Ether (ETH) traded at $3,310, up 11% year-to-date, as restored ETF purchasing and record onchain activity positioned it on a course towards $4,500 over the next couple of weeks.

Secret takeaways:

-

Area Ethereum ETFs taped $474.6 million in inflows over 4 days, exceeding brand-new supply in the middle of a rise in institutional purchasing.

-

Ethereum network activity blew up, with active addresses increasing to a 28-month high.

-

Traders anticipate ETH to rally to $4,500 as long as essential assistance levels hold.

Ethereum ETFs bring in almost $500 million

Ether has actually seen a sharp boost in need from institutional financiers that have actually just recently increased their ETH direct exposure through area Ethereum exchange-traded funds (ETFs).

Information from Farside Investors exposes that US-based area Ethereum ETFs have actually taped inflows over 4 straight days, amounting to $474.6 million.

Related: Ether’s rate vs. basics space might signify 2026 chance

The $175.1 million taped on Wednesday was the greatest given that Dec. 9, 2025, and marked the biggest single-day inflows of 2026.

Daily institutional purchasing, consisting of both DATs and ETFs, has actually likewise increased to net purchasing of 6,964 ETH each day, according to information from Capriole Investments.

Although regular monthly and weekly volumes continue to decrease for Ethereum treasury business, there are a couple of active gamers, such as Bitmine, led by Wall Street strategist Tom Lee, which continue to include ETH.

While inflows have actually gotten attention today, a go back to stable institutional need is required for a continual ETH rate healing.

Ethereum’s network activity is “taking off”

Ethereum’s network activity continues to reveal strength, with active addresses increasing by 53% over the last thirty days, reaching a 28-month high of 995,779 on Thursday, according to Nansen information.

The last time Ethereum’s everyday activity addresses saw these levels was on Sept. 13, 2023, when the metric rose to about 1.09 million– the second-highest level in the network’s history, just behind a peak of around 1.4 million in December 2022.

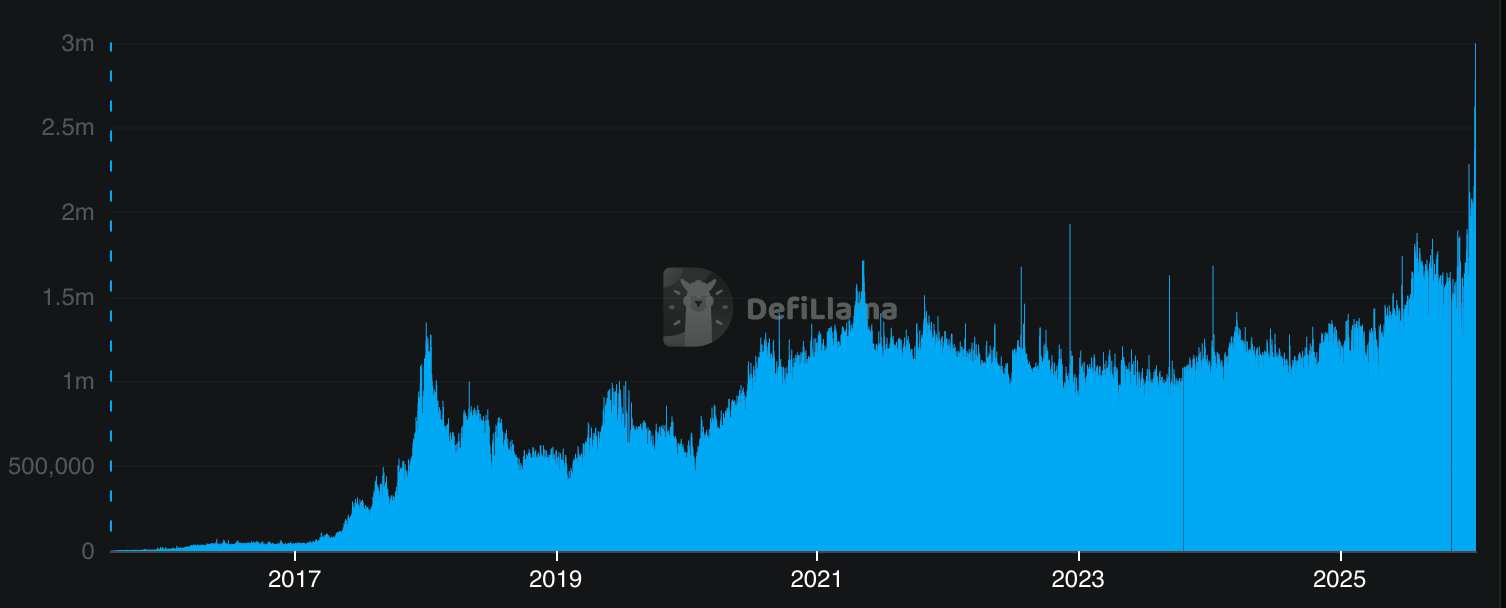

The everyday deal count has actually likewise reached a record high of 2.9 million on Friday, according to information from DefiLlama.

” Daily Ethereum deals are taking off,” stated YouTuber CryptoRover in an X post on Friday, responding to the network’s turning point.

” Ethereum smashed a brand-new ATH with 2.6 M everyday deals and gas costs are listed below $0.01!!!,” fellow expert FenoXBT stated, including:

” This is what real scaling appear like.”

Experts state Ether’s rate is “going greater”

At the time of composing, ETH was trading at $3,300, up 7.3% over the last 7 days.

As Cointelegraph reported, holding above the $3,050-3,170 need zone is essential to ETH’s benefit potential customers and sets the phase for a possible rally above $4,000.

The 50-week rapid moving typical sits within this zone, and a weekly close above this trendline was required to protect the bullish weekly structure, according to trader Coinvo Trading.

” The weekly structure remains undamaged, ETH is going higher.”

According to Crypto Rover, ETH is all set to take off as it reveals strength after breaking out of a balanced triangle. The target of this triangle pattern on the everyday chart is $4,500, according to information from TradingView.

Nevertheless, Crypto Rover shared a chart recommending a prolonged rally to $5,500, based upon Fibonacci retracement analysis, as revealed listed below.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this info.