Secret takeaways:

-

Over 21,000 brand-new XRP wallets were developed in 2 days, the fastest development in 8 months.

-

Record decentralized exchange deals accompanied XRP’s rate weak point, meaning non-organic activity.

-

Whale wallet outflows have actually supported after $650 million in selling, recommending a prospective bottom development for XRP.

XRP (XRP) closed Tuesday’s everyday candle light at $2.20, its most affordable level considering that July 4, before rebounding by 16% to $2.40 from the month-to-month lows of $2.06 on Thursday. Regardless of the relief rally, the altcoin continued to have a hard time to gain back bullish supremacy, as more comprehensive belief stays careful.

Nevertheless, onchain information indicated restored activity throughout the XRP Journal. Analytics platform Santiment kept in mind a sharp boost in XRP network involvement, with over 21,000 brand-new wallets developed in simply 2 days, the greatest development rate in 8 months.

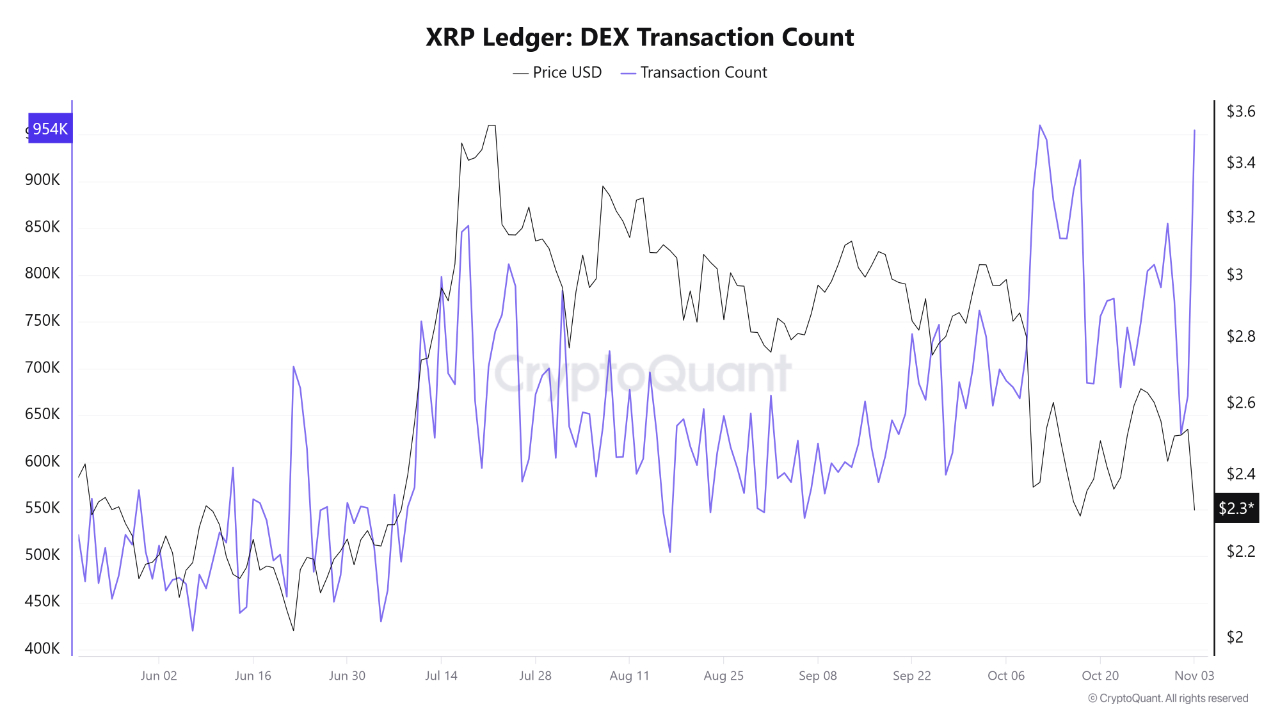

Also, information from CryptoQuant reported record-breaking activity on the XRP Journal’s native decentralized exchange (DEX), with 954,000 deals marking the most active day in current months.

Such a spike normally indicates better network health and adoption, however this time, it accompanied a noteworthy rate decrease, a divergence that raised concerns about the underlying motorists of the activity.

Experts recommend that this detach might show that a substantial part of the deal volume stems from whale circulation, arbitrage or automated trading, instead of natural purchasing.

