Bitcoin treasury business Kindly MD has actually gotten a Nasdaq notification after its shares traded listed below the exchange’s $1 minimum quote cost for 30 successive organization days, beginning a six-month window to restore compliance or threat being delisted.

The notification, which was released Wednesday, does not right away impact trading, however offers the business up until June 8, 2026, to raise its share cost above $1 for a minimum of 10 successive trading days, according to a regulative filing from the Securities and Exchange Commission (SEC).

If the business stops working to restore compliance within the preliminary 180-day duration, it might look for an extra extension by moving its listing to the Nasdaq Capital Market, based on fulfilling other listing requirements, the according to the filing. Nasdaq might eventually delist the shares if the business stops working to please the quote cost guideline or pursue offered solutions.

Kindly MD, a Utah-based health care providers, revealed on Might 12 strategies to combine with Nakamoto Holdings, marking a shift towards a Bitcoin treasury method. The business’s shares rose to a peak of around $25 by Might 27, and the merger was closed on Aug. 14.

The stock, trading under the ticker NAKA, has actually given that fallen by more than 98% and was at $0.39 a share at the time of composing, according to Yahoo Financing information.

Related: Trump-backed American Bitcoin turns ProCap in business BTC treasury race

pipeline funding weighs on Nakamoto shares

Nakamoto Holdings was established in 2025 by Bitcoin Publication CEO David Bailey and is structured as a Bitcoin-native holding business developing a network of crypto treasury companies in collaboration with BTC Inc., the moms and dad business of Bitcoin Publication and the Bitcoin Conference.

The sharp drop in Kindly MD’s share cost, which fell listed below $1 in October, has actually been connected to the business’s funding method, which depend on offering reduced shares to personal financiers through $563 million in personal financial investment in public equity (PIPELINE) deals to money BTC purchases.

Those pipeline deals developed sharp down pressure when a big part of the shares ended up being qualified for resale in September. The rise in sell orders drove a high drop in the share cost, CEO David Bailey informed Forbes in October.

Bailey likewise stated he prepares to bring Bitcoin Publication, the Bitcoin Conference and hedge fund 210k Capital under Nakamoto Holdings as part of an effort to reinforce the business’s capital.

Kindly MD still holds 5,398 Bitcoin, ranking it as the 19th biggest public business by BTC holdings, according to information from BitcoinTreasuries.NET. Back in August, the business stated among its objectives was to get 1 million Bitcoin (BTC).

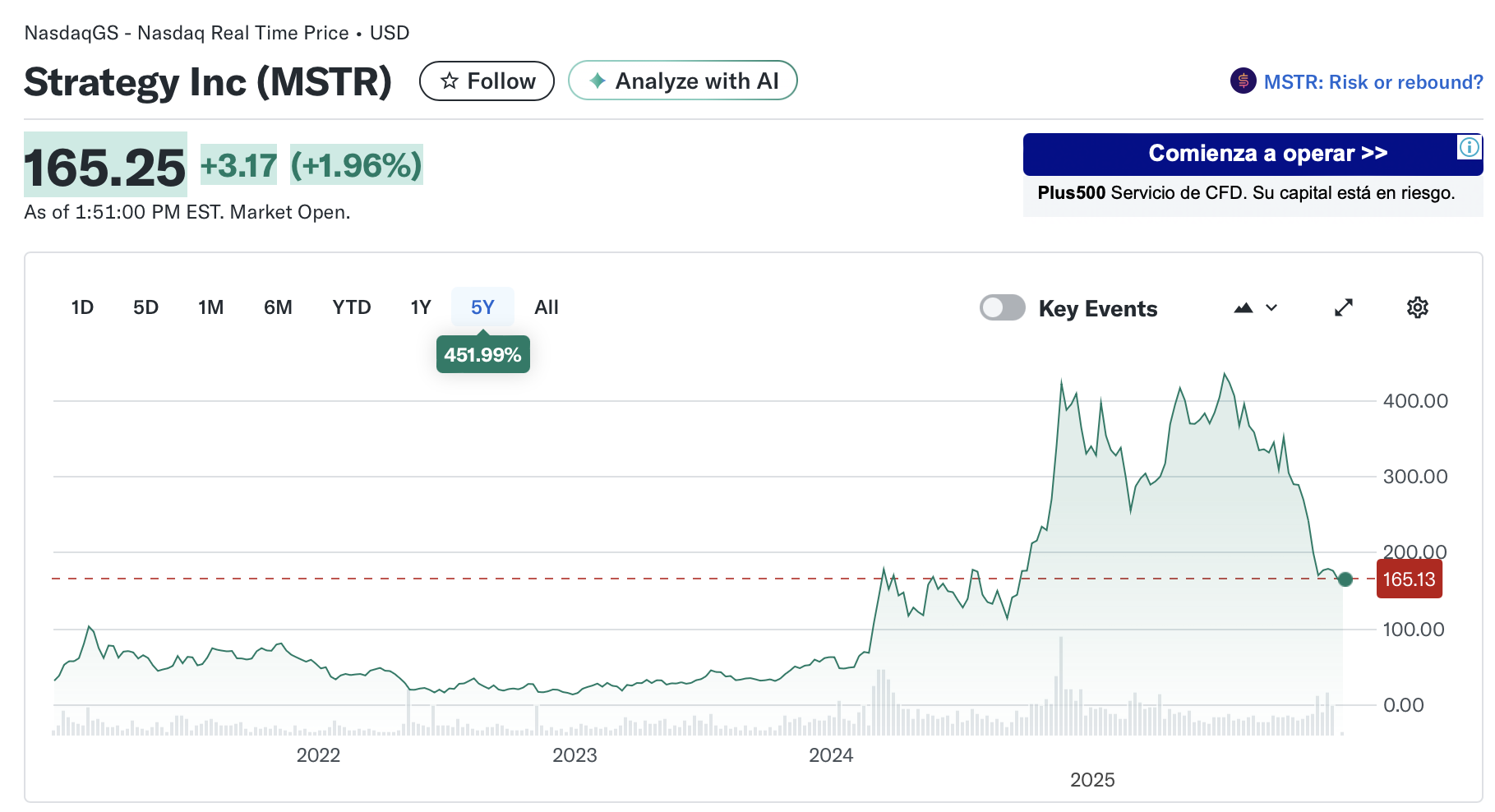

By contrast, Technique, the very first Bitcoin treasury business, holds 671,268 BTC. Although its stock (MSTR) is down over 40% year-to-date, it’s still up 452% given that the business started purchasing BTC in 2020.

Publication: Huge concerns: Would Bitcoin endure a 10-year power interruption?