Secret takeaways:

-

Bearish choices methods keep an edge unless Bitcoin protects a definitive rate breakout above 90,000.

-

Traders are utilizing $100,000 call (buy) choices as earnings tools instead of direct bets on an enormous Bitcoin rally.

Bitcoin (BTC) has actually rebounded numerous times from the $87,000 level over the previous 2 months, however traders stay hesitant about a definitive breakout above $95,000. Friday’s upcoming $10.8 billion BTC choices expiration represents a turning point for bulls, particularly as call (buy) choices control general market interest.

The aggregate $6.6 billion in call choices open interest sits 57% greater than the $4.2 billion in put (sell) instruments; nevertheless, this does not always suggest bulls remain in control. As typical, Deribit keeps a comfy lead over its rivals with a 78.7% market share, followed by OKX at 6.3%. The Chicago Mercantile Exchange (CME) holds 3rd location with a 5% share.

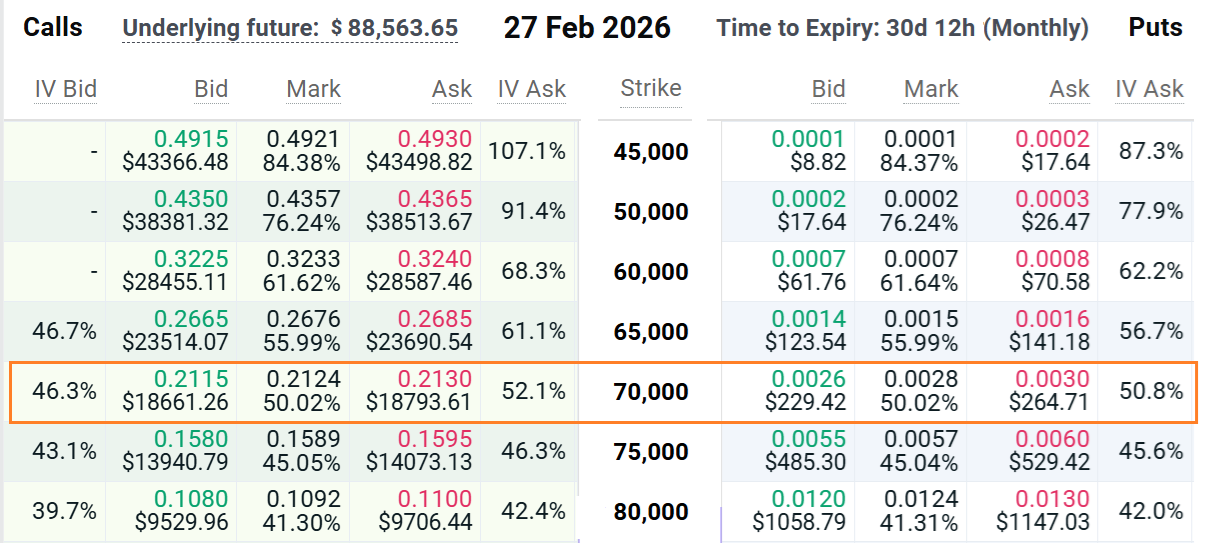

Less than 17% of the Jan. 30 call choices interest at Deribit is placed listed below $92,500. Moreover, considered that Bitcoin’s most affordable rate in 2 months was $84,000, it is most likely that call choices at $70,000 and lower are being made use of for complicated onchain methods instead of direct bets on rate gratitude. Buying a call alternative 20% listed below existing market levels is excessively pricey for the majority of retail traders.

For instance, a $70,000 BTC call alternative for Feb. 27 presently trades at 0.212 BTC, which is substantially greater than an $80,000 call alternative at 0.109 BTC. This rate space discusses why bulls normally choose choices near or somewhat above the area rate level. On the other hand, BTC call choices at $110,000 or greater are typically overlooked, as their expense is lower than 0.002 BTC (approximately $180).

Bearish Bitcoin choices methods preferred listed below $90,000

A considerable part of the $100,000 and greater call choices can be credited to covered call methods. In this setup, the seller gets an in advance premium, comparable to making interest on a bond. This varies from basic fixed-income items due to the fact that the seller keeps the underlying Bitcoin, despite the fact that their prospective earnings is topped. Subsequently, these are seldom considered as simply bullish signs.

