Bitcoin (BTC) remained caught listed below $90,000 at Friday’s Wall Street open as gold and silver approached historical turning points.

Bottom line:

-

Bitcoin stops working to move its sideways trading habits while gold comes within 2% of $5,000 per ounce.

-

Bullish BTC rate outlooks end up being progressively unusual as safe houses outshine.

-

Gold snags an extraordinary $23,000 target for the next 8 years.

Bitcoin rate avoid breakout relocations

Information from TradingView revealed fixed BTC rate action contrasting a growing number of with record highs for rare-earth elements.

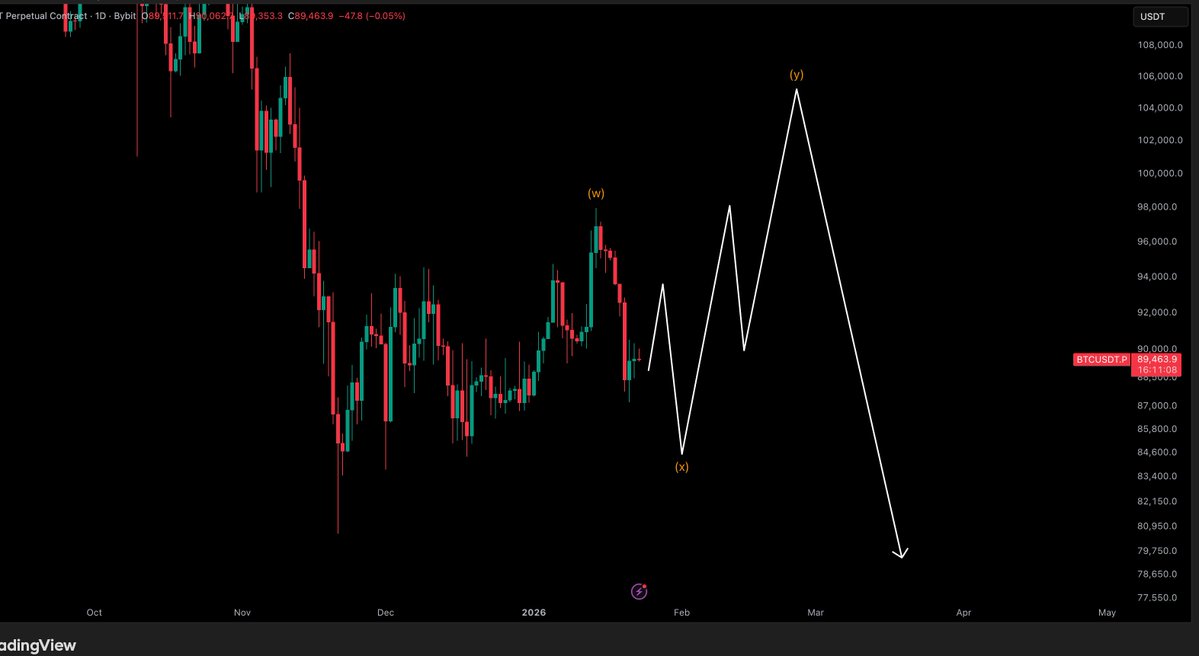

As traders concurred that brand-new macro lows were on the cards for BTC/USD, upside targets progressively concentrated on the 2025 annual open at $93,500.

” So my bullish outlook still has our decreasing in general to $75,000 – $70,000 area, however we review $100,000 initially,” trader Crypto Tony informed X fans in his newest analysis.

Crypto Tony kept in mind that the 2025 beginning level accompanied a close-by “space” in CME Group’s Bitcoin futures, possibly increasing its pull as a rate magnet.

” We would just see this occur if we get that upper hand to $93,000 to close the CME space IMO,” he continued.

” A tap of $85,000 would provide the very best long chance. IF WE HOLD.”

Previously, BTC/USD “filled” an open space at $88,000 before rebounding to existing levels, with the only spaces staying now above the area rate.

