Secret takeaways:

-

ETH is up to a 4-month low in spite of current layer-2 development cutting base costs and increasing Ethereum’s usage in tokenization and stablecoin.

-

ETH might recuperate as international dangers ease and brand-new liquidity gets in markets, assisting the rate return towards $3,900.

Ether (ETH) crashed listed below $3,000 on Monday, and the drop shows a sector-wide risk-off shift where traders are fretted that the bull run might have ended after a 40% correction from the $4,956 all-time high in August.

Ether’s efficiency has actually carefully tracked the altcoin market, indicating an absence of asset-specific drivers or a minimum of traders’ shift towards wider macroeconomic aspects. If Ether dealt with clear competitive pressure or compromising principles, ETH would likely lag altcoins, which has actually not occurred.

Experts argue the crypto recession comes from increasing issue over international development. The United States federal government shutdown and brand-new import tariffs were followed by weak consumer-sector revenues and doubts surrounding the expert system market. Information centers now handle greater expenses and energy restrictions, even as business stays extremely rewarding.

Need for bullish ETH utilize has actually remained soft for a month, with the futures premium stuck under the 5% neutral level. Part of this doubt originates from how market tension impacts business constructing ETH reserves, consisting of Bitmine Immersion (BMNR United States), SharpLink Video Gaming (SBET United States) and The Ether Maker (ETHM United States).

Those business concentrated on ETH reserves through financial obligation and equity problems now hold latent losses as their shares trade listed below net property worth, that includes crypto holdings. Even if no forced selling impends, financier interest in the sector drops, decreasing need for brand-new financial obligation and triggering steady dilution for existing holders.

Falling Ethereum onchain activity moistened bullish hunger

Ether’s weak onchain information has actually likewise harmed financiers’ bullish hunger. Lower network activity lowers need for ETH and raises supply. Ethereum’s burn system just ends up being significant when need for base layer information increases, so slower DApp use is a net unfavorable for ETH staking.

