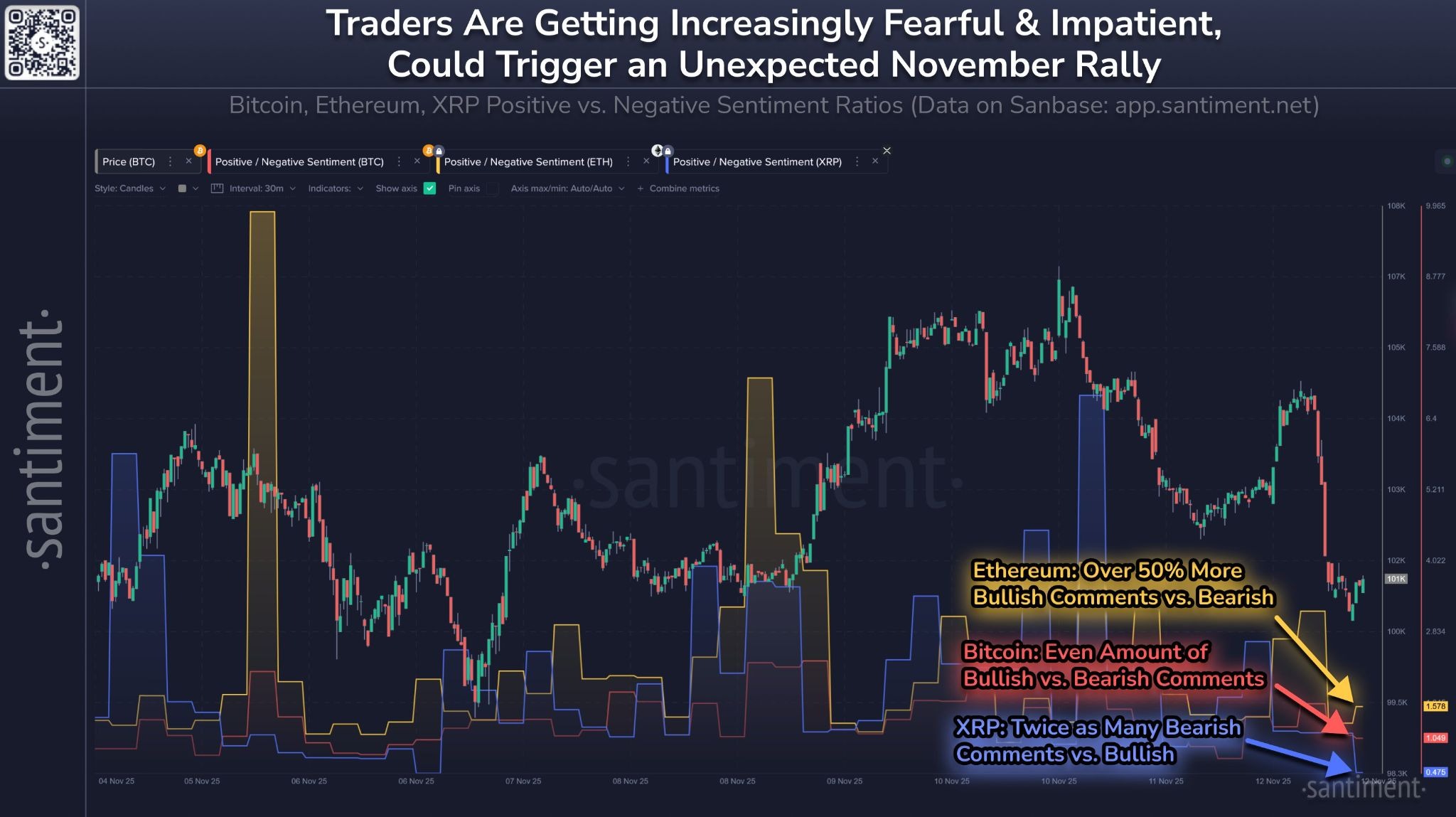

Crypto might see an “unanticipated November rally” with the most recent indications revealing traders are getting significantly afraid, which normally leads to a shift of cash from weaker hands to long-lasting accumulators.

Social network remarks about Bitcoin (BTC) are equally divided in between bullish and bearish, while Ether (ETH) has simply over 50% more bullish vs bearish remarks. Both are less than normal, Santiment stated in an X post on Wednesday.

At the exact same time, less than half the discuss social networks about XRP (XRP) are bullish, making it among the most “afraid minutes of 2025” for the token.

A sell-off might be a plus for the marketplace

Crypto market belief stays afraid as the wider market continues to plunge. Experts have actually associated it to a series of macroeconomic aspects, like traders moving to possessions with clearer direct exposure to financial policies and credit circulations, as completion of the United States Federal government shutdown looms.

The Crypto Worry & & Greed Index, which tracks general market belief, returned a rating of 15 out of 100 on Thursday, marking “severe worry,” the most affordable score because February.

Joe Consorti, head of Bitcoin development at trading and liquidity procedure Horizon, stated the general belief amongst traders is at the exact same level it remained in 2022, when Bitcoin was around $18,000, mentioning information from Glassnode.

Nevertheless, Santiment stated traders’ souring state of minds might be “invited news for the client,” and sustain an “unanticipated November rally,” since there are more diamond-handed holders waiting to grab what weaker hands offer.

” When the crowd turns unfavorable on possessions, particularly the leading market caps in crypto, it is a signal that we are reaching the point of capitulation,” Santiment stated.

” As soon as retail sells, essential stakeholders scoop up the dropped coins and pump costs. It’s not a matter of if, however when this will next take place.”

Samson Mow, the creator of Bitcoin innovation facilities business Jan3, who argued the Bitcoin bull run is yet to start recently, shared a comparable viewpoint on Tuesday, declaring that “newish purchasers” are the only ones offering and traders with long-lasting holding strategies are utilizing it as a possibility to stack more crypto into their wallets.

Related: Bitcoin whale and retail significant ‘divergence’ is an indication: Santiment

Holders with conviction purchasing coins

Trim argues that offering pressure is originating from individuals who purchased Bitcoin in the last 12 to 18 months and are taking earnings due to worries that the cycle has actually peaked.

” These are not Bitcoin purchasers from very first concepts, however rather speculators that follow the news,” he stated.

” This associate of sellers is likewise diminished, and HODLers with conviction have actually now taken their coins, which is constantly the very best case circumstance. 2026 is going to be a terrific year. Strategy appropriately.”

Publication: All the best taking legal action against crypto exchanges, market makers over the flash crash