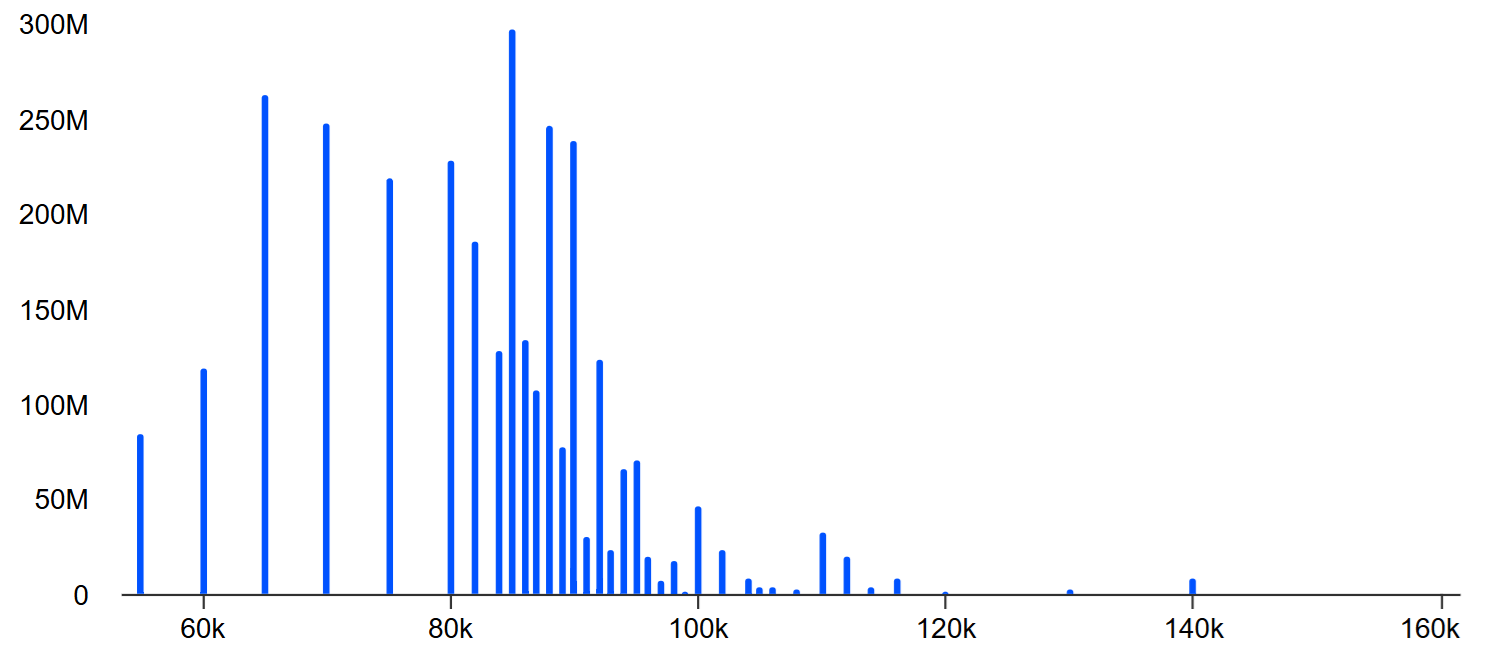

Call choices at Deribit in between $75,000 and $92,000 overall $850 million. To identify if bulls are much better placed for Friday’s expiration, one need to compare how put choices are stacked and approximate if they are being utilized for drawback defense or neutral methods. A main indication is the volume of put choices listed below $70,000, where the expense is less than $300.

Regardless of being less represented than call choices, put instruments in between $86,000 and $100,000 total up to $1.2 billion at Deribit. For that reason, even if we presume that puts at $102,000 and greater do not take advantage of a rate dip, bearish methods appear much better placed for the January expiration.

Related: Bitcoin’s genuine ‘Uptober’ minute may begin in February– Here’s why

Below are 3 possible results for Friday’s BTC choices expiration at Deribit based upon existing rate patterns:

-

In Between $86,000 and $88,000: The net outcome prefers the put (sell) instruments by $775 million.

-

In Between $88,001 and $90,000: The net outcome prefers the put (sell) instruments by $325 million.

-

In Between $90,001 and $92,000: The net outcome prefers the call (buy) instruments by $220 million.

As long as the Bitcoin rate stays listed below the $90,000 mark, the mathematical benefit continues to prefer bearish choices methods.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this info.