Bottom line:

-

Bitcoin has actually begun a relief rally, which is anticipated to deal with selling near $84,000.

-

Numerous significant altcoins are at threat of breaking listed below their assistance levels if the bulls stop working to clear the overhead resistance levels.

Bitcoin (BTC) showed up from the $74,508 level on Monday, and the purchasers are trying to keep the rate above $79,000. BTC expert PlanC stated in a post on X that the fall to the $75,000 to $80,000 zone may be “the inmost pullback chance this Bitcoin bull run.”

The Crypto Worry & & Greed Index, which determines total crypto market belief, plunged into the “Extreme Worry” zone with a rating of 14, the most affordable in 2026. Crypto analytics platform Santiment stated in a report on Friday that the severe negativeness on social networks was a silver lining as “traditionally, crypto markets relocate the opposite instructions of the crowd’s expectations.”

Nevertheless, not everybody thinks that a bottom remains in. Numerous experts are bearish on BTC and anticipate it to fall even more. Traders on Polymarket likewise prepare for the drop to continue, with the chances of BTC falling listed below $65,000 increasing to 72% on Monday.

Could BTC and the significant altcoins begin a strong relief rally in the near term? Let’s evaluate the charts of the leading 10 cryptocurrencies to discover.

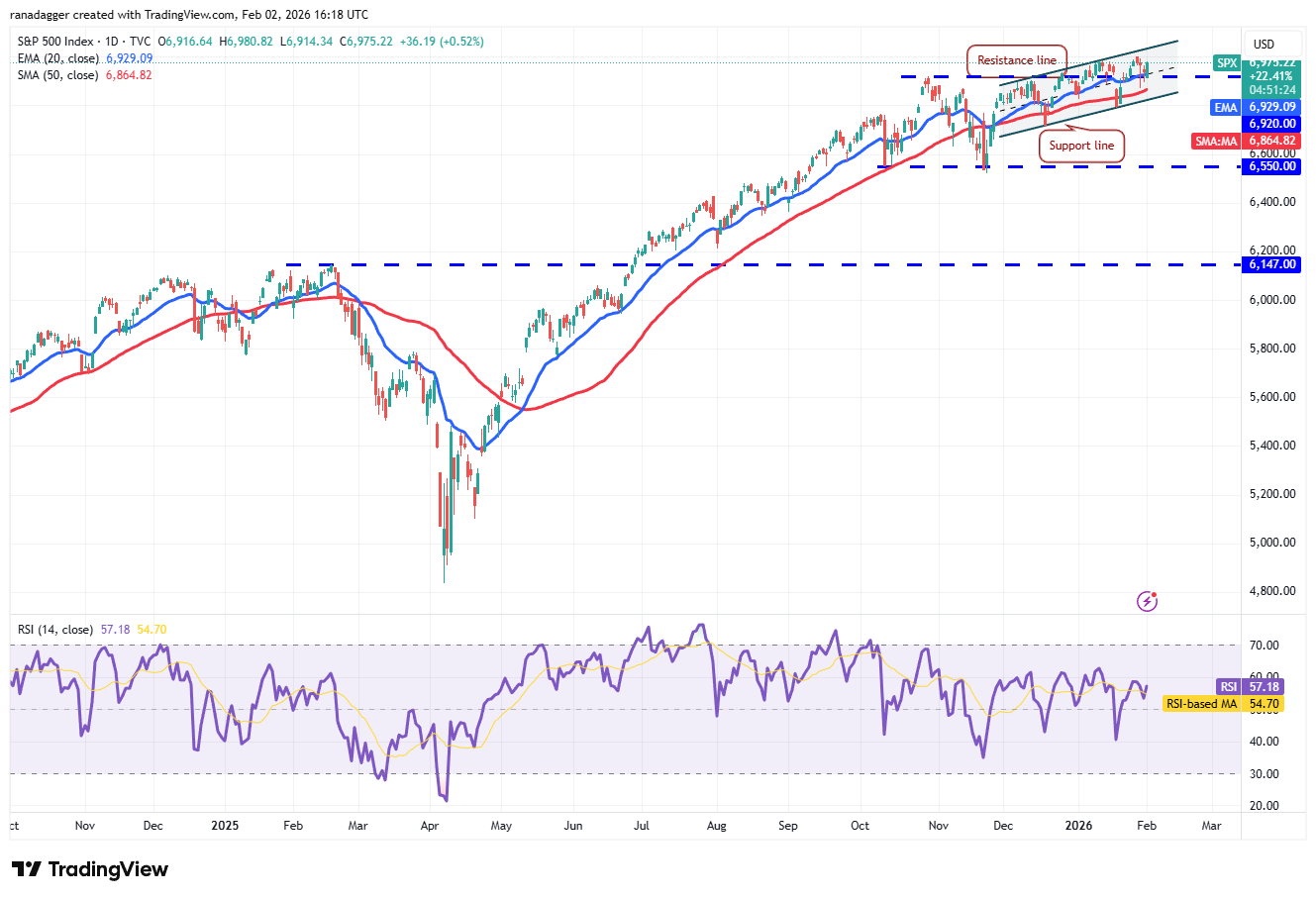

S&P 500 Index rate forecast

The S&P 500 Index (SPX) was up to the 50-day basic moving average (6,864) on Thursday, however the bulls effectively protected the level.

