Secret takeaways

-

Bitcoin onchain information exposes that the marketplace might be getting in a macro drop.

-

The mental level at $100,000 stays the primary BTC assistance in the meantime.

Bitcoin (BTC) was up to four-month lows of $98,900 on Tuesday, as experts stated that BTC was “transitioning into a bearishness.”

Information from Cointelegraph Markets Pro and TradingView revealed that Bitcoin cost action had actually developed a brand-new variety on lower amount of time, and market observers were enjoying the following crucial assistance levels listed below.

Bitcoin is getting in bearish market

Personal wealth supervisor Swissblock stated that the Bitcoin risk-off signal destabilized as offering pressure magnified over the last couple of days.

Swissblock highlighted that the indication is “still within a low-risk program,” as displayed in the chart below.

Related: Bitcoin reveals fatigue as experts state $125K target not likely in 2025

Nevertheless, “if it transitions into a high-risk, it would signify a possible pattern shift,” the personal wealth supervisor stated, including:

” If the indication goes into and remains in a high-risk, it would recommend that Bitcoin is transitioning into a bearishness, marking a structural modification instead of a short-term correction.”

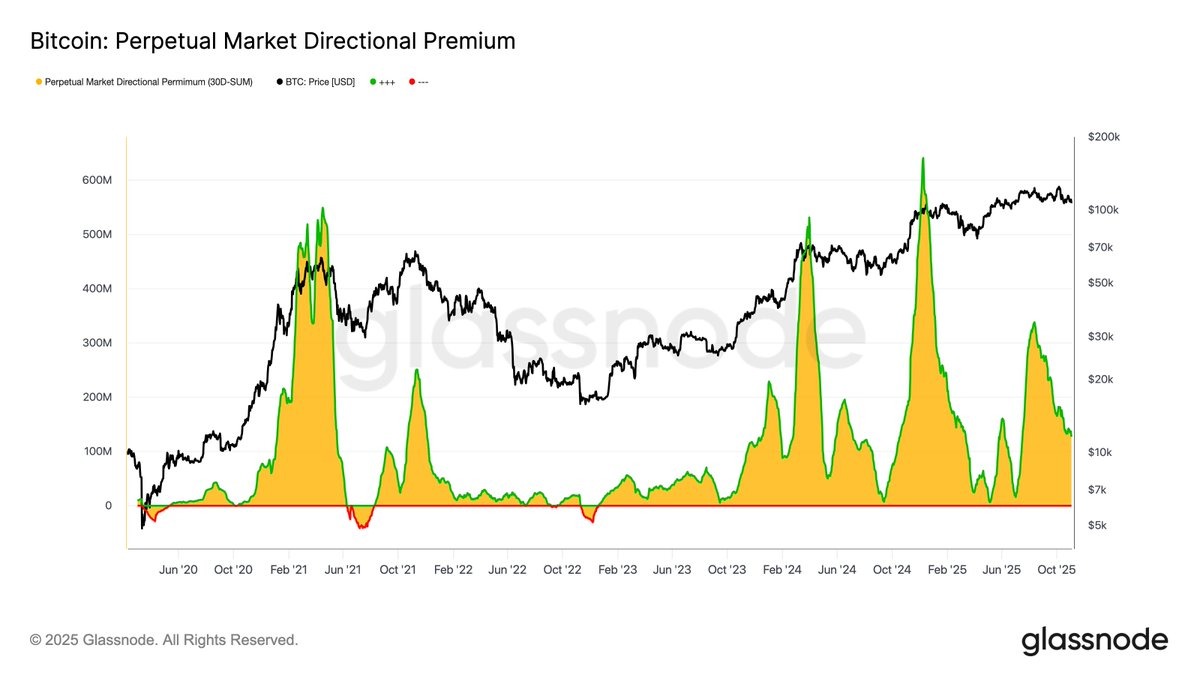

Echoing this observation, onchain information supplier Glassnode explained that the month-to-month financing paid by longs in Bitcoin perpetuals has actually decreased by about 62%, from $338 million monthly in mid-August to $127 million monthly since Tuesday.

This signals lowered bullish utilize, which frequently precedes cost tops and mean a possible bearish shift in the wider market pattern.

Glassnode stated:

” This highlights a clear macro drop in speculative cravings, as traders grow unwilling to pay interest to preserve long direct exposure.”

” Bearishness verified,” stated expert Mikybull Crypto in a Wednesday X post highlighting the breakout of the USDt (USDT) market supremacy from an inverted head-and-shoulders pattern in the weekly timespan.

” Comparable development in previous cycles caused a bearishness,” Mikybull Crypto stated in a follow-up post.

A breakout in USDT supremacy would signify increasing stablecoin choice, suggesting threat hostility and capital leaving BTC and other cryptocurrencies.