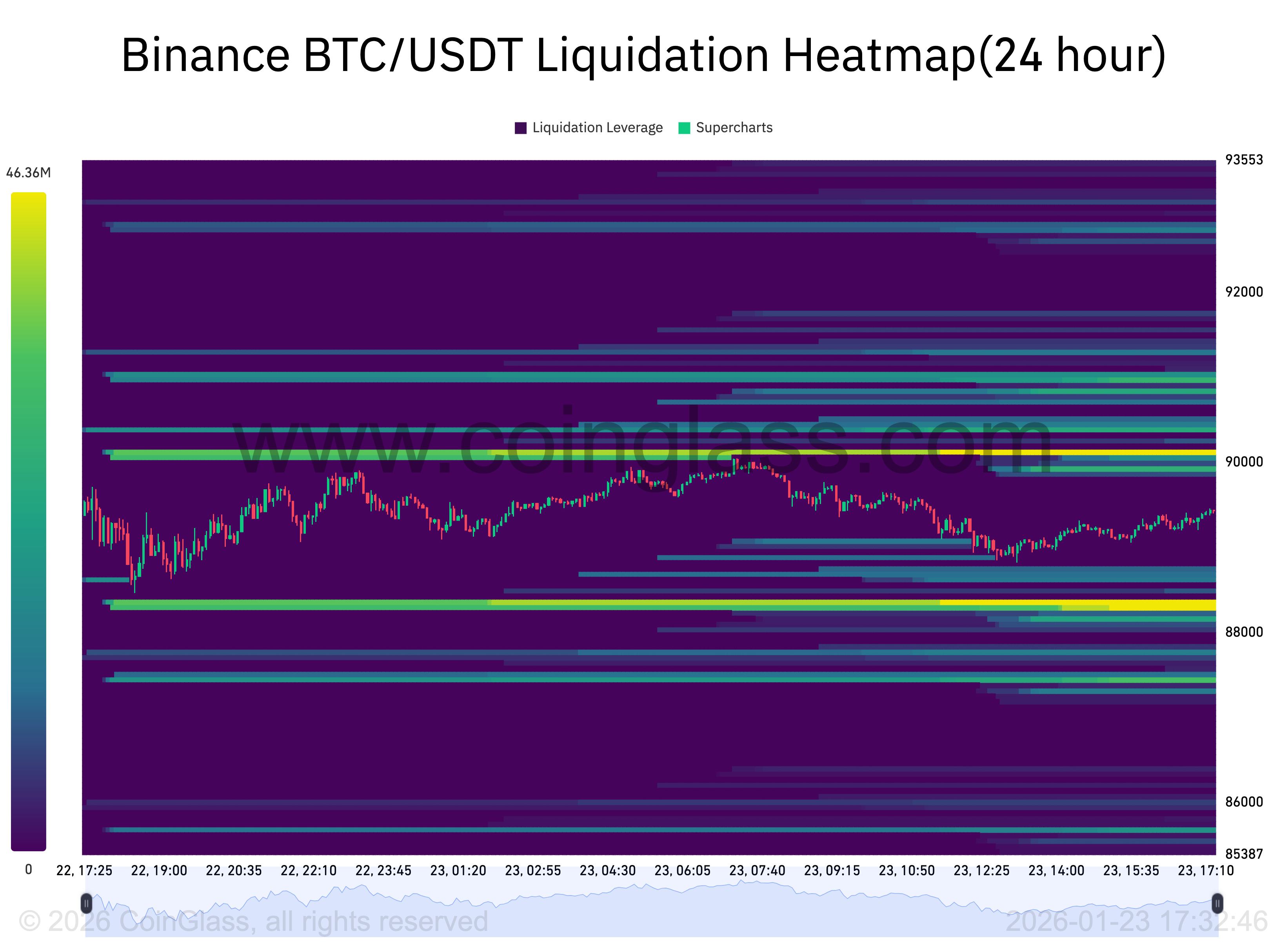

Information from keeping track of resource CoinGlass revealed thickening liquidation levels at $88,300 and $90,100 as the United States trading session approached.