The bulls will need to thrust the rate above the resistance line of the rising channel pattern to show the resumption of the uptrend. The index might then rally to 7,290.

Contrary to this presumption, if the rate declines from the resistance line and breaks listed below the 20-day rapid moving average ($ 6,929), it recommends that the index might stay inside the channel for a while longer. The bears will acquire the advantage on a close listed below the assistance line. The index might then decrease towards the 6,550 assistance.

United States Dollar Index rate forecast

The United States Dollar Index (DXY) toppled listed below the 96.21 assistance on Tuesday, however the bears might not sustain the lower levels.

The bulls pressed the rate back above the 96.21 level on Wednesday, however the healing is anticipated to deal with costing the 20-day EMA ($ 97.78). If the rate declines greatly from the 20-day EMA, the bears will try to sink the index listed below the 96.21 level.

On the other hand, a break and close above the 20-day EMA recommends that the break listed below the 96.21 level might have been a bear trap. The index might then rally towards the stiff overhead resistance of 100.54.

Bitcoin rate forecast

BTC fell listed below the Nov. 21, 2025, low of $80,600 on Saturday and reached the crucial assistance of $74,508 on Monday.

The relative strength index (RSI) plunged into the oversold area, signifying a possible relief rally in the near term. The Bitcoin rate is anticipated to deal with selling in the $80,600 to $84,000 zone. If the BTC/USDT set declines greatly from the overhead zone, the threat of a break listed below the $74,508 level boosts. The next assistance on the drawback is at $60,000.

The very first indication of strength will be a break and close above the moving averages. That recommends the $74,508 level will continue to act as a flooring for some more time.

Ether rate forecast

Ether (ETH) broke listed below the $2,623 level on Saturday and was up to the next significant assistance of $2,111 on Monday.

The RSI has actually slipped into the oversold classification, suggesting that the selling might have been exaggerated in the near term. That increases the possibility of a relief rally, which is anticipated to deal with costing the 20-day EMA ($ 2,833).

A shallow bounce off the existing level or a sharp turnaround from the 20-day EMA recommends that the benefit stays with the bears. If the $2,111 assistance fractures, the Ether rate might come down to $1,750. The bulls will be back in the video game after the ETH/USDT set increases above the moving averages.

