Blockchain-based forecast markets are attracting more speculators as traders hunt for returns that can beat just holding area cryptocurrencies, according to a brand-new report.

Forecast markets are becoming a brand-new speculative arena for traders, pitting casual retail individuals versus data-driven, expert traders, producing “severe details asymmetry and significant arbitrage windows,” according to a Monday report from crypto research study business 10X Research study.

While sports bets represent the lion’s share of activity on these platforms, Bitcoin (BTC) and crypto-outcome associated occasions exist more specific niche chances that digital possession traders can’t neglect, according to 10X.

” It is an important tip that almost every significant crypto trading location ran its own market-making or ‘treasury’ desk, not simply to supply liquidity, however to base on the opposite of retail circulation, and seldom at a loss,” the business composed.

Related: BTC poised for December healing on ‘macro tailwinds,’ Fed rate cut: Coinbase

For quantitative traders, forecast markets can provide uneven rewards that compare positively with the benefit on underlying area tokens, the report recommended.

For example, traders on decentralized forecast market Polymarket are banking on whether the BNB (BNB) token will strike $1,500 by Dec. 31, 2025. “Yes” shares on that market just recently traded around $0.01, suggesting a prospective 100x payment if the occasion takes place. By contrast, an area BNB holder would see approximately a 1.65 x gain if the token reached the exact same level from existing rates.

Related: BitMine purchases $199M in Ether as clever cash traders bank on ETH decrease

High win-rate accounts, AI bots raise Expert trading issues

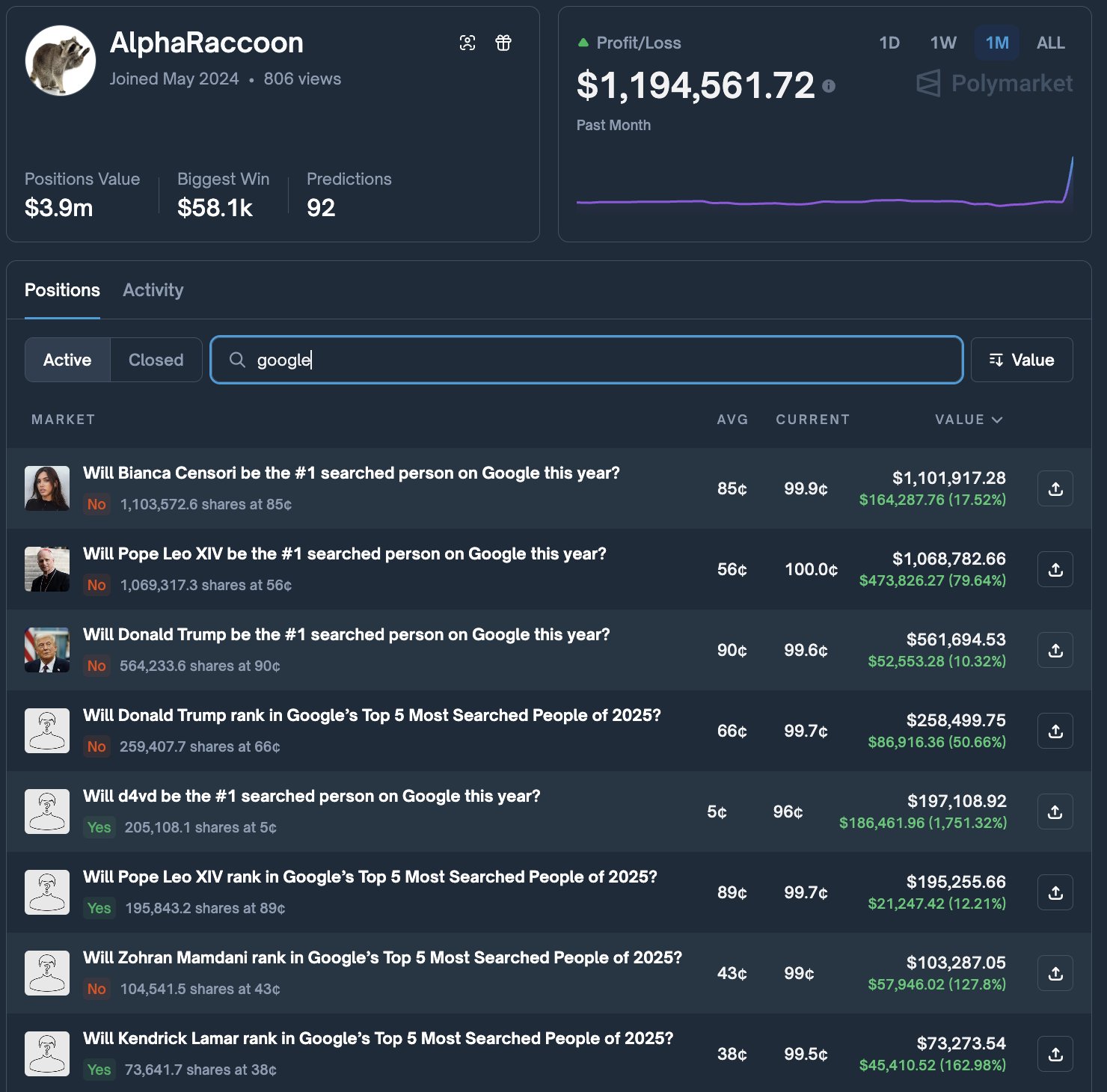

Nevertheless, some forecast market accounts are revealing worrying indications of expert trading, especially a freshly emerged account that made over $1 million in a single day by banking on Google search patterns.

Polymarket user ‘AlphaRaccoon’ produced $1 million by effectively winning 22 out of 23 positioned bets, according to crypto financiers Haeju.

” This isn’t a fortunate streak. He formerly made $150K+ forecasting the early release of Gemini 3.0 before outcomes were out,” he composed in a Thursday X post.

Others are using expert system bots to increase their opportunities of winning.

Polymarkt user “ilovecircle” made over $2.2 million throughout the previous 2 months, boasting a 74% win rate through bets including politics, sports and cryptocurrency.

The user’s volume and winning consistency “nearly assurances” that it is using an artificial intelligence (ML) design for “cross-niche arbitrage and automobile trading,” composed forecast market trader Archive, in a Sunday X post.

Publication: Train AI representatives to make much better forecasts … for token benefits