Business Bitcoin holdings continue to climb up, however treasury executives argue the pattern is enhancing, not damaging, decentralization throughout the network.

Regardless of increasing issues about focused Bitcoin (BTC) ownership, emerging business treasury companies and brand-new institutional gamers are adding to wider circulation throughout the community, according to numerous executives speaking at Bitcoin Amsterdam 2025.

” At the end of the day, what we are doing is actually decentralizing Bitcoin. It does not appear like that, however it holds true through the need that we supply in the market,” stated Alexander Laizet, board director of Bitcoin method at Capital B.

Laizet stated more banks using Bitcoin custody alternatives are providing people and corporations brand-new opportunities for storage and decreasing single-point reliance on a little set of custodians.

Related: Bitcoin ETFs bleed $1.1 B as experts caution of ‘mini’ bearish market at turning point

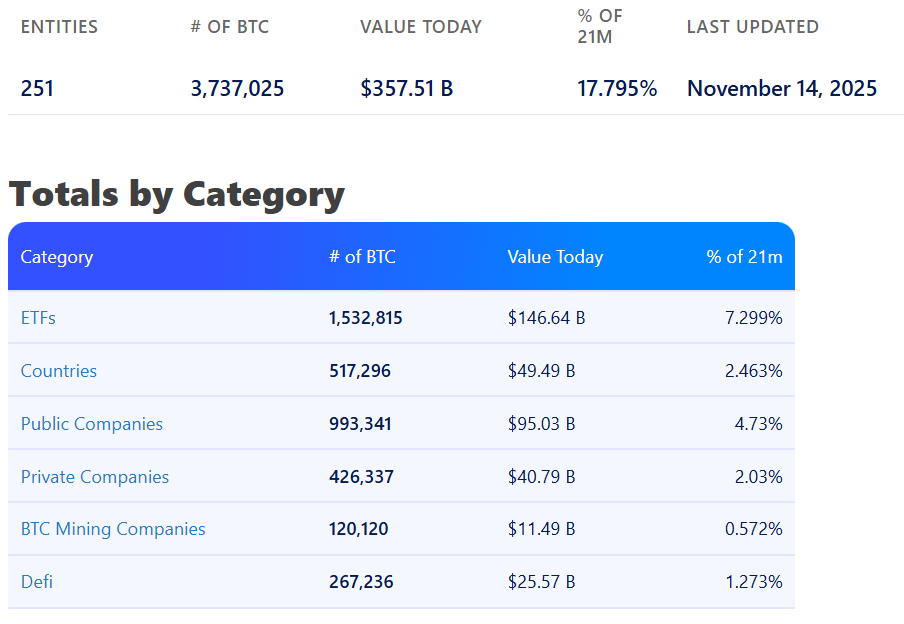

Corporations accumulate almost 7% of the overall Bitcoin supply

Corporations and Bitcoin exchange-traded funds (ETFs) are silently collecting the Bitcoin supply, significantly centralizing the circulation of the world’s very first cryptocurrency.

Business individuals have actually currently accumulated 6.7% of the overall Bitcoin supply, consisting of 4.73% through public business and 2.03% through personal business, according to treasury information company bitbo.io

Area Bitcoin ETFs have actually likewise built up almost 7.3% of the Bitcoin supply, ending up being the biggest section of holders in less than 2 years given that their launching in January 2024.

The growing centralized holdings are not an “instant hazard” for Bitcoin, as its “financial ownership is still spread out throughout lots of hidden financiers– not a single star,” Nicolai Sondergaard, research study expert at crypto intelligence platform Nansen, informed Cointelegraph.

” It does not alter Bitcoin’s essential homes. The network stays decentralized even if custody ends up being more centralized.”

While this does not provide an “Achilles heel” for Bitcoin, it highlights that big custodial gamers might have “more impact over liquidity and market behaviour” as their BTC holdings continue to grow, he included.

Related: Metaplanet’s Bitcoin gains fall 39% as October crash pressures business treasuries

Still, some market watchers are growing worried about Bitcoin’s increasing institutional adoption as business crypto treasuries went beyond $100 billion in digital property holdings in August.

Bitcoin’s growing business concentration might provide a brand-new central point of vulnerability, setting BTC on the very same “nationalization course” as gold in 1971, according to crypto expert Willy Woo.

” If the United States dollar is structurally getting weak and China is being available in, it’s a reasonable point that the United States may do a deal to all the treasury business and centralize where it might be then taken into a digital type, not produce a brand-new gold requirement,” Woo stated throughout a panel conversation at Baltic Honeybadger 2025, including:

” You might then rug it like occurred in 1971. And it’s all centralized around the digital Bitcoin. The entire history repeats once again back to the start.”

In 1971, United States President Richard Nixon ended the Bretton Woods system, suspending the dollar’s convertibility into gold and deserting the repaired $35-per-ounce rate, efficiently ending the gold requirement.

Publication: Mystical Mr Nakamoto author– Finding Satoshi would injure Bitcoin