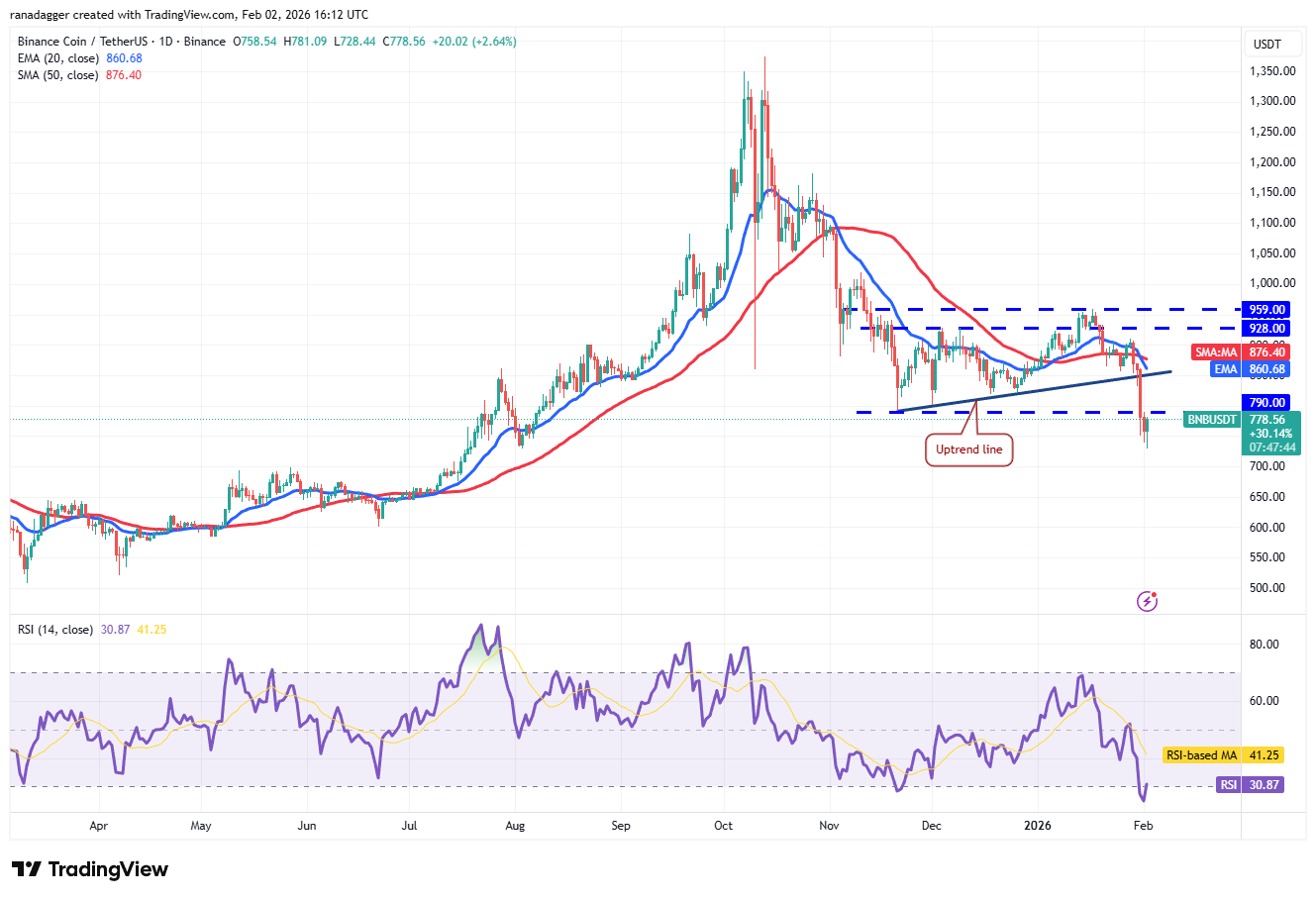

BNB rate forecast

BNB (BNB) dropped listed below the uptrend line and the $790 assistance on Saturday, suggesting aggressive selling by the bears.

The bulls are trying to safeguard the $730 assistance, however the relief rally is anticipated to deal with costing the breakdown level of $790. If the BNB rate declines greatly from $790, it indicates that the bears have actually turned the level into resistance. That increases the potential customers of a drop to $700.

Rather, if the rate closes above $790, it recommends that the lower levels are drawing in purchasers. The BNB/USDT set might then rally to the moving averages, where the bulls are anticipated to come across strong selling by the bears.

XRP rate forecast

XRP (XRP) is experiencing a hard fight in between the purchasers and sellers at the important $1.61 assistance.

A shallow bounce increases the possibility of a drop to the assistance line of the coming down channel pattern. Purchasers are anticipated to protect the assistance line, as a break listed below it may sink the XRP/USDT set to the Oct. 10, 2025, low of $1.25.

The moving averages are the crucial resistance to keep an eye out for on the benefit. A close above the moving averages recommends that the XRP rate might stay inside the channel for a couple of more days.

Solana rate forecast

Solana (SOL) collapsed listed below the $117 level on Saturday and reached the crucial assistance at $95.

The bulls have actually effectively protected the $95 level, however the failure to begin a strong bounce recommends that the bears continue to apply pressure. If the $95 assistance paves the way, the SOL/USDT set might begin the next leg of the drop to $79.

Contrarily, if the Solana rate increases above $107, the healing might reach the 20-day EMA ($ 121). Sellers will try to protect the 20-day EMA, however if the bulls dominate, the set might march towards the $147 resistance.

Related: XRP rate threats duplicating 2022 crash as brand-new purchasers go undersea

Dogecoin rate forecast

Dogecoin (DOGE) plunged listed below the Oct. 10, 2025, low of $0.10 on Saturday, suggesting aggressive selling by the bears.

The bulls have actually begun a relief rally, which is anticipated to deal with costing the 20-day EMA ($ 0.12). If the Dogecoin rate declines greatly from the 20-day EMA, the threat of a break listed below the $0.10 level boosts. The DOGE/USDT set might then nosedive to $0.08.

Additionally, if purchasers pierce the 20-day EMA, it recommends that the marketplace has actually turned down the break listed below the $0.10 level. The set will then try a rally to the strong overhead resistance at $0.16.

Cardano rate forecast

Cardano (ADA) fell listed below the Oct. 10, 2025, low of $0.27 on Saturday, signifying that the bears stay in charge.

The Cardano rate has actually bounced off the assistance line however is anticipated to deal with costing the 20-day EMA ($ 0.34). If the rate declines greatly from the 20-day EMA, the bears will once again attempt to pull the ADA/USDT set listed below the assistance line. If they prosper, the drop might encompass $0.20.

The bulls will need to catapult the rate above the drop line to recommend that the drop might be ending. The set might then rise to the breakdown level of $0.50.

Bitcoin Money rate forecast

Bitcoin Money (BCH) fell towards its pattern target of $456 on Saturday, where the purchasers actioned in.

The bulls have actually begun a relief rally, which is anticipated to deal with resistance in the zone in between the 50% Fibonacci retracement level of $535 and the 61.8% retracement level of $551. If the Bitcoin Money rate declines from the resistance zone, the bears will try to pull the BCH/USDT set listed below $500.

On the contrary, if purchasers move the rate above $551, the set might reach the 20-day EMA ($ 571). A close above the 20-day EMA signals that the bulls are back in the video game.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this info.