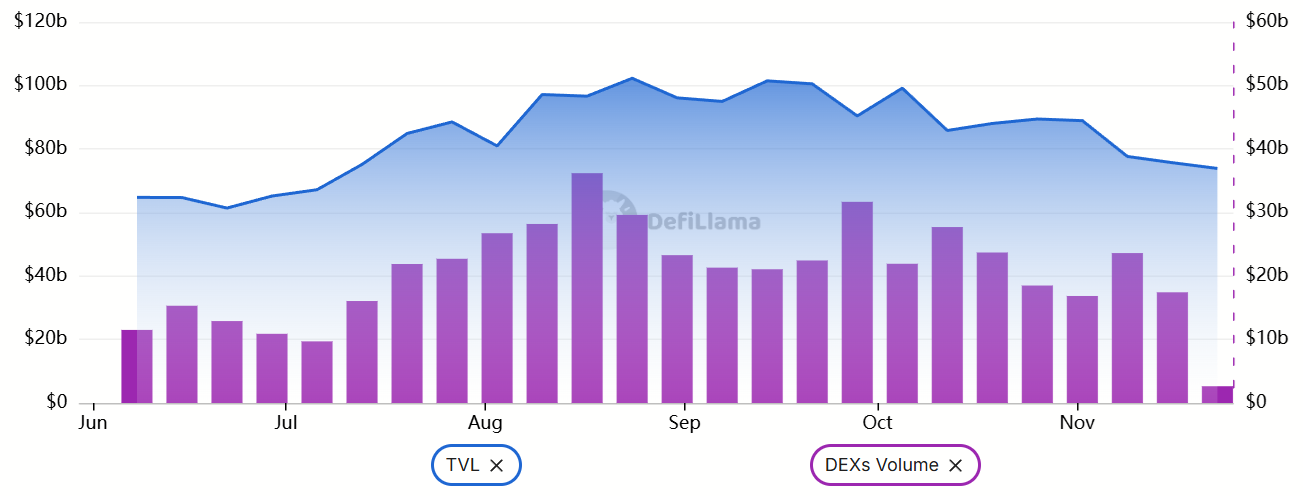

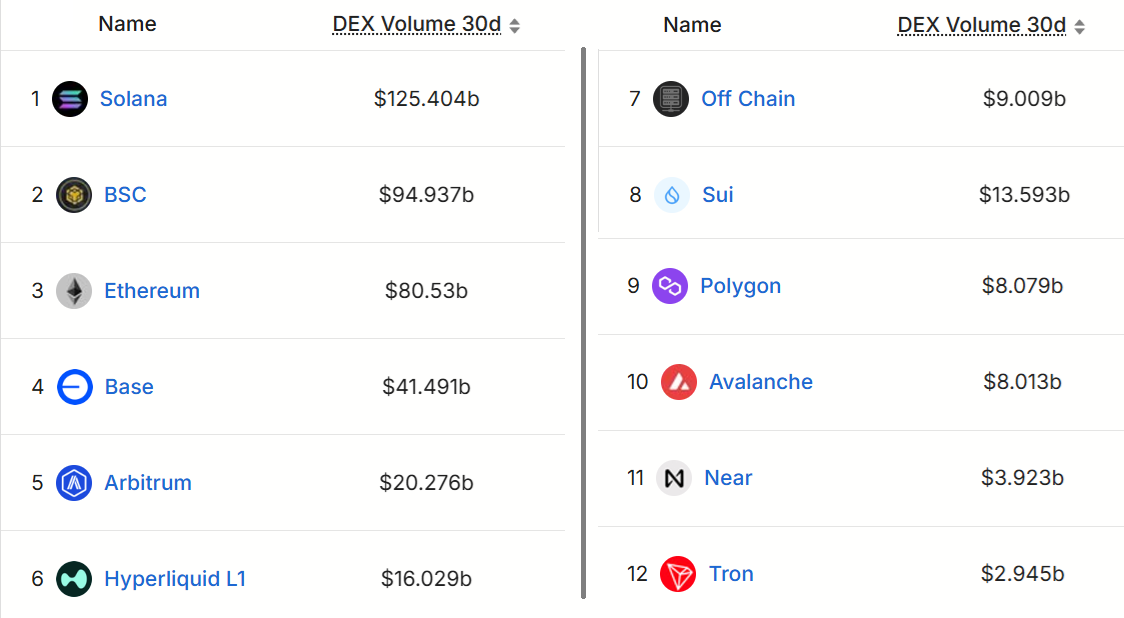

Deposits on the Ethereum network, determined by Overall Worth Locked (TVL), was up to a four-month low of $74 billion, a 13% drop from 1 month previously. Activity on Ethereum decentralized exchanges (DEX) reached $17.4 billion in the previous 7 days, down 27% from the previous month. Ethereum stays the clear leader in deposits, however it deals with harder competitors in trading volume.

Critics might argue that BNB Chain and Solana are more central, which Ethereum leads when the layer-2 environment is considered. Scaling services like Base, Arbitrum and Polygon considerably enhanced Ethereum’s capability, however likewise raised issues over costs. Due to the fact that rollups batch and procedure deals off the base layer, they dramatically lower need for base layer costs.

Related: Republic raises $100M for ETH purchases under uncommon zero-interest offer

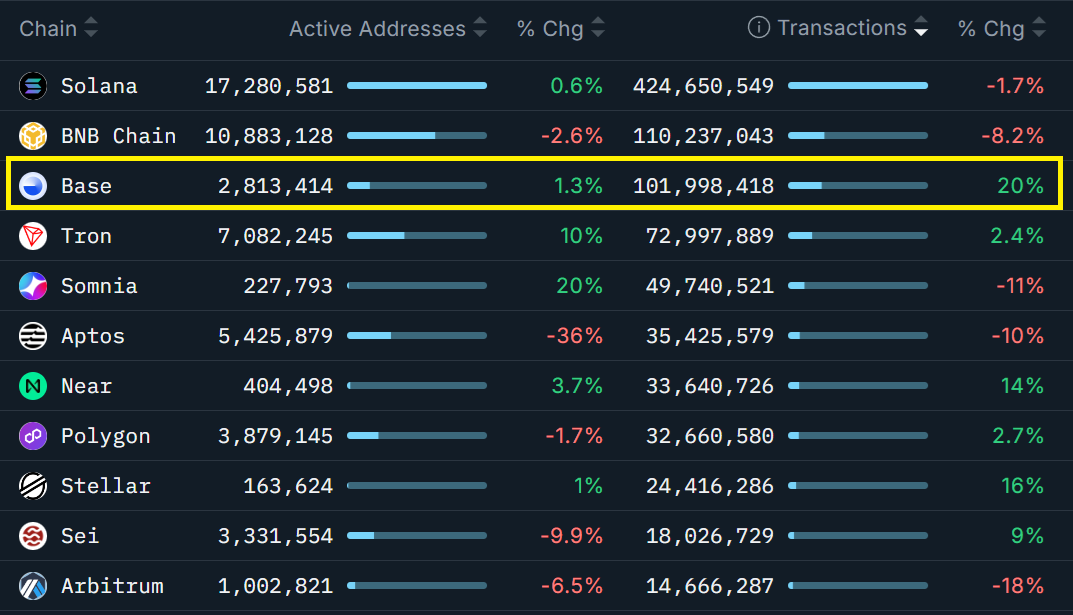

Still, the shift of activity towards layer-2s is far from a danger. The increase of Ethereum’s scaling environment has actually reinforced its lead in Real life Property (RWA) tokenization and in decentralized stablecoin systems such as Sky, previously called MakerDAO. Base alone processed almost 102 million deals in the previous 7 days, a figure equivalent to networks with much more users and deposits, such as Solana.

Ether’s outlook depends greatly on lower international socio-political unpredictability, particularly as the United States deals with pressure from its broadening federal government financial obligation. Ultimately, reserve banks will likely require to include liquidity and support their economies, and ETH is well-positioned to gain from that inflow. Such a shift might be enough for Ether to retest the $3,900 level.

This short article is for basic info functions and is not meant to be and ought to not be taken as legal or financial investment suggestions. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.