” If the $86.8 K level is lost and does not get recovered rapidly after that, I would presume we’ll begin to see a test of the lows,” crypto trader, expert and business owner Michaël van de Poppe composed in an X upgrade on the day.

” On the other hand, an important level is discovered at $91K. Break that & & we’ll see a strong rise.”

Gold forecast sees $23,000 per ounce

Headings generally concentrated on rare-earth elements as both gold and silver neared the essential mental levels of $5,000 and $100, respectively.

Related: Bitcoin diamond hand BTC offering not ‘repeat of 2017, 2021,’ research study alerts

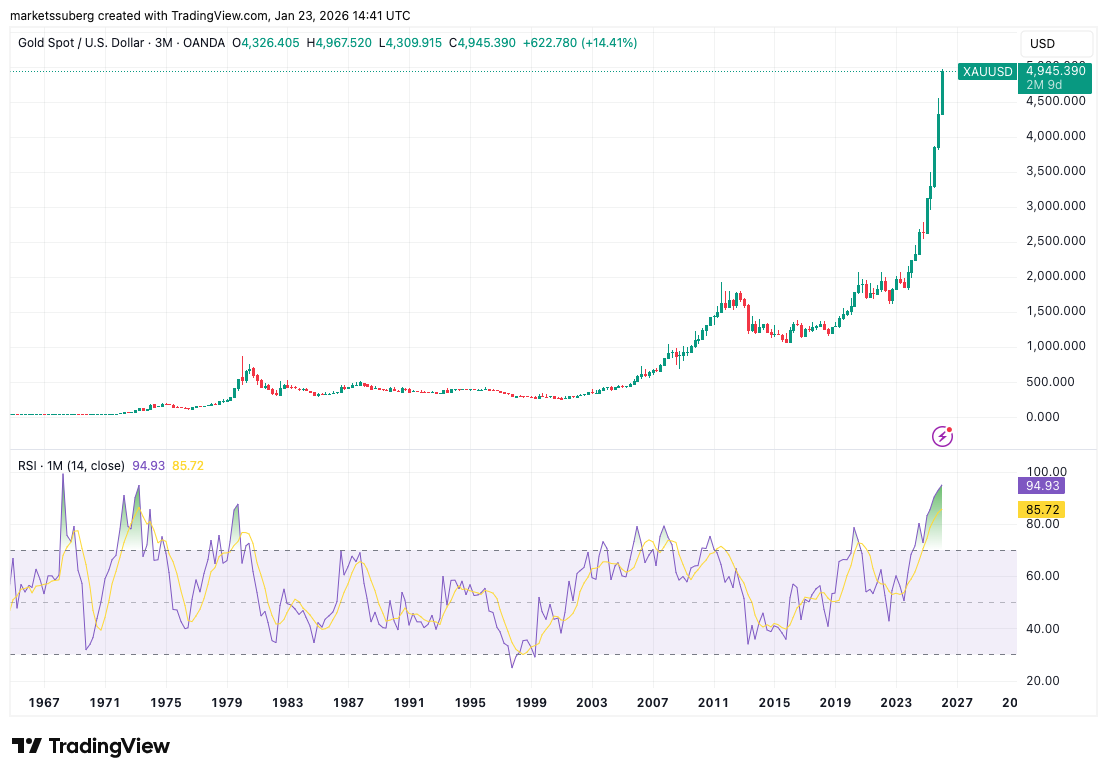

XAU/USD reached brand-new highs of $4,967 per ounce over night, with BTC/XAU hardly holding the 18-ounce mark.

While gold’s regular monthly relative strength index (RSI) worths struck their most “overbought” considering that the 1970s, bullish rate projections continued to stream.

Charles Edwards, creator of quantitative Bitcoin and digital property fund Capriole Investments, brought out a huge $23,000 gold price.

