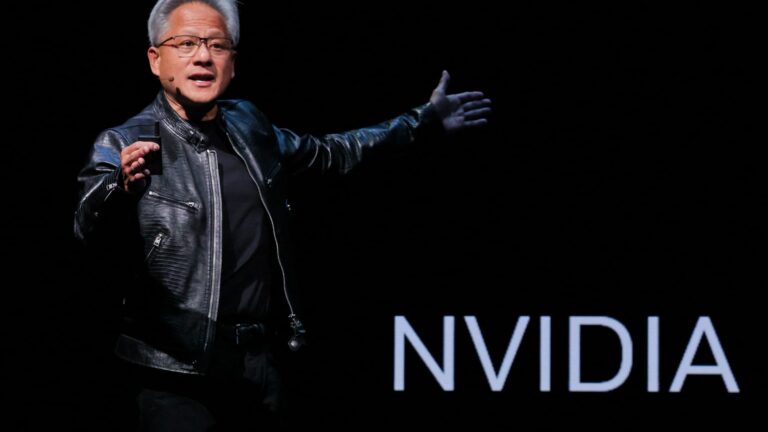

Goldman Sachs called a multitude of stocks that stay finest placed heading into year-end. The Wall Street financial investment bank stated business like Nvidia are engaging, with more space to run. Other buy-rated names evaluated by CNBC Pro consist of: Cock’s Sporting Item, Wynn Resorts, Beast Drink and Genius Sports. Wynn Goldman states the gambling establishment and resort business is shooting on all cylinders. Expert Lizzie Dove included the stock to the company’s prominent conviction purchase list previously today. Dove stated Wynn has the ideal access to appealing the most upscale tourists. “WYNN is exposed to the highest-end client on the strip,” she composed. The company is likewise bullish on the business’s chance overseas. “The launch of Wynn Al Marjan in the UAE in 1Q27, plus WYNN’s best-in-class Las Vegas possessions, take advantage of to a higher-income customer, a strong 2026 Las Vegas occasion calendar, and an enhancing background in Macau must drive transformative advantage at WYNN,” she went on to state. The stock is up 46% this year. Cock’s Sporting Item Shares of the sporting products business have a lot of space to run, according to the company. Expert Kate McShane prompted financiers to stay calm following Cock’s current revenues report. McShane sees a robust market background for sporting products and applauded the business’s relationships with suppliers too its competitive chops. The company did confess that financiers stay conflicted surrounding the business’s acquisition of Foot Locker, however stated a lot of financiers it speaks to are bullish on the deal. Nevertheless, shares of the business are up 2% this year. “We repeat our Buy ranking on DKS as the business likely continues to gain from a continuous pattern towards health and health, strong brand name heat, market share gains, and structurally greater margins, with gross margins and EBT staying well above pre-pandemic levels,” she composed. Beast Drink Expert Bonnie Herzog is feeling more bullish on the drink stock after a series of financier conferences. “Looking ahead, mgmt struck a positive tone as it associates with the classification development outlook next year in spite of difficult y/y compensations …,” she composed. Herzog, who raised her cost target to $83 per share from $80, states the business continues be an innovator which will eventually assist drive income to other parts of Beast’s organization. “Bottom line– MNST stays among our favored stock choices, as we continue to think it is among the most appealing volume-driven development stories in more comprehensive Staples,” she went on to state. The stock is up 40% this year. Nvidia “We repeat our Buy ranking as we continue to think Nvidia has a sustainable design benefit over peers in AI training applications, we see substantial advantage to Street quotes, and we see appraisal as fairly appealing at present levels.” Genius Sports “We stay positive in our view of Genius Sports as a business: 1) well-positioned to gain from a variety of nonreligious development tailwinds and a clear item roadmap equating into intensified income well into the double-digits; 2) well placed to produce foreseeable incremental margins (with much better presence into its multi-year expense structure.” Wynn “WYNN is exposed to the highest-end client on the strip. … The launch of Wynn Al Marjan in the UAE in 1Q27, plus WYNN’s best-in-class Las Vegas possessions, take advantage of to a higher-income customers, a strong 2026 Las Vegas occasion calendar, and an enhancing background in Macau must drive transformative advantage at WYNN.” Cock’s “We repeat our Buy ranking on DKS as the business likely continues to gain from a continuous pattern towards health and health, strong brand name heat, market share gains, and structurally greater margins, with gross margins and EBT staying well above pre-pandemic levels.” Beast Drink “Looking ahead, mgmt struck a positive tone as it associates with the classification development outlook next year in spite of difficult y/y compensations. … Bottom line– MNST stays among our favored stock choices, as we continue to think it is among the most appealing volume-driven development stories in more comprehensive Staples.”

Related Articles

Add A Comment