Bitcoin has actually been called “digital gold,” and a few of its essential residential or commercial properties might assist BTC rally more than the rare-earth element in portion terms.

Bitcoin (BTC) has vastly underperformed gold (XAU) in the past year, dropping by 13.25% compared with the precious metal’s almost 100% rally. Can BTC catch up to gold’s gains?

Key takeaways:

-

Bitcoin’s supply is capped at 21 million, with about 1 million left to be mined.

-

Gold miners increase production when prices rise, unlike Bitcoin miners.

-

Bitcoin’s small size versus gold amplifies any potential upside even from minor reallocations.

Bitcoin supply does not depend on demand

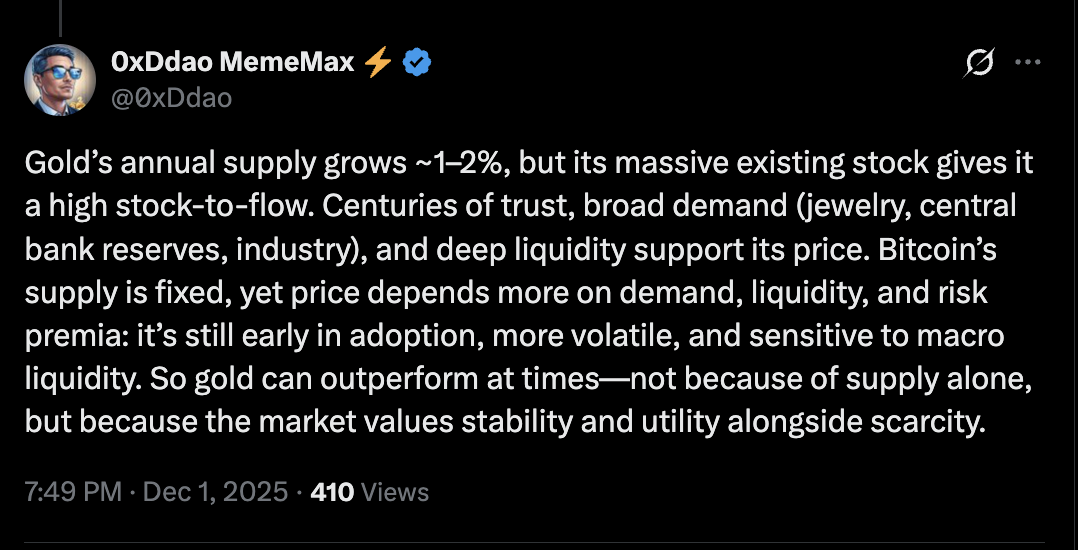

Bitcoin’s issuance does not respond to higher prices like gold.

The protocol releases new BTC on a fixed schedule, which tapers over time through halvings toward a hard 21 million supply cap.

Miners can add machines or switch them off, but they cannot change how many coins the network issues.

“The problem with gold as a long-term treasury asset is that it lacks a difficulty adjustment and halving,” said Pierre Rochard, the CEO of Bitcoin Bond Company, adding:

“The higher the gold price goes, the more capital gets invested in new gold mining projects and accelerates the dilution of above ground gold supply.”

Global gold production has increased over the past 25 years, from about 2,300 tonnes in 1995 to over 3,500 tonnes by 2018, according to the World Gold Council.

It reached a record high of 3,672 tonnes in 2025.

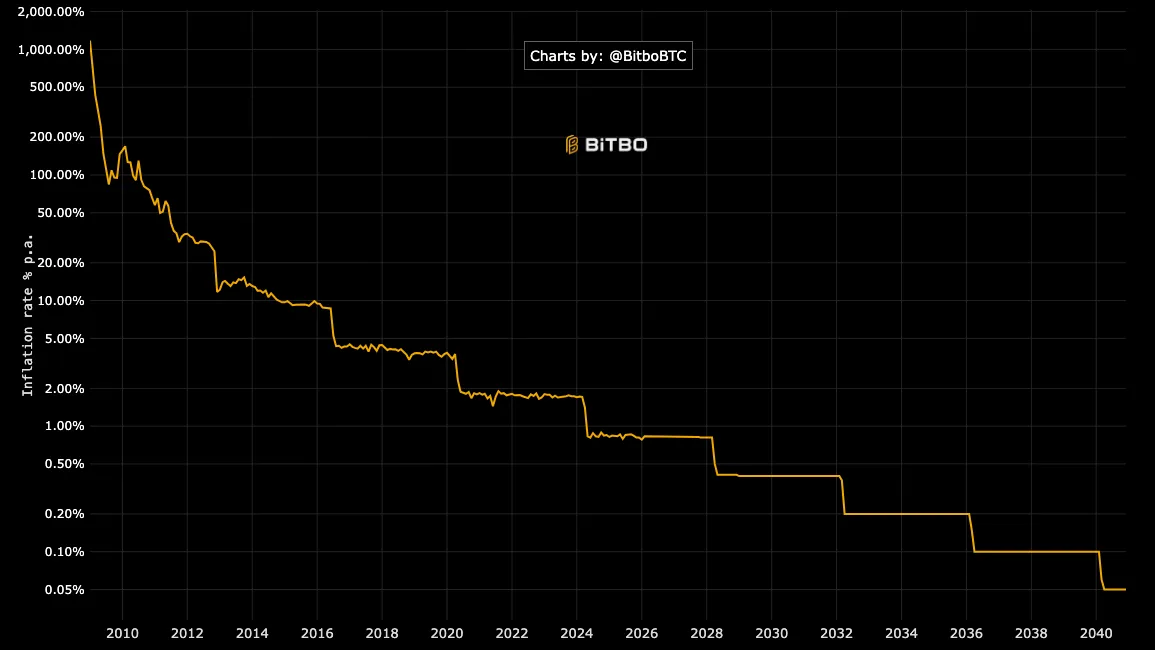

At the end of 2025, 93% of all BTC had already been mined, with its annual inflation rate at around 0.81%. It could drop to 0.41% after the next BTC halving in March 2028, according to Bitbo data.

