Secret takeaways:

-

Inactive Bitcoin holders moving large amounts to exchanges raises issues about long-lasting self-confidence in the middle of growing issues about the prospective effect of quantum computing.

-

Strong inflows into Bitcoin ETFs stopped working to raise belief, with traders rather turning towards fast-rising personal privacy coins, such as ZEC and DCR.

Bitcoin (BTC) has actually consistently had a hard time to preserve costs above $106,000 because early November, in spite of the S&P 500 sitting 1% listed below a brand-new all-time high. On the other hand, gold, the standard shop of worth, has actually pared its current losses and now trades simply 4% listed below its previous record of $4,380.

Lots of traders state that elements distinct to the cryptocurrency market might be impacting Bitcoin’s efficiency, however are these major adequate to keep BTC from reaching $112,000 once again?

The current fortifying of the United States Dollar Index (DXY) versus a basket of significant currencies shows restored self-confidence in the United States Treasury’s capability to handle its financial difficulties. When financiers fear stagnating development in the middle of relentless inflation– a circumstance frequently referred to as stagflation– the domestic currency usually deteriorates, as financial growth ends up being inevitable.

Because of that, traders frequently highlight the enduring inverted connection in between the DXY and Bitcoin’s cost. By contrast, the United States stock exchange tends to take advantage of a more powerful dollar and lower rate of interest. Lowered loaning expenses raise business appraisals, while beneficial currency exchange rate make imported products more budget friendly when priced in the regional currency.

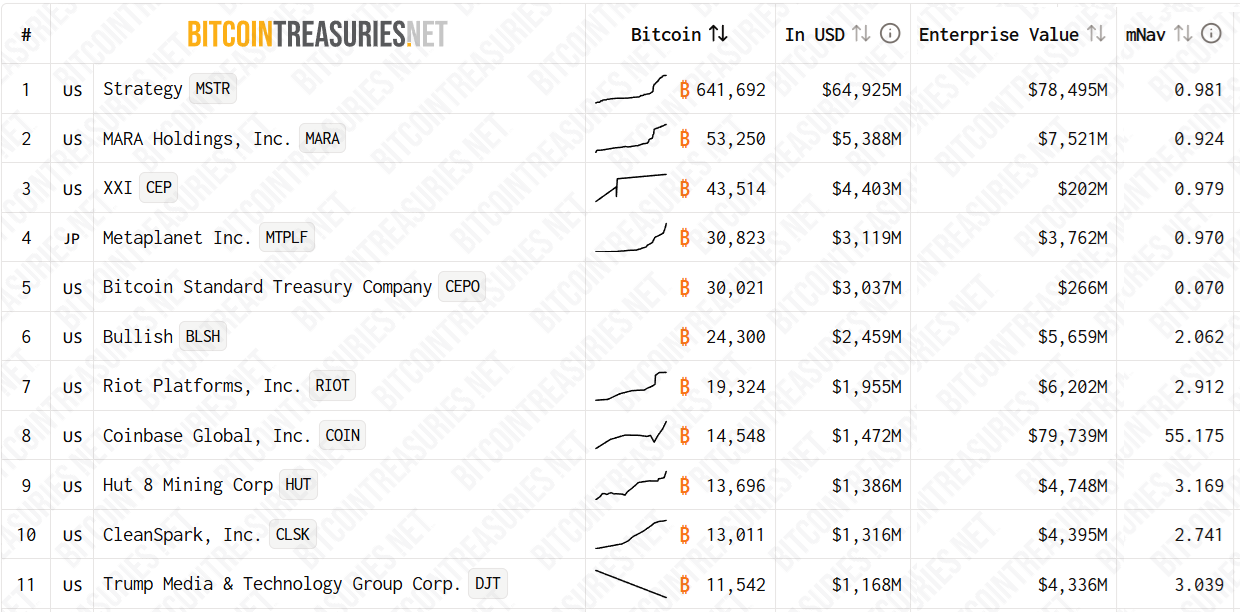

Business pursuing Bitcoin reserve techniques, such as Method (MSTR) and Metaplanet (MTPLF), have actually formerly been amongst the biggest business purchasers, particularly when their shares traded at a premium to their underlying possessions. The mNAV numerous captures this relationship, representing the worth of the Bitcoin held relative to the business’s business assessment.