Related: XRP gets legal acknowledgment as home in India: Why this court judgment matters

XRP whale circulation mean rate stability

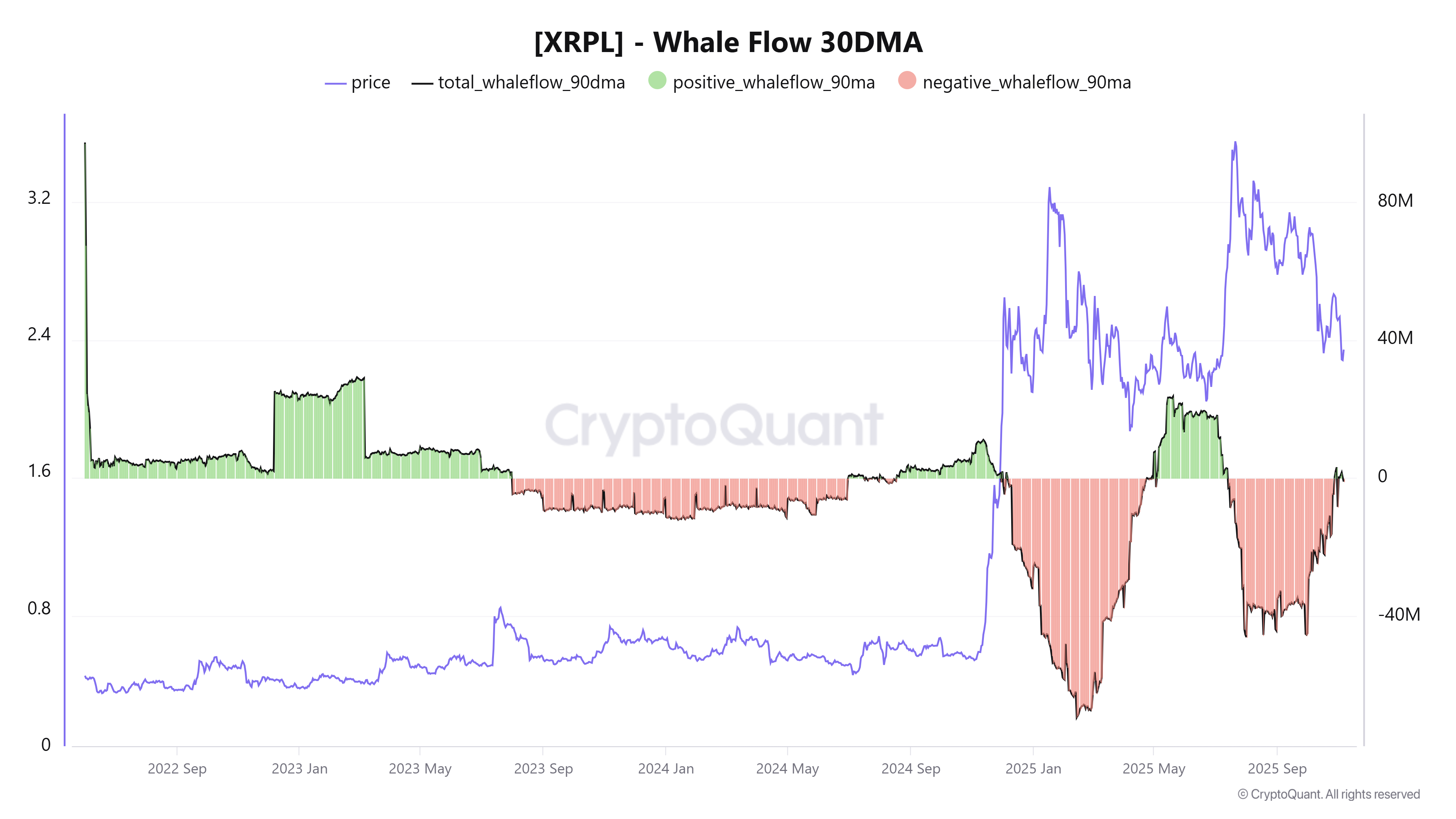

XRP’s rate has actually remained in a continual drop considering that peaking at $3.66 on July 18, a duration marked by consistent whale selling. Over the previous 90 days, XRP tape-recorded unfavorable whale streams surpassing $650 million, showing constant massive outflows.

Nevertheless, current information shows that this pattern might be reversing, as overall whale streams for the 90-day duration have actually turned neutral, possibly signifying early indications of a market bottom.

Crypto expert Crazzyblockk kept in mind that futures information on Binance likewise showed a plain contrast in between XRP and significant cryptocurrencies. While Bitcoin and Ether futures saw substantial open interest decrease to $59.87 million and $148.69 million, respectively, while XRP’s futures placing stayed relatively resistant.

” Traders seem turning into XRP,” the expert stated, “utilizing small dips to build up positions, in plain contrast to the risk-off belief controling BTC and ETH markets.”

With whale selling relieving and brand-new wallet development speeding up, XRP’s onchain and derivatives information mean a possible stabilization stage, though verification from rate action stays crucial.

Related: XRP rate flashes traditional ‘concealed bullish divergence.’ Is $5 still in play?

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.