Bitcoin (BTC) fell back listed below $90,000 around Monday’s Wall Street open as United States selling pressure returned.

Bottom line:

-

Bitcoin keeps volatility coming as United States sellers send out cost back listed below $90,000.

-

Liquidations stay consistent as financiers remain on the sidelines amidst indecisive cost action.

-

Proof of purchasing the dip shows up throughout exchanges over the previous 2 weeks.

BTC cost lacks space as Wall Street returns

Information from Cointelegraph Markets Pro and TradingView revealed BTC cost action remaining unpredictable as the TradFi trading week got underway.

Having actually passed $92,000 throughout the Asia session, BTC/USD quickly lacked upward momentum, deserting a prospective retest of the annual open at $93,500.

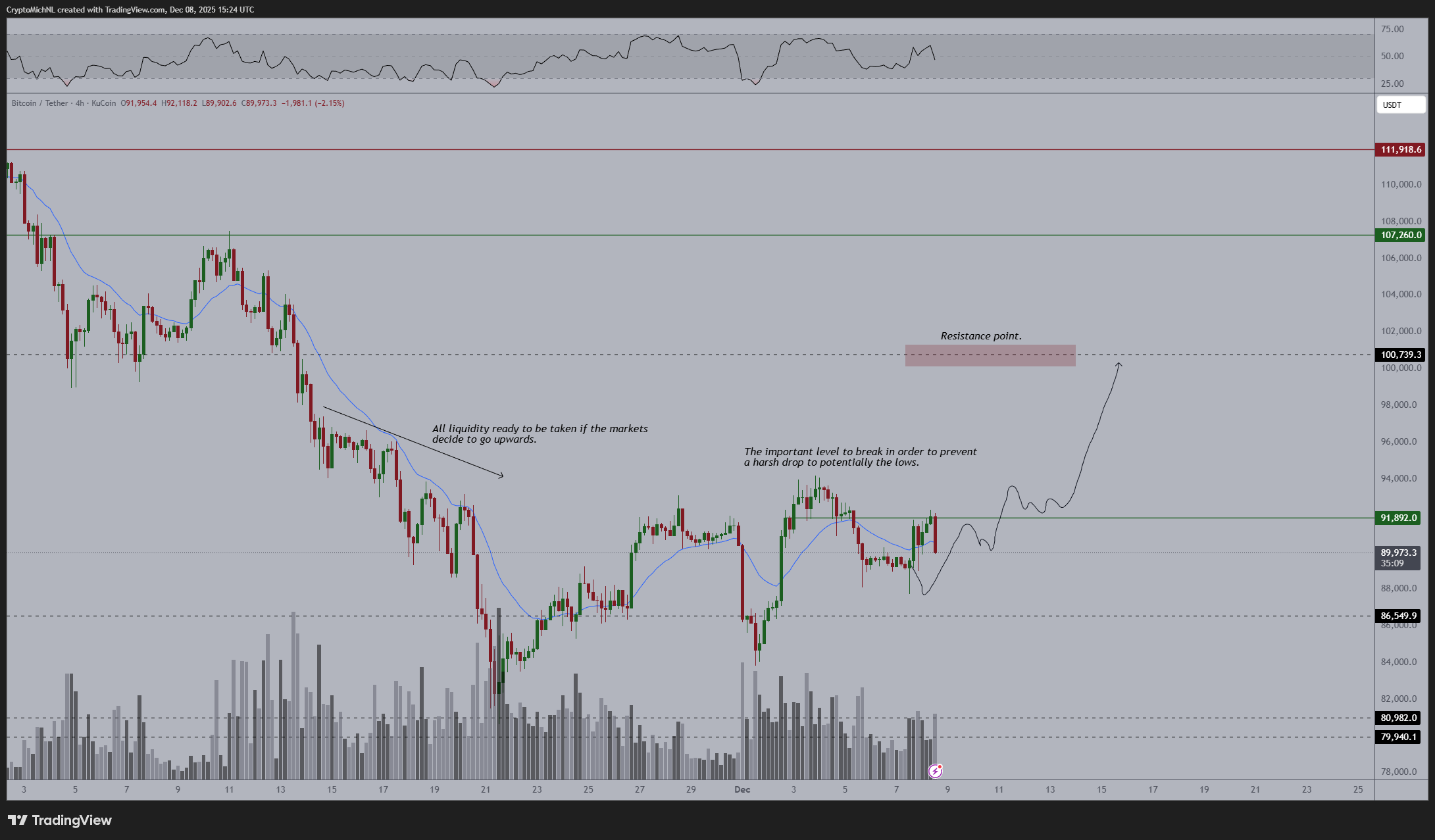

” This is precisely why you’ll require to remain calm for a bit if there’s a proceed $BTC. Terrific proceed some Altcoins today, however extreme rejection on the important resistance of Bitcoin,” crypto trader, expert and business owner Michaël van de Poppe responded in a post on X.

Van de Poppe stated that he expected a greater low to form next, likewise flagging $86,000 as an essential level.

” And, what if that does not occur?” he continued about the greater low.

” Precisely, that’s the minute that I’m taking a look at a sweep of the lows and $86K to hold, that’s the last level of assistance before a test of the lows.”

Trading business QCP Capital kept in mind that liquidations through the volatility had actually stayed “reasonably modest.”