This will normally press BTC cost downward in the short-term, showing bearish crypto market belief and possible additional decreases as capital is sidelined.

Enjoy these Bitcoin cost levels next

The most recent sell-off has actually seen the BTC/USD set draw down 20% from its all-time high above $126,000.

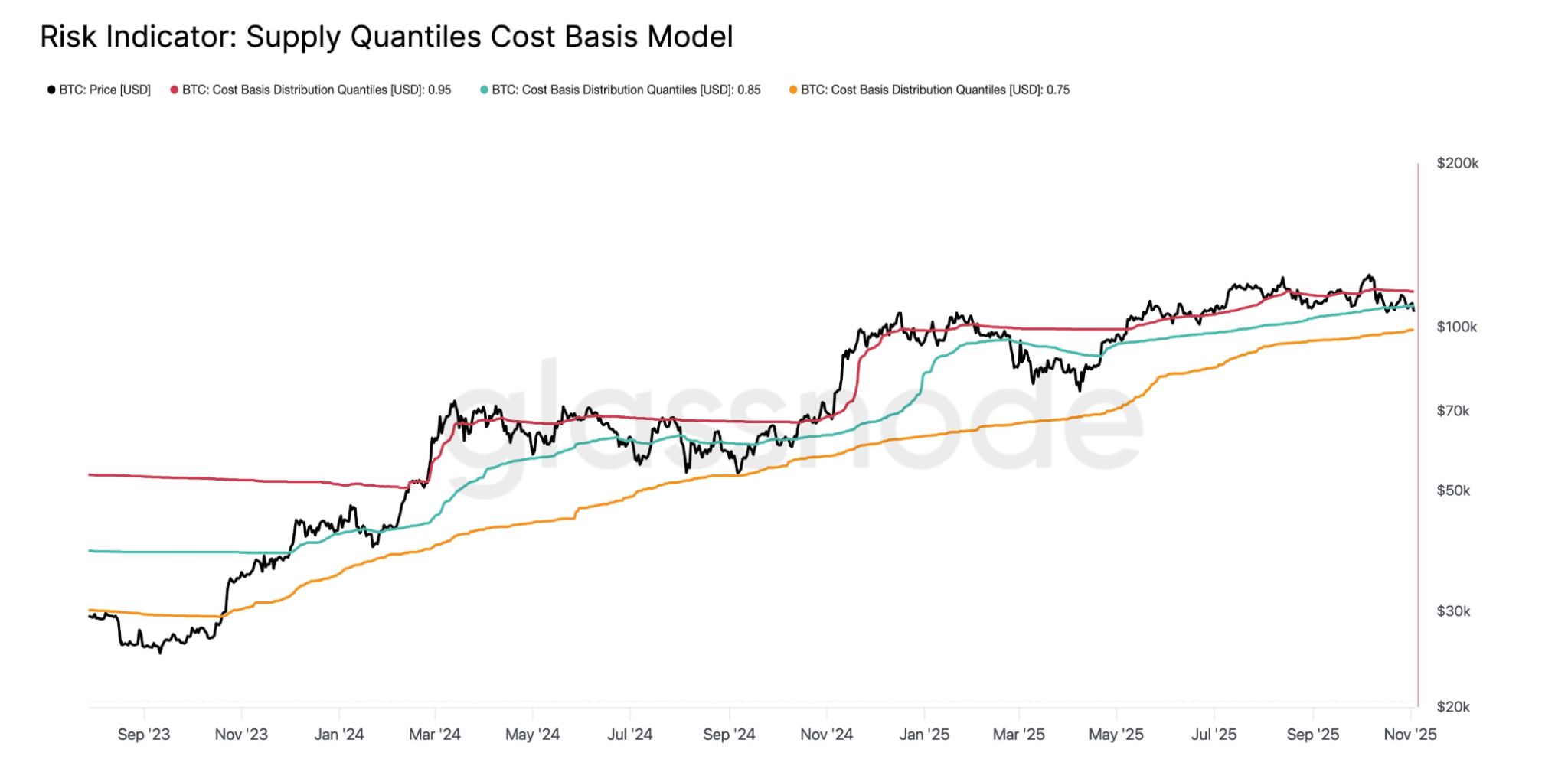

Bitcoin has actually likewise dropped listed below the short-term holders’ expense basis of around $113,00, a structure that has actually traditionally preceded the beginning of a mid-term bearish stage, as current purchasers continue to capitulate.

Bitcoin has now “lost the assistance at the 85th percentile expense basis” around $109,000, stated Glassnode in a Tuesday post on X, including:

” The next crucial level relaxes the 75th percentile expense basis (~$ 99K), which has actually traditionally supplied assistance throughout pullbacks.”

“$ BTC Now broke listed below its 10th of October low,” Trader Daan Crypto Trades stated in a Tuesday post on X, describing the Oct. 10 crypto market crash that sent out Bitcoin to $103,500 in Bitstamp.

