Secret takeaways:

-

Brazil’s relocations are business and community, not sovereign.

-

B3’s area ETFs and resized 0.01-BTC futures let treasurers acquire, size and hedge direct exposure utilizing familiar tools.

-

New VASP requirements (licensing, AML/CFT, governance, security), efficient February 2026, decrease functional unpredictability.

-

Secret series: Compose guidelines → list plain-vanilla gain access to items → include hedging tools → implement disclosure.

What’s really taking place in Brazil?

To be clear, Brazil’s National Treasury and reserve bank are not including Bitcoin to the nation’s sovereign reserves. There is likewise no law needing federal government bodies or state-owned companies to hold Bitcoin (BTC).

What is taking place rather is a patchwork of city efforts, noted business and brand-new market facilities coming online:

In the following areas, we’ll describe the “whats,” the “whys” and the dangers included.

Did you understand? B3 (brief for Brasil, Bolsa, Balcão) is Brazil’s primary stock market, formed in 2017 through the merger of São Paulo’s securities, futures and products exchanges. It is among the biggest market facilities worldwide and the very first in Latin America to note an area Bitcoin exchange-traded fund (ETF).

What has Brazil constructed up until now?

Brazil has actually invested the previous couple of years developing managed, familiar methods to gain access to Bitcoin.

In 2021, B3 noted Latin America’s very first area Bitcoin ETF (QR Property’s QBTC11), providing organizations an auditor-friendly instrument without needing self-custody from the first day. Derivatives followed.

In mid-2025, B3 minimized the Bitcoin futures agreement size from 0.1 BTC to 0.01 BTC to expand involvement and enhance hedging. The modification was officially executed on June 16, 2025, through circular and public notification.

Item development kept up. Property supervisors introduced hybrid funds that mix Bitcoin and gold on B3, revealing that regulators and the exchange are comfy hosting crypto-linked items in public markets.

The rulebook is growing along with the items. In November 2025, the reserve bank released comprehensive requirements for VASPs covering licensing, AML/CFT, governance, security and customer security, with enforcement beginning in February 2026.

For treasurers, that decreases functional unpredictability as they count on ETFs, futures and managed intermediaries.

Why Brazilian treasurers are doing this

Treasury groups are attempting to smooth revenues and secure buying power in a market where the Brazilian real can swing greatly on policy choices and external shocks.

A little Bitcoin allowance, held through audited instruments, includes a liquid, non-sovereign hedge along with dollars and regional notes without needing brand-new custody operations.

It’s likewise about utilizing familiar pipelines. Area ETFs and noted futures on B3 let treasurers size, rebalance and hedge within the very same governance and audit regimens they utilize for other possessions. The smaller sized 0.01-BTC futures agreement makes hedging more exact and less expensive to execute at a treasury scale.

There’s a governance plan now. Méliuz revealed the series boards wish to see: investor approval → clear disclosure → execution → extra capital to scale the position. That decreases profession threat for other primary monetary officers thinking about a pilot allowance.

Gain access to matters for those who can’t hold crypto straight. OranjeBTC’s B3 listing offers equity direct exposure to a big on-balance-sheet BTC position, permitting organizations to get involved through a noted lorry while remaining within required.

Lastly, the regulative arc reduces functional unpredictability. With the reserve bank’s VASP requirements covering licensing, AML/CFT, governance and security set to work in February 2026, treasurers can count on certified intermediaries and recorded controls instead of bespoke crypto facilities.

Did you understand? An area Bitcoin ETF is a fund that holds real Bitcoin and lets you purchase shares of that Bitcoin on a stock market, much like any other ETF. It offers you cost direct exposure, day-to-day liquidity and examined custody without handling your own wallet or secrets, which is why treasurers and organizations typically choose it over holding coins straight.

The dangers and how Brazil is resolving them

Brazil understands the dangers and is tightening up the playbook.

-

Market volatility: Bitcoin can swing hard, so treasurers that decide in generally cap position sizes, set rebalancing guidelines and utilize noted hedges. B3’s smaller sized 0.01-BTC futures, efficient June 16, 2025, make it much easier to hedge earnings and loss and liquidity shocks with finer accuracy.

-

Functional and counterparty threat: Self-custody, exchange direct exposure and supplier security are not minor. The reserve bank’s brand-new VASP requirements press crypto intermediaries towards traditional-finance standards.

-

Legal and enforcement clearness: District attorneys and regulators require foreseeable tools when crypto intersects with criminal cases. A brand-new expense would let banks liquidate taken crypto, lining up treatment with forex and securities procedures and lowering gray locations in enforcement.

-

Public optics and disclosure: ” Bitcoin treasury” stays politically delicate. Noted courses pull business into auditor-vetted reporting and constant disclosure on direct exposure, custody and threat. That openness assists boards and regulators get comfy as the marketplace grows.

