Decentralized perpetuals exchange Hyperliquid has actually been amongst crypto’s breakout tasks in 2025, however competitors’ rewarding benefits systems are competing to tempt financiers away.

Cantor Fitzgerald projections Hyperliquid’s buzz (BUZZ) token to rise to $200 by 2035. Hyunsu Jung, CEO of buzz treasury business Hyperion DeFi argues that the rise will be sustained by the Hyperliquid Enhancement Proposition 3 (HIP-3).

” We see HIP-3 as the significant motorist of Hyperliquid’s next stage of development, and as an essential enabler of the assessment structure proposed by Cantor,” Jung informed Cointelegraph.

Continuous swaps are futures acquired agreements that track the cost of a hidden possession however have no expiration date. Agreements preserve their cost near to the area properties by a financing system, which moves payments in between long and brief position holders.

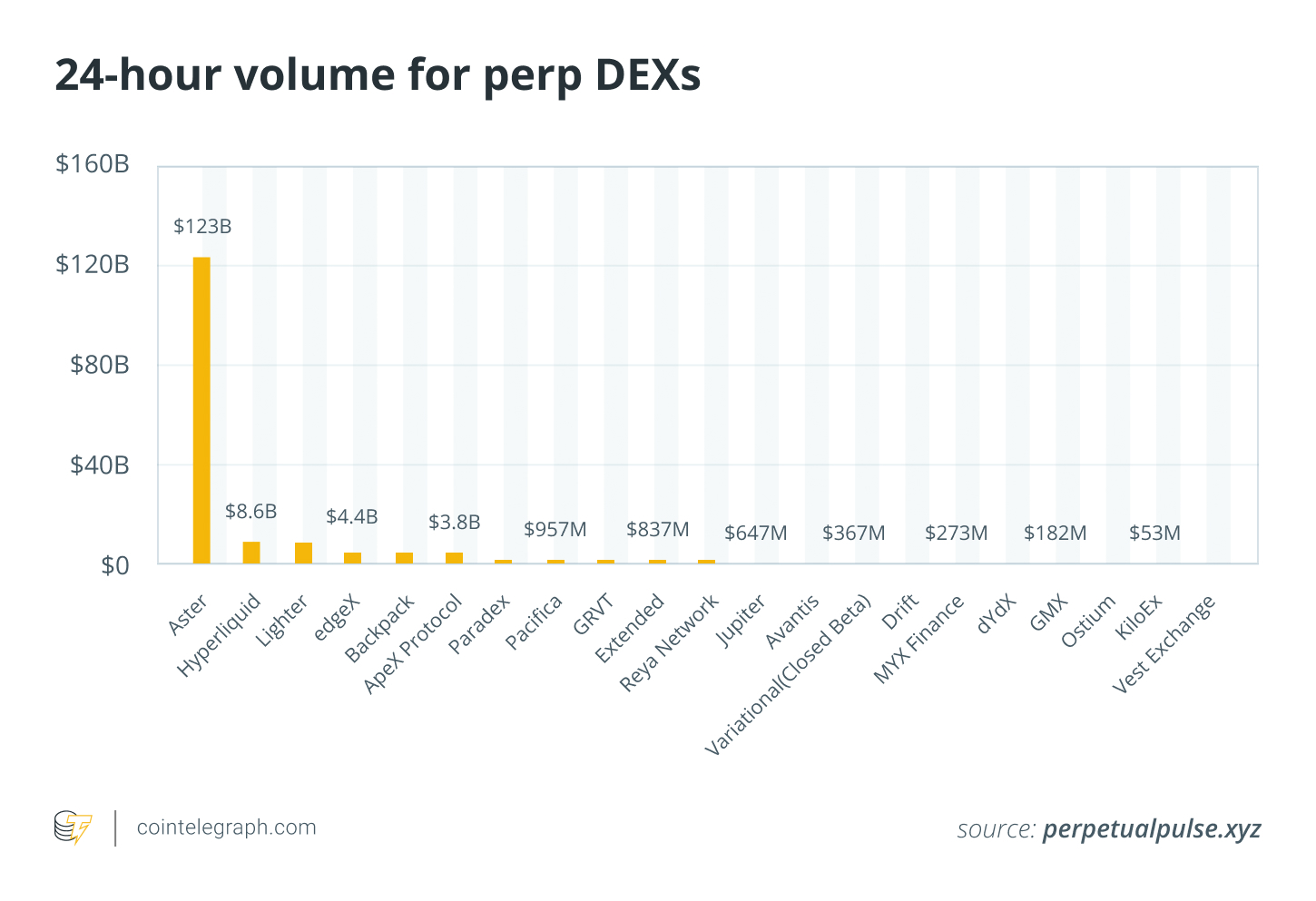

The marketplace share of continuous futures DEXs increased from 2.1% in January 2023 to a brand-new all-time high of 11.7% in November 2025, according to a report by information aggregator CoinGecko.

