Over the previous 2 weeks, Bitcoin rate consistently reviewed the $90,000 variety as retail financier belief enhanced, fund supervisors reiterated their bullish expectations for a prospective end-of-year rally, and Method revealed a large BTC purchase.

According to VanEck head of digital property research study, Matthew Sigel, Bernstein composed that “the Bitcoin cycle has actually broken the 4-year pattern (cycle peaking every 4 years) and is now in an extended bull-cycle with more sticky institutional purchasing balancing out any retail panic offering.”

Bernstein’s remarks follow BlackRock chair and CEO Larry Fink pointing out that sovereign wealth funds are “incrementally” purchasing Bitcoin as it “has actually fallen from its $126,000 peak.”

Fink stated,

” I understand they purchased more in the 80s. And they’re developing a longer position. And you own it over years. This is not a trade. You won if for a function, however the marketplace is manipulated, it is greatly leveraged which’s why you’re going to have more volatility.”

Mirroring Fink’s and Bernstein’s view, on Monday, Method revealed a fresh 10,624 BTC ($ 962.7 million) purchase at a typical $90,615 per coin. Bitwise European head of research study Andre Dragosch kept in mind that Method’s purchase “was the most significant quantity given that July 2025.”

While Bitcoin’s healing from its Nov. 21 low of $80,612 has actually followed the enhancement in financier belief, the rate is still topped in the $90,000 to $93,000 variety. On Saturday, chartered market service technician Aksel Kibar stated,

” This becomes part of the choppy rate action where BTC/USD is potentially searching for a bottom. Technical assistance is lower in between $73.7 K and $76.5 K. It took couple of months in March-May duration to form that short-term double bottom.”

Related: Did BTC’s Santa rally start at $89K? 5 things to understand in Bitcoin today

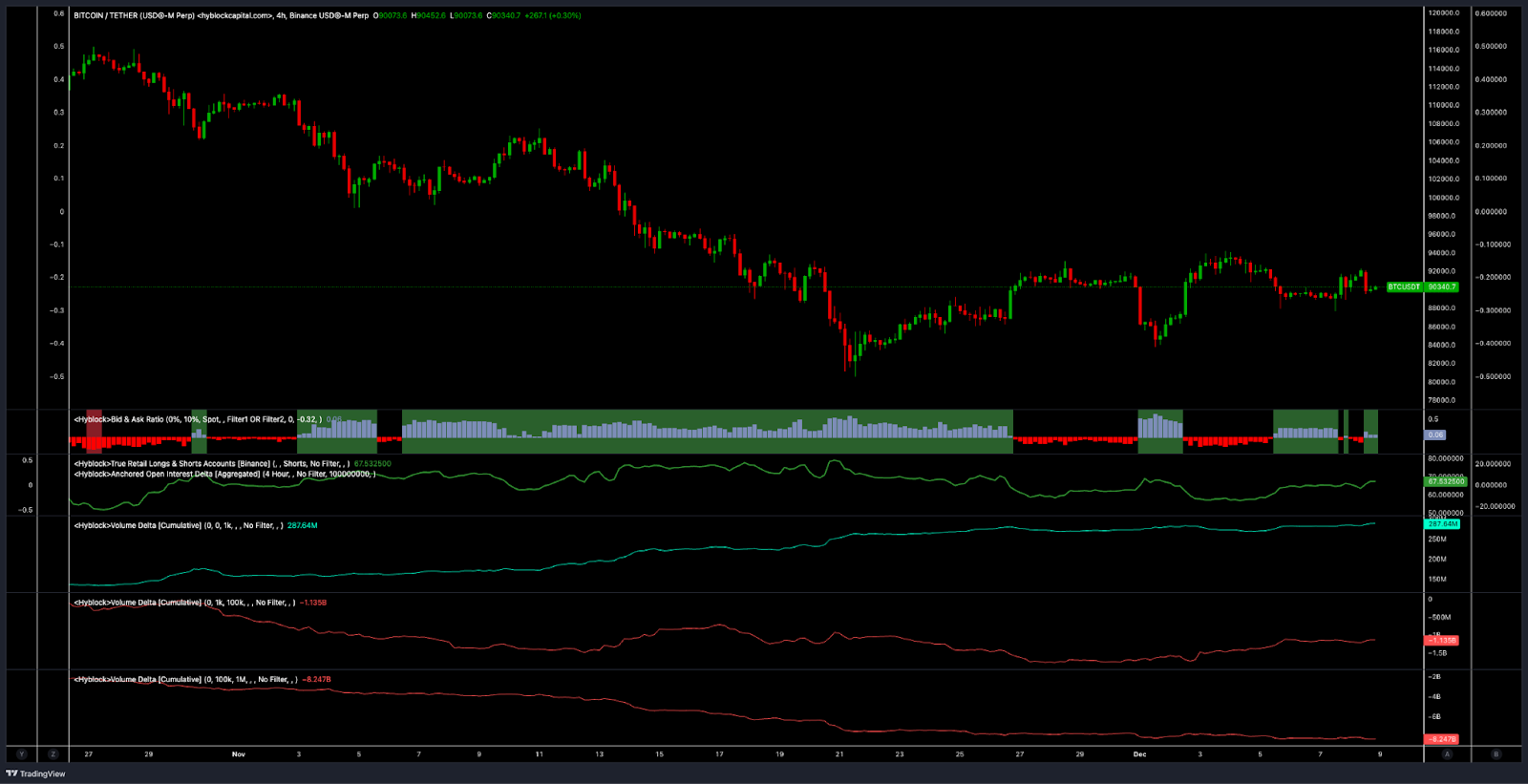

Cumulative volume information from Hyblock supplies a more nuanced view, highlighting increasing involvement from financiers in the 0 to 100 BTC trade associate, which some experts identify as retail. Bigger trade-size accomplices in the 1,000 to 100,000 and 100,000 to 1 million (cumulative volume delta) seem offering on rallies in the $90,000 to $93,000 rate variety.

Likewise, order book information for BTC/USDT (continuous agreements at Binance) reveals a wall of asks beginning at $90,000 and thickening from $94,000 to $95,000.

Liquidation heatmap information, on the other hand, reveals brief liquidity at $94,000 to $95,300, which might work as fuel for bulls to try a work on $100,000 if the marketplace supplies enough drivers to cause an uptick in either area or futures purchasing.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.