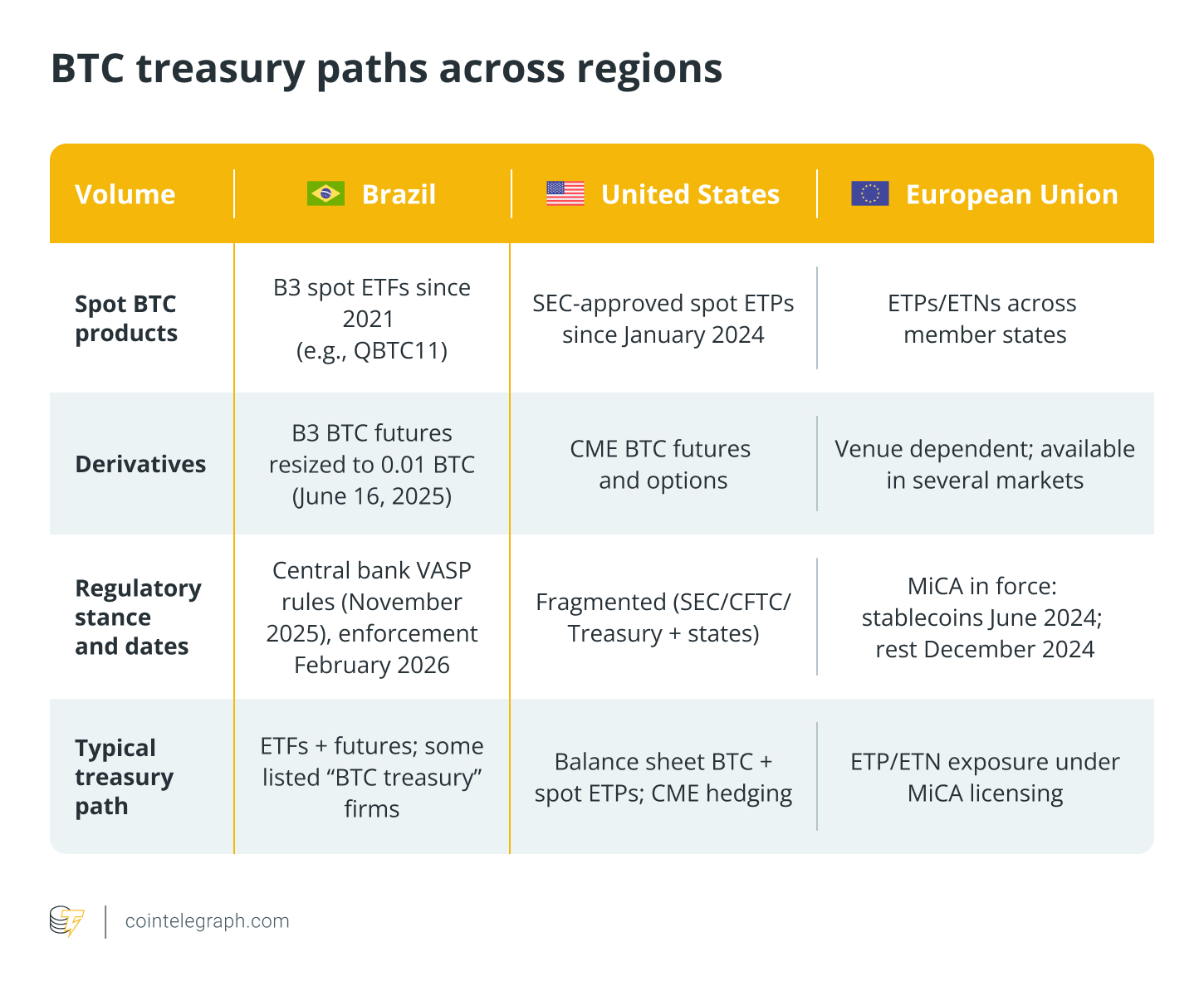

How Brazil compares: BTC treasury paths

What other countries can find out

-

Keep in mind, Brazil composed guidelines. The reserve bank set clear requirements for when crypto-fiat conversions are dealt with as forex and raised requirements for VASPs throughout AML/CFT, governance, security and customer security.

-

Ship easy gain access to items early. QBTC11 and its peers introduced in 2021, providing organizations a familiar, audited instrument rather of requiring them to construct custody from scratch. With an ETF course, treasurers can size direct exposure within existing requireds.

-

Include hedging tools for threat supervisors. In June 2025, B3 cut the Bitcoin futures agreement size to 0.01 BTC. Smaller sized agreements make hedges less expensive and tighter, permitting boards to authorize them and treasury groups to handle worth at threat (VaR) and drawdowns with more accuracy.

-

Motivate disclosure standards through public lorries. Noted “Bitcoin-treasury” business such as Méliuz and OranjeBTC develop recommendation points for audits, board procedures, problems policies and reporting cadence. These end up being design templates others can copy.

-

Pilot listed below the federal level. City or firm pilots emerge political and accounting concerns early. Rio’s 1% signal in 2022 demonstrated how rapidly optics end up being the story and why requireds and run the risk of limitations should be specific.

The series is uncomplicated: compose the rulebook, present plain-vanilla gain access to items, scale down derivatives to support hedging and permit disclosure requirements to establish in public markets. Just then does the discussion about putting BTC in the treasury ended up being significant.