Secret takeaways:

-

Ethereum holders are back in the black, increasing the opportunities of a rally to $4,000.

-

Ether offer pressure danger exists around $3,800, a resistance level that might postpone the bulls.

Ether’s (ETH) rebound to $3,600 over the weekend pressed its worth above its active understood rate, suggesting that the typical ETH holder is no longer in the red. Is this sufficient fuel for the bulls to press the ETH rate above $4,000?

Ethereum trades above its active expense basis

Information from Cointelegraph Markets Pro and TradingView reveals that Ether’s rate increased 20% to $3,650 on Sunday from its four-month low of $3,050 reached on Nov. 4.

The healing was sustained by Trump’s pledge of $ 2,000 tariff dividend payments and optimism towards the possible end of the United States federal government shutdown. This rebound has actually likewise pressed ETH above its active understood rate, presently at $3,545, according to information from Glassnode.

Related: Ethereum network gas costs drop to simply 0.067 gwei amidst downturn

The typical ETH holder going back to benefit after latent losses supplies significant monetary relief for lots of holders, signifying a bullish outlook.

Historically, breaking above this level moved market belief from “worry,” decreasing sell pressure from undersea holders and motivating holding.

The chart listed below programs that when the rate recovered its active understood rate after briefly dipping listed below it in January 2024, it rallied 89% to $4,100 from $2,165.

Holding above $3,500 is vital for the bulls to guarantee a possible retest at $4,000.

Other essential locations of assistance levels for the ETH/USD set lie around $2,870, $2,530, and $1,800, based upon Ether’s severe variance rates bands.

The ETH bears will protect the $3,800 level

According to Ether’s expense basis circulation information, financiers hold about 4.2 million ETH at a typical expense of in between $3,600 and $3,815, producing a possible resistance zone.

This concentration recommends that lots of financiers might cost breakeven, possibly stalling Ether’s upward momentum.

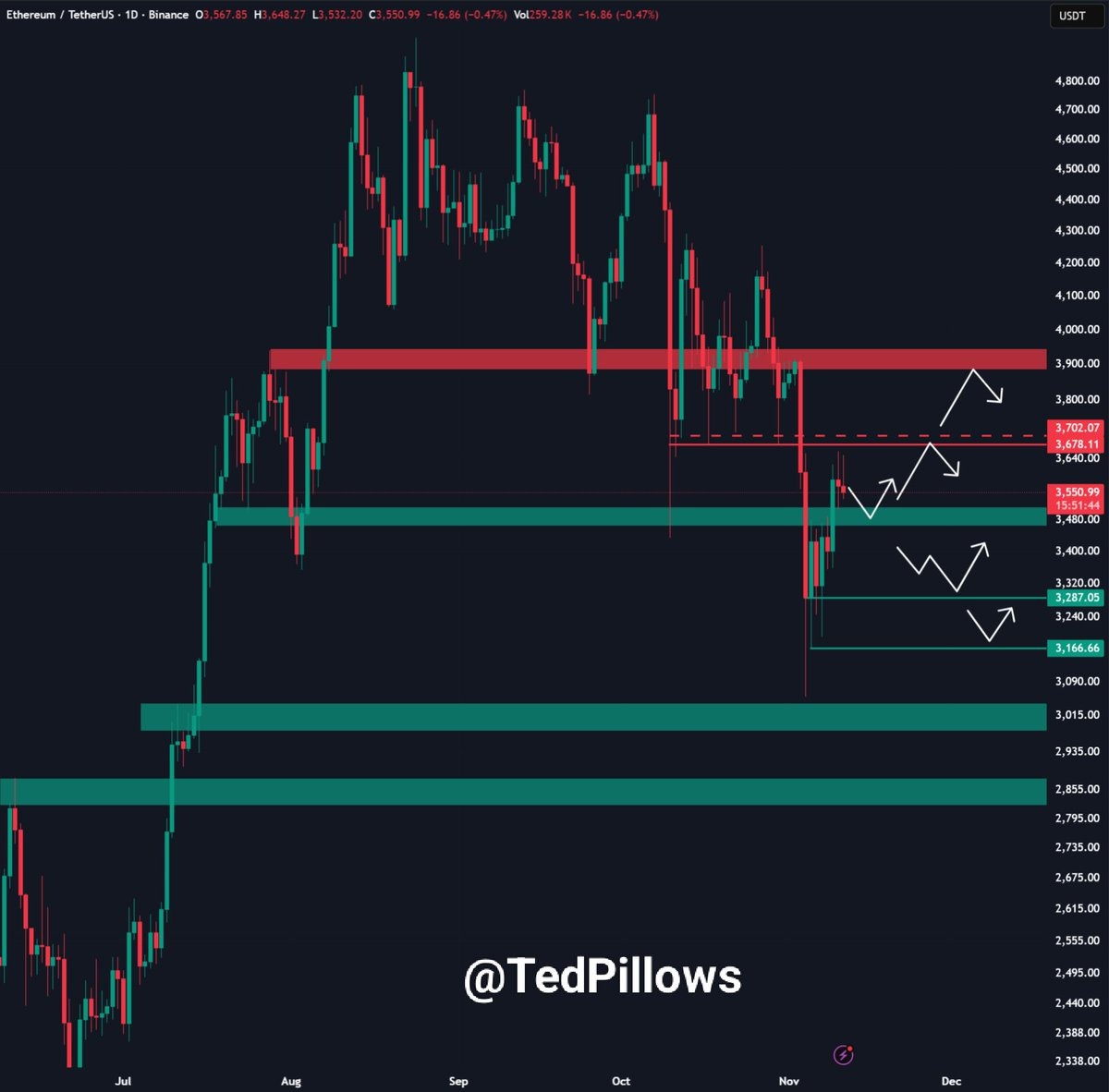

Traders state ETH needs to turn the resistance in between $3,700 and $3,900 into assistance to target greater highs above $4,000.

“$ ETH stopped working to recover the $3,700 level and is now decreasing,” stated crypto expert Ted Pillows in an X post on Tuesday, including:

” In case ETH has the ability to recover the $3,700 level, it’ll tap the $4,000-$ 4,100 liquidity zone.”

Michael van de Poppe stated the ETH/USD set “requires to break the $3,800-3,900 location,” to activate an approach all-time highs.

On the other hand, Jelle stated the bulls require to “action in more” and press the ETH rate to $4,000.

” The earlier we return above $4K, the much better.”

As Cointelegraph reported, Tom Lee’s BitMine accelerated its ETH build-up recently, including 110,288 Ether to its $12.5 billion treasury as it targets 5% of the overall supply.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.