Properties in area Bitcoin (BTC) ETFs slipped listed below $100 billion on Tuesday following a fresh $272 million in outflows.

According to information from SoSoValue, the relocation marked the very first time area Bitcoin ETF possessions under management have actually fallen listed below that level considering that April 2025, after peaking at about $168 billion in October.

The drop came amidst a more comprehensive crypto market sell-off, with Bitcoin moving listed below $74,000 on Tuesday. The international cryptocurrency market capitalization fell from $3.11 trillion to $2.64 trillion over the previous week, according to CoinGecko.

Altcoin funds protected modest inflows

The current outflows from area Bitcoin ETFs followed a short rebound in circulations on Monday, when the items drew in $562 million in net inflows.

Still, Bitcoin funds resumed losses on Tuesday, pressing year-to-date outflows to nearly $1.3 billion, being available in line with continuous market volatility.

By contrast, ETFs tracking altcoins such as Ether (ETH), XRP (XRP) and Solana (SOL) taped modest inflows of $14 million, $19.6 million and $1.2 million, respectively.

Is institutional adoption moving beyond ETFs?

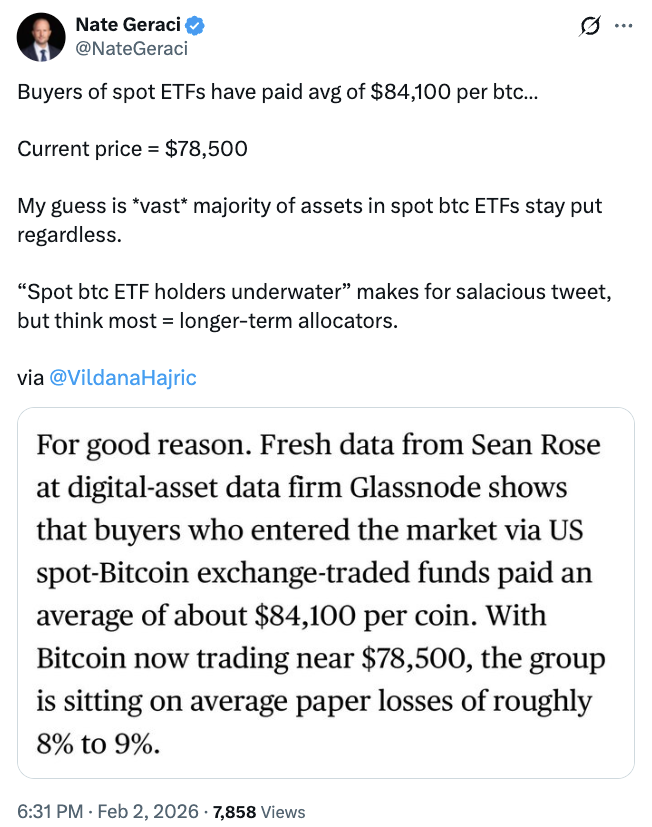

The continuous sell-off in Bitcoin ETFs comes as BTC trades listed below the ETF development expense basis of $84,000, recommending brand-new ETF shares are being provided at a loss and positioning pressure on fund streams.

Market observers state that the depression is not likely to activate more mass sell-offs in ETFs.

” My guess is huge bulk of possessions in area BTC ETFs sit tight regardless,” ETF expert Nate Geraci composed on X on Monday.

Thomas Restout, CEO of institutional liquidity company B2C2, echoed the belief, keeping in mind that institutional ETF financiers are normally durable. Still, he hinted that a shift towards onchain trading might be underway.

Related: VistaShares launches Treasury ETF with options-based Bitcoin direct exposure

” The advantage of organizations being available in and purchasing ETFs is they’re even more durable. They will rest on their views and positions for longer,” Restout stated in a Rulematch Area On podcast on Monday.

” I believe the next level of change is organizations in fact trading crypto, instead of simply utilizing securitized ETFs. We’re anticipating the next wave of organizations to be the ones trading the underlying possessions straight,” he kept in mind.

Publication: DAT panic discards 73,000 ETH, India’s crypto tax stays: Asia Express