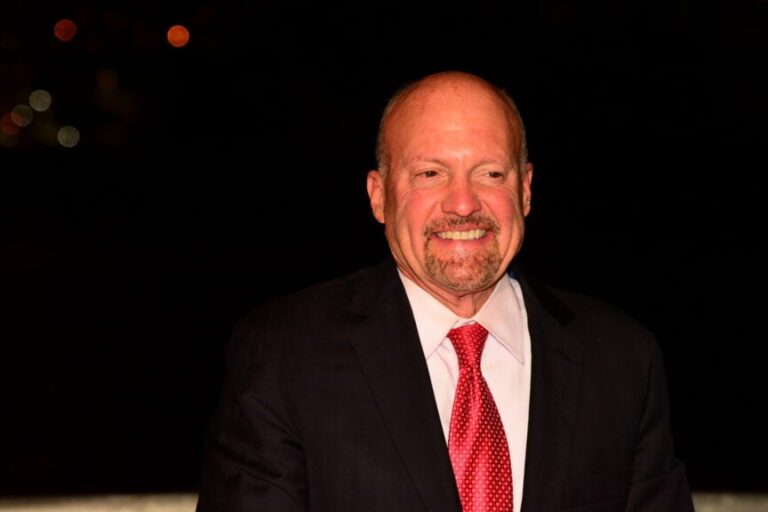

OpenAI’s aggressive push to control the expert system landscape might be revealing indications of pressure, according to CNBC’s Jim Cramer, who alerted that the business’s huge costs spree might check even the greatest bulls in the AI trade.

Cramer Flags ‘Fractures’ In AI Development Story

Cramer required to X to voice issue over the installing expenses connected to the information center boom, stating financiers are now becoming aware of “fractures” in the trade.

” On the one hand, it’s ‘excessive costs, sell,’ and on the other, it is ‘excessive costs, sell,'” he composed. “The truth is that the invest is strong the bulls simply desire OpenAi to invest within its methods. However it does not appear to have enough …”

His remarks highlight growing anxiousness amongst financiers who have actually sustained AI’s stock exchange rally however are now questioning how sustainable the capital-heavy development design truly is.

Simply previously this month, financier Michael Burry— the “Huge Brief” trader who notoriously forecasted the 2008 real estate crash– alerted that today’s AI craze is a speculative bubble similar to the dot-com bust of 2000.

See Likewise: China EV Heat Inspect: Nio, Li Car, XPeng on Fire

OpenAI’s $1.4 Trillion Dedication Raises Warning

OpenAI CEO Sam Altman recently exposed that the business has actually devoted $1.4 trillion over the next 8 years, mostly for information centers, chip purchases and facilities growth.

He anticipates OpenAI to close 2025 with a $20 billion annualized earnings run rate, however confessed that preserving that trajectory takes a great deal of work.

Experts alert that unless OpenAI transforms development into revenue quickly, it might deal with major monetary pressure. “They have actually got to begin producing some major earnings,” TECHnalysis Research study’s Bob O’Donnell informed Yahoo Financing. “That’s the part that has individuals sort of worried.”

Read Next:

Disclaimer: This material was partly produced with the assistance of AI tools and was evaluated and released by Benzinga editors.

Image courtesy: katz/ Shutterstock.com