Gold’s market cap dwarfs Bitcoin’s

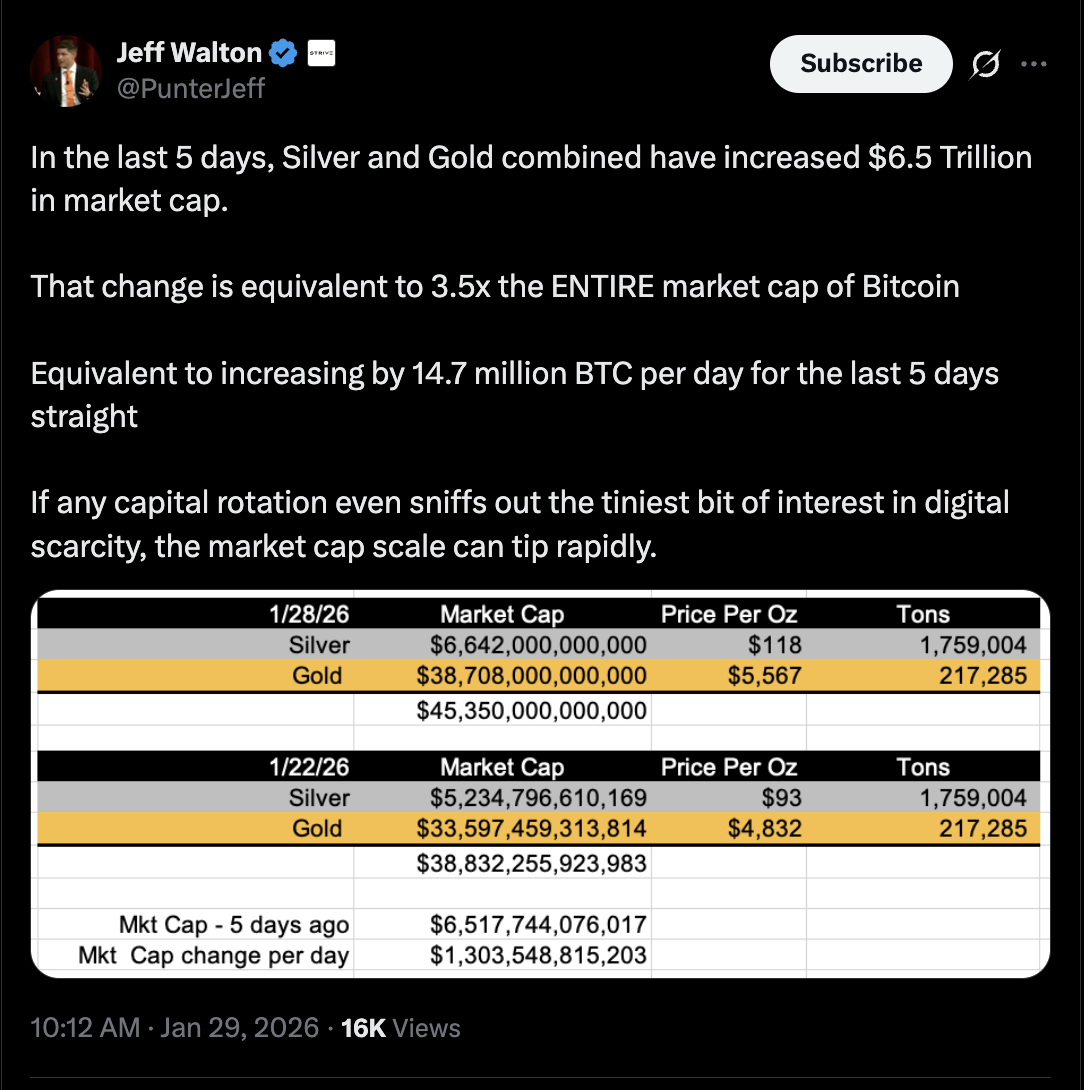

As of January, Bitcoin’s worth was only about 4.30% of gold’s $41.69 trillion market cap.

If investors already buy gold for hard-asset exposure, due to currency hedging, geopolitical risk or long-run purchasing-power protection, Bitcoin can still attract a marginal allocation.

Bitcoin only needs a modest share of gold-style demand to rotate into BTC, according to Jeff Walton, chief risk officer at Strive, a BTC treasury company.

With a smaller market cap, that marginal demand can translate into a larger percentage move.

Related: Brazil’s largest private bank advises investors to allocate 3% to Bitcoin in 2026

Theoretically, a 5% rotation from gold into Bitcoin equals over $2 trillion in inflows, implying a 116.25% upside in BTC market cap and a price target of about $192,000, based on current valuations.

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this post. This post might consist of positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage developing from your dependence on this details.