Bitcoin cost slump removes share issuance reward for business

The current slump in the cryptocurrency market has actually mainly removed this benefit, getting rid of the reward for business to provide extra shares. At present cost levels, any brand-new issuance would water down existing investors, making it an unsightly choice without a significant mNAV premium.

These business can still raise funds through financial obligation or convertible notes, however such funding is usually less helpful for financiers. Financial obligation holders frequently require security, which successfully lowers the quantity of Bitcoin factored into a business’s business worth; therefore restricting prospective mNAV development.

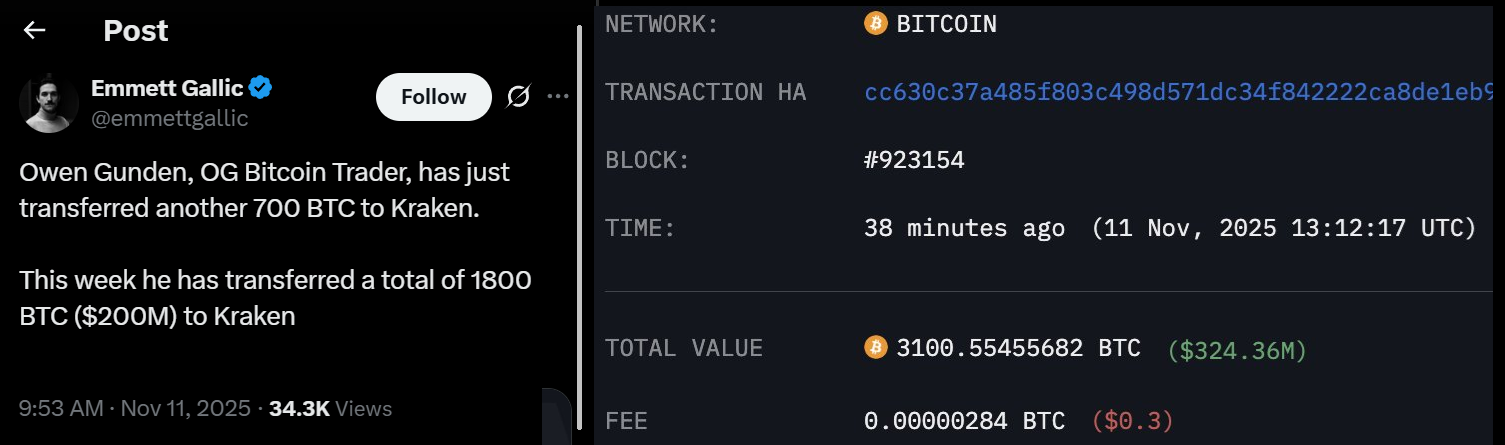

Financier stress and anxiety deepened after long-lasting Bitcoin holders, consisting of those from 2018 or earlier, started offering in the middle of a 20% pullback from the all-time high of $126,220. One popular case is thought to include Owen Gunden, an arbitrage trader from the period of the stopped working Japanese Mt. Gox exchange, who apparently holds more than $1 billion worth of Bitcoin.

In the previous week alone, Owen moved more than 1,800 BTC to the Kraken exchange, valued at over $200 million. While it’s not uncommon for long-dormant addresses to move funds, traders are questioning whether these deals show subsiding long-lasting self-confidence, especially in the middle of growing issues about quantum resistance and the sharp rallies in privacy-focused cryptocurrencies.

Zcash (ZEC) has actually risen 99% over the previous 1 month, followed by a 74% gain in Decred (DCR), a 37% increase in Dash (DASH) and a 22% boost in Monero (XMR). In spite of $524 million in net inflows into Bitcoin area exchange-traded funds (ETFs) on Tuesday, purchaser belief stays soft, leaving the chances of BTC reaching $112,000 in the near term reasonably low.

The selling by long-lasting Bitcoin holders, relentless United States dollar strength and growing interest in privacy-focused tokens are jointly limiting Bitcoin’s healing, keeping costs under $106,000 and indicating that significant advantage might stay restricted.

This post is for basic info functions and is not meant to be and must not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.