Related: Bitcoin dips listed below $85K as DATs deal with ‘mNAV rollercoaster’: Financing Redefined

Cantor Fitzgerald forecasts $200 buzz token cost by 2035

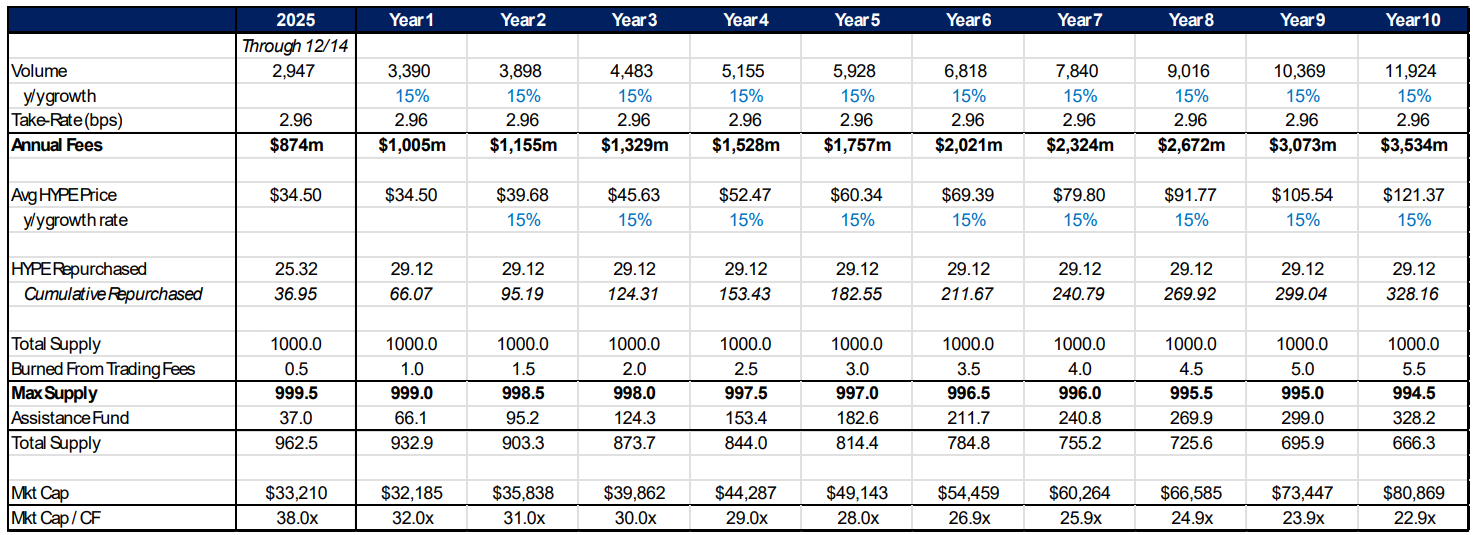

Previously in December, a research study note by Cantor Fitzgerald anticipated that the growing use of decentralized trading places would press the buzz token to over $200 in the next ten years.

” Provided the reality that all costs are gone back to token holders by means of buybacks, we make the argument that buzz must trade at closer to 50x,” by 2035, composed the business in a research study note released on Dec. 16, including:

” Utilizing this approach, we see a course for buzz eclipsing $200.”

The business’s forecast presumed that the token’s cost will grow at a 15% substance yearly development rate (CAGR) while the Support Fund will buy about 291 million buzz tokens, minimizing the overall supply to 666 million tokens.

The AF is an onchain entity that utilizes 99% of procedure trading costs to redeem buzz tokens, intending to synthetically reinforce need for the token.

The positive forecast likewise presumes that CEXs will lose about 1% of yearly market share to DEXs, which is comparable to an approximated $600 billion in trading volume.

Related: Fidelity macro lead calls $65K Bitcoin bottom in 2026, end of bull cycle

Emerging competitors are the most significant risk to Hyperliquid

Emerging competing DEXs stay the most significant risk to Hyperliquid’s projection development, especially the inbound token generation occasion (TGE) of Lighter DEX.

” In the short-term, competitors from other continuous DEXs provides a threat, especially more recent entrants such as Lighter that are utilizing token generation occasions as rewards to catch market share,” Jung stated.

Ethereum-rollup-based DEX, Lighter, began getting momentum through its zero-fee trading design and special points-based yield farming system, reporting day-to-day trading volumes surpassing $8 billion.

Lighter’s benefit farming system sparked prevalent trader expectations for an inbound TGE, reported to take place at the end of 2025. While the platform has yet to officially reveal a token, Lighter points have actually been costing around $12 in non-prescription markets since Dec. 20, according to airdrop farming account Legends Trade.

Publication: If the crypto bull run is ending … it’s time to purchase a Ferrari– Crypto Kid