park up their properties forever. They turn, hedge, enhance and continuously change them to take full advantage of yield (risk-adjusted). With Bitcoin, nevertheless, allocators are still in the build-up stage, however ultimately, like any other property, they’ll require to begin putting their Bitcoin to work.

What does that mean for allocators? It’s making Bitcoin work like efficient capital with recognized and dependable structures. Believe short-term financing that’s backed by significant security. Additionally, market-neutral basis methods that are not based on Bitcoin’s rate gratitude, providing liquidity on vetted and certified institutional platforms, and conservative or low-risk covered call programs with clear, pre-programmed threat limitations.

Each path needs to be transparent and simple to audit. It needs to be set up for period, counterparty quality and liquidity. The objective isn’t to take full advantage of yield; it’s to enhance it to hedge volatility within the required. If the yield is too low relative to the threat profile, the risk/reward of releasing capital isn’t worth it for lots of, so some liquidity companies (LPs) hold.

What we require is an operating design that enables us to utilize it without breaching compliance requirements, all while keeping it easy. As soon as yield is safe and standardized, the bar shifts, preventing the liability that capital ends up being when idle.

By Q4 2024, over 36 million mobile crypto wallets were active internationally. That’s a record high and an indication of a wider community engagement where retail is discovering to negotiate, provide, stake and make. A comparable circumstance is possible for organizations that hold considerably more capital and run under rigorous requireds. Lots of still regard Bitcoin just as a shop of worth, having not yet completely released its capacity– and by doing so, in a totally certified way.

Turning direct exposure to release

There are strategies to increase crypto allotments amongst institutional financiers, particularly 83%, according to a 2025 study. The allowance development can just reach its complete capacity, nevertheless, if functional requirements are consulted with a strong facilities to support it.

The equipments are currently turning. Arab Bank Switzerland and XBTO are presenting a Bitcoin yield item as some centralized exchanges prepare to introduce their own yield-bearing Bitcoin fund for institutional customers, giving access to structured BTC earnings.

These are early signals, not recommendations. What matters is the instructions of travel: whether yield is provided through creditworthy paths, with segregated properties and clear drawback structures. Organizations desire low-volatility earnings sourced from onchain mechanics, however covered in controls they currently comprehend.

What’s occurring here isn’t speculative; it’s fundamental. Bitcoin is being developed into a programmable facilities, including additional yield paths beyond its currently strong credibility as “digital gold.” It’s no longer a specific niche interest and is being actively pursued by organizations looking for liquidity and low-volatility earnings methods– just this time, they’re onchain.

A noticeable maturation of Bitcoin is happening. It’s undoubtedly a significant structural pattern where efficient properties are winning allowance. What the marketplace requires now is not more gain access to; it’s more methods to utilize Bitcoin proficiently.

Certified facilities substances yield

Updating the requirement to efficiency suggests specifying success in terms that are quantifiable and measurable. Believe in regards to recognized versus suggested yield, slippage and target drawdown tolerance– likewise, funding expenses, security health and time to liquidity under tension.

When the tools exist to release BTC proficiently, sticking to institutional custody, threat management and compliance, the requirement will update and move to efficiency. As not doing anything ends up being the exception, Bitcoin’s function in the economy moves from passive allowance to efficient, yield-bearing capital. Allocators will no longer have the ability to manage to sit idle.

Organizations that fast to execute these modifications in requirements will protect the lion’s share of liquidity, structure and openness that composable facilities deals.

The window to specify finest practice is currently open.

It’s now time to formalize policy, launch little, auditable programs that scale and produce more than simply gain access to. It’s time to turn direct exposure into release in an efficient, transparent and completely certified way, and take the complete capacity of Bitcoin.

Viewpoint by: Thomas Chen, CEO of Function.

This post is for basic details functions and is not meant to be and need to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.