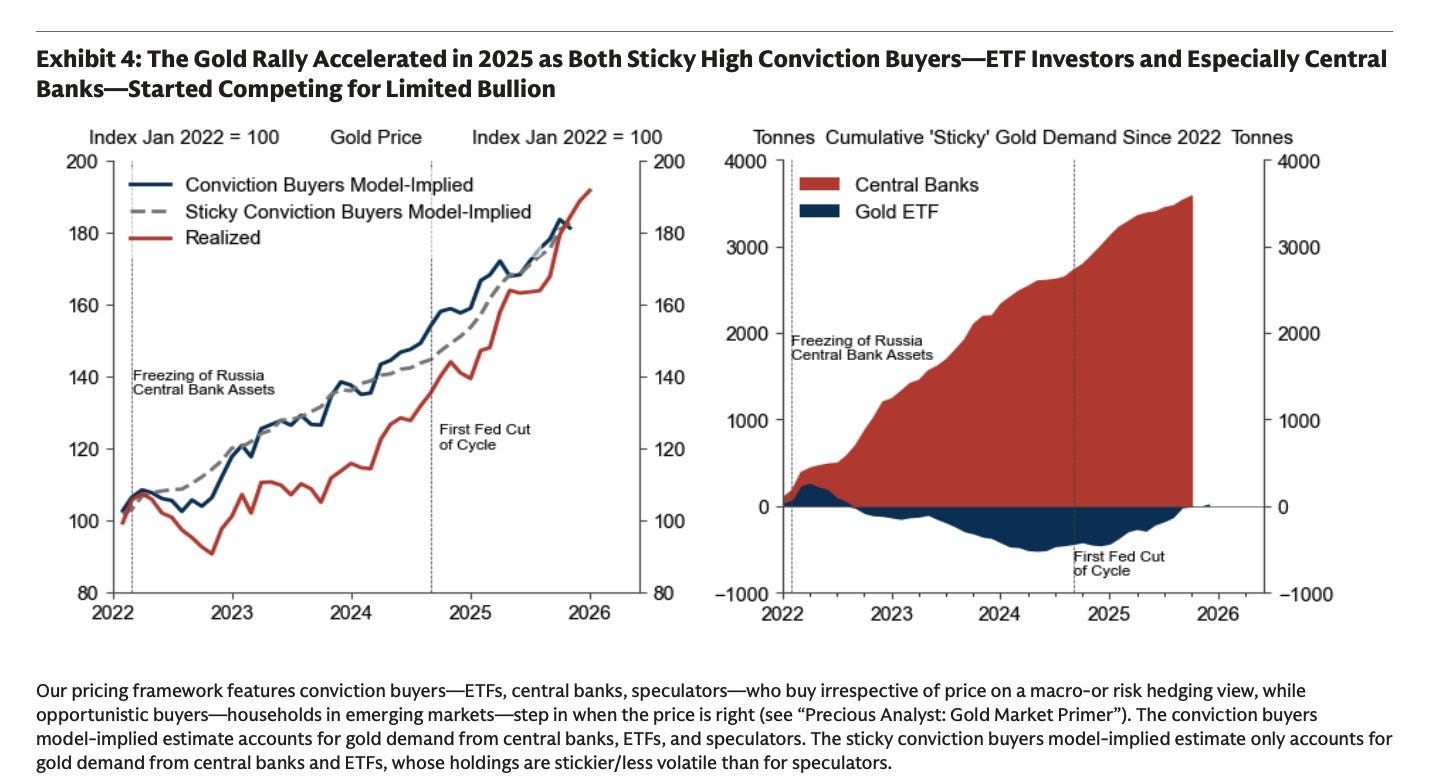

” We have record high Reserve bank gold build-up. China has actually 10Xed their gold stack in the last 2 years alone,” he composed in a post devoted to analysis of gold within the existing macro landscape.

” We have an extraordinary 10.5% fiat cash supply inflation annually, ratcheting up property costs.”

Edwards recommended that the existing property bull run might well follow in the steps of the best durations of growth over the twentieth century.

” If is, we can anticipate the gold rate to pattern to in between $12,000 to $23,000 over the coming 3-8 years,” he concluded.

This short article does not consist of financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might consist of positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this details.