Bitcoin (BTC) closed its weekly candle light at $76,931 on Sunday, triggering BTC to lose its 100-week moving average for the very first time given that October 2023. Experts are now weighing whether the relocation marks the early phases of a bearishness and what this shift might indicate for Bitcoin’s healing in the long term.

Secret takeaways:

-

Bitcoin closed a weekly candle light listed below the 100-week easy moving average, a pattern related to multi-month drawdowns.

-

Previous bearish breakouts listed below the weekly pattern lasted in between 182 and 532 days.

-

Heavy area volume in between $85,000 and $95,000 might turn that level into a significant resistance.

Bitcoin slips listed below a long-lasting weekly pattern

Bitcoin closed a weekly candle light listed below its 100-week easy moving average (SMA), which sits near $87,500. This marks a loss of a crucial macro pattern level for BTC.

Crypto supporter Brett kept in mind that, aside from the 2020 COVID-19 flash crash, Bitcoin has actually invested prolonged durations listed below the 100-week SMA. Throughout the 2014 to 2015 cycle, BTC stayed under the level for 357 days as costs varied in between $200 and $600 following the 2013 booming market peak.

In 2018 to 2019, the duration lasted 182 days, accompanying the bearish market bottom in between $3,000 and $6,000.

In 2022, Bitcoin invested 532 days listed below the 100-week SMA after the FTX collapse, combining in between $16,000 and $25,000.

Each circumstances resulted in a build-up stage instead of a fast rebound, recommending time might once again be the essential aspect before the next bullish duration.

USDT supremacy and $85,000 resistance raise bearish market threat

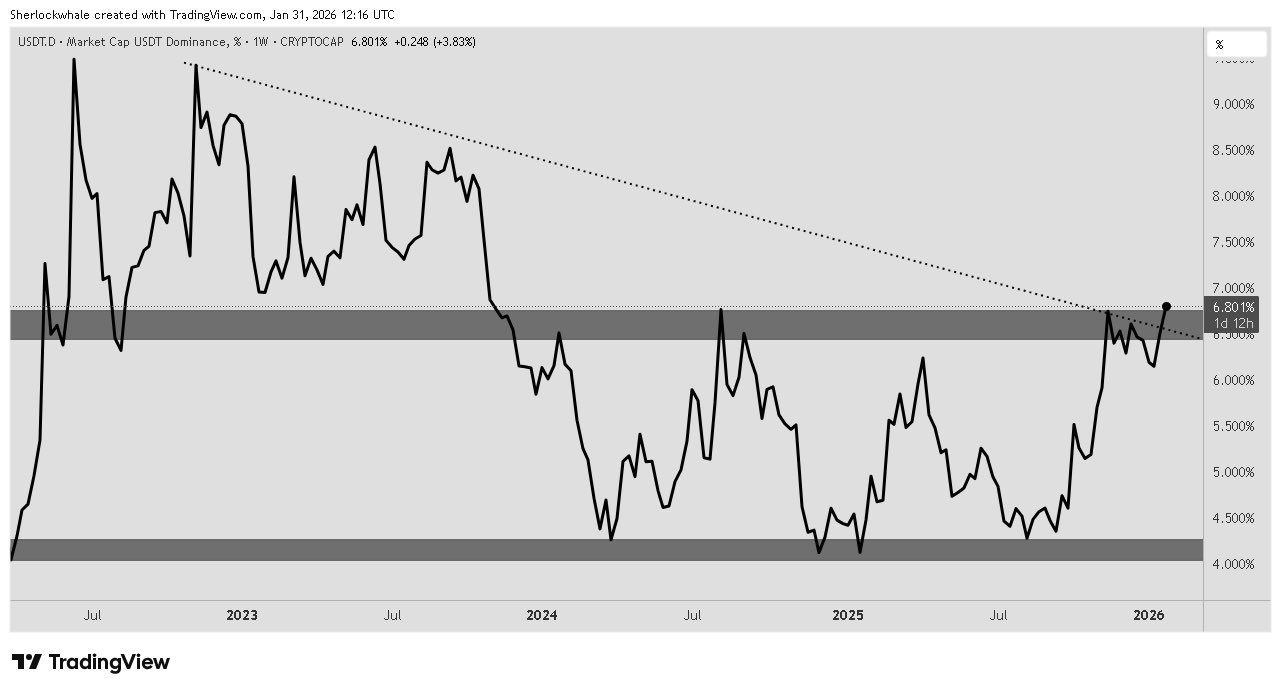

Crypto expert Sherlock stated a bearishness might emerge after the USDT supremacy chart published a weekly close above 7.2%. In previous cycles, a close above 6.7% validated bearish conditions, making the current breakout, its very first in more than 2 and a half years, especially substantial.

The expert highlighted $85,000 as a crucial resistance zone. More than $120 billion in area volume was traded in between $85,000 and $95,000 in Q4, 2025, leaving numerous BTC holders undersea. With BTC near $78,000, any rally towards $85,000 might deal with stable selling pressure as the traders might seek to leave at breakeven, with the understood cost of one-to-three-month holders presently at $91,500.

Related: BTC cost heads back to 2021: 5 things to understand in Bitcoin today

BTC fractal structure mirrors dip from 2022

Bitcoin’s weekly structure is revealing resemblances to the 2022 dip. At that time, BTC formed lower highs, lost the 100-week SMA, and stopped working to sustain a healing before moving into a much deeper correction.

A comparable pattern is now noticeable in 2026. If the fractal continues, Bitcoin might review the $40,000 to $45,000 variety, a recognized need zone. While fractals are not predictive, the setup recommends disadvantage threat stays raised unless Bitcoin decisively recovers the 100-week SMA.

Related: Saylor’s Technique purchases $75.3 M in BTC as costs quickly dip listed below $75K

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this details.