” This is the last significant level before the $98K low from the Middle Eastern war fud back in June.”

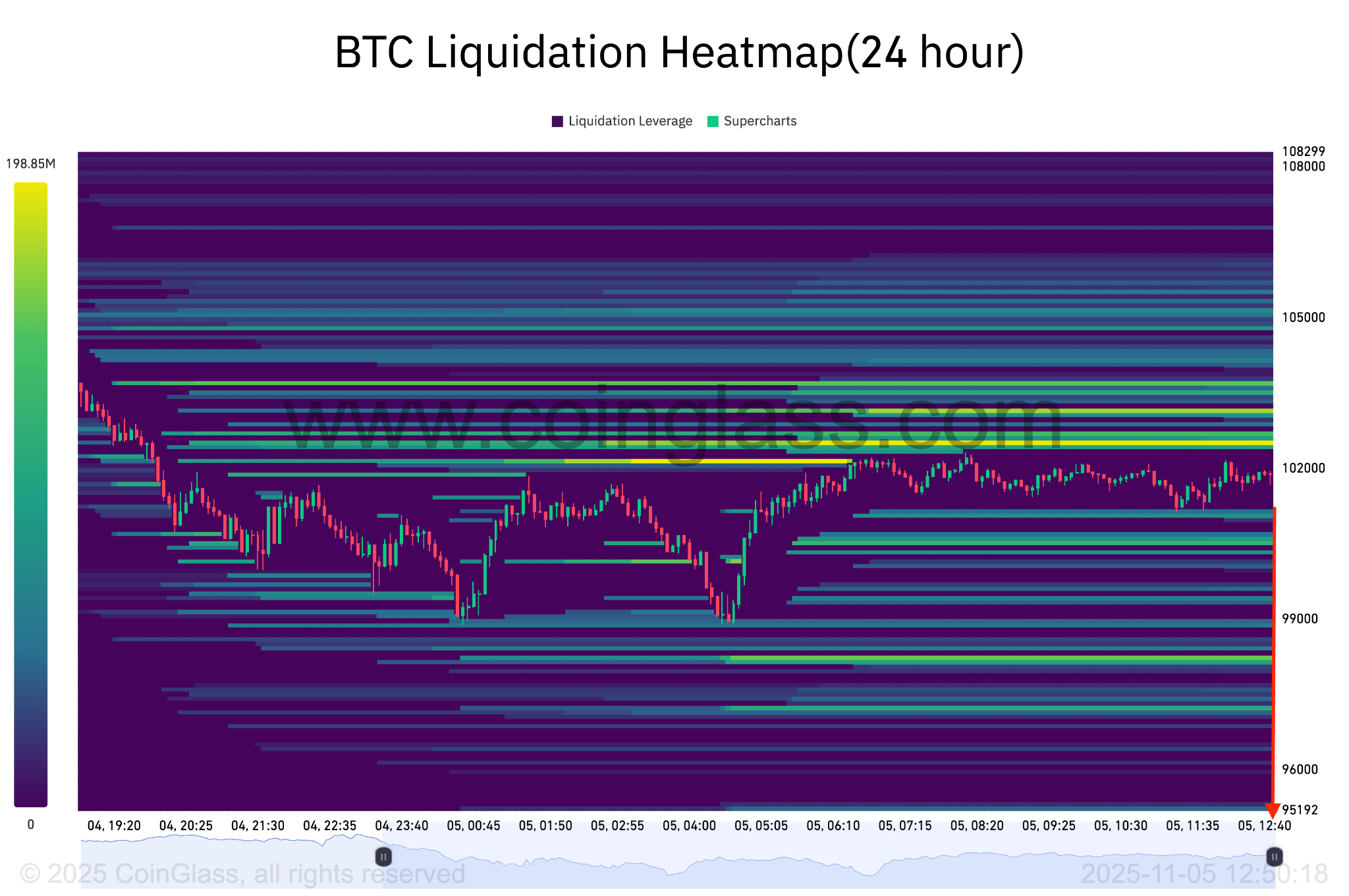

The Bitcoin liquidation heatmap exposes a high concentration of liquidations near the June lows, around $98,000, with the yellow location suggesting a cluster of leveraged positions, recommending it’s a crucial assistance level.

If $98,000 is broken, it might trigger a liquidation capture, requiring brief sellers to close positions and driving costs to $95,000, where the next significant liquidity cluster lies.

On the advantage, ask orders are developing around $102,500, with the next huge cluster in between $103,000 and $105,000.

As Cointelegraph reported, offering by long-lasting Bitcoin holders, capitulation by short-term holders, and a day-to-day candlestick close listed below the $100,000 mental level might press BTC’s cost to as low as $72,000.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.