” This shows a significant drop in placing as wider interest in crypto continues to fade, whether due to tiredness, care or basic indifference while traders wait on clearer instructions,” it composed in its most current “Asia Color” market upgrade.

24-hour cross-crypto liquidations stood at $330 million at the time of composing, per information from keeping an eye on resource CoinGlass.

” Moving” BTC supply postures liquidity concern

Company intelligence business Method revealing a brand-new Bitcoin purchase worth nearly $1 billion, on the other hand, stopped working to improve market self-confidence.

Related: Did BTC’s Santa rally start at $89K? 5 things to understand in Bitcoin today

As Cointelegraph reported, Method increased its BTC holdings by 10,624 BTC recently, at a typical expense of simply over $90,000 per coin.

QCP, nevertheless, stated that purchaser cravings for both Bitcoin and altcoins encompassed the wider exchange user base.

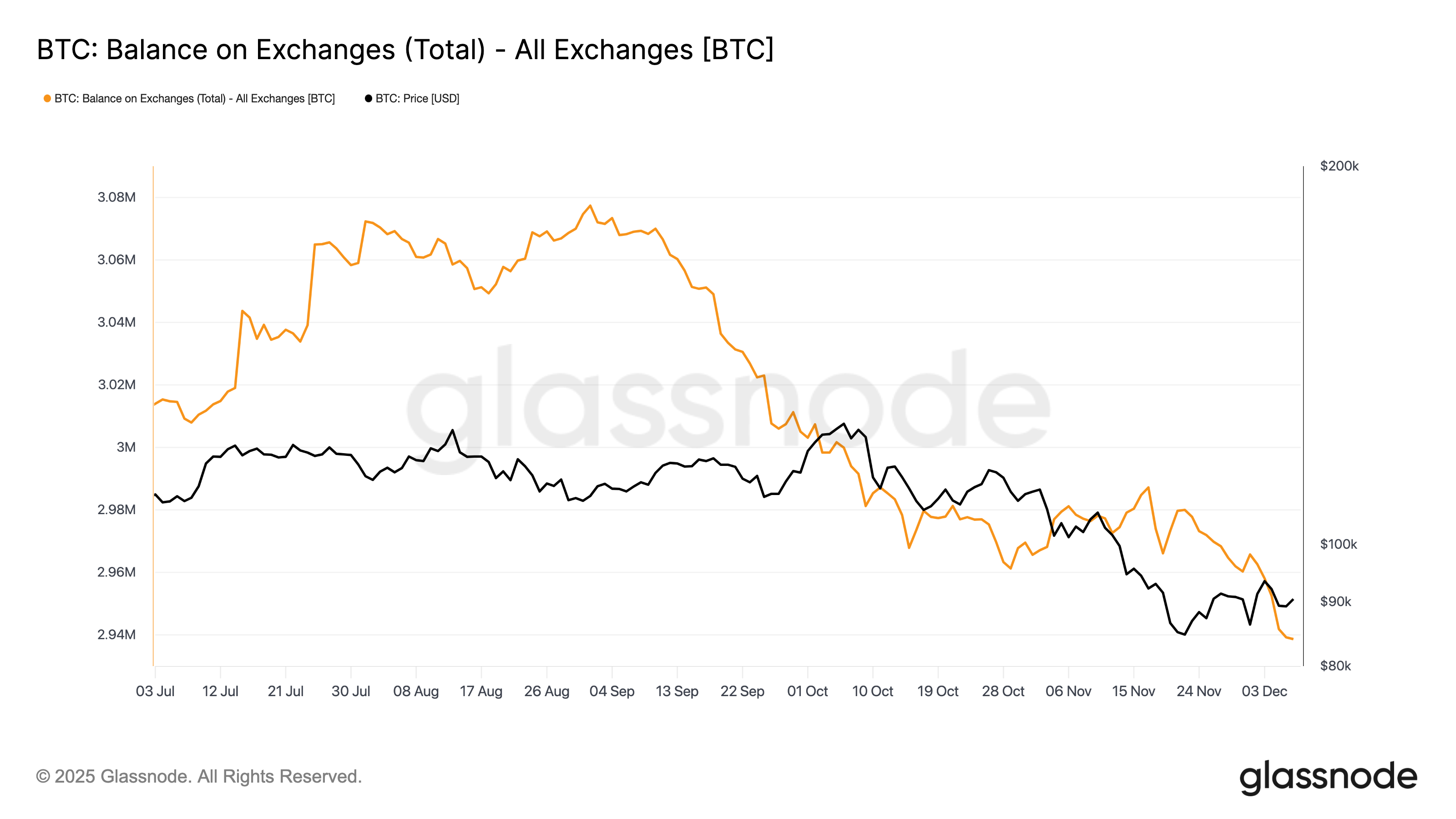

Over the previous 2 weeks, it stated, over 25,000 BTC left exchange order books. Information from onchain analytics platform Glassnode put two-week exchange outflows at closer to 35,000 BTC.

” Bitcoin ETFs and business treasuries now jointly hold more BTC than exchanges, a significant shift that indicates supply moving into longer-term custody and tightening up the readily available float,” Asia Color included.

” ETH is revealing a comparable pattern, with exchange balances being up to years lows. Versus this background, Sunday’s relocations highlighted how little market depth stays as year-end liquidity thins.”

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage developing from your dependence on this details.