Secret takeawys:

-

Bitcoin fell listed below $63,000 as weak United States task information and issues over AI market financial investments sustained financier danger hostility.

-

Options markets reveal a 6% opportunity of Bitcoin going back to $90,000 by March.

Bitcoin (BTC) moved listed below $63,000 on Thursday, striking its least expensive level considering that November 2024. The 30% drop considering that the unsuccessful effort to break $90,500 on Jan. 28 has actually left traders hesitant of any instant bullish momentum. The present bearish belief is sustained by weak United States task market information and increasing issues over enormous capital investment within the expert system sector.

Despite whether Bitcoin’s downturn was set off by macroeconomic shifts, alternatives traders are now pricing in simply 6% chances of BTC recovering $90,000 by March.

On Deribit exchange, the right to purchase Bitcoin at $90,000 on March 27 (a call alternative) traded at $522 on Thursday. This prices recommends financiers see long shot of a huge rally. According to the Black-Scholes design, these alternatives show less than 6% chances of Bitcoin reaching $90,000 by late March. For context, the right to offer Bitcoin at $50,000 (a put alternative) for the exact same date traded at $1,380, indicating a 20% likelihood of a much deeper crash.

Quantum calculating dangers and required liquidation worries drive Bitcoin selling

Market individuals have actually lowered crypto direct exposure due to emerging quantum computing dangers and worries of forced liquidations by business that constructed Bitcoin reserves through financial obligation and equity. In mid-January, Christopher Wood, worldwide head of equity technique at Jefferies, eliminated a 10% Bitcoin allotment from his design portfolio, mentioning the danger of quantum computer systems reverse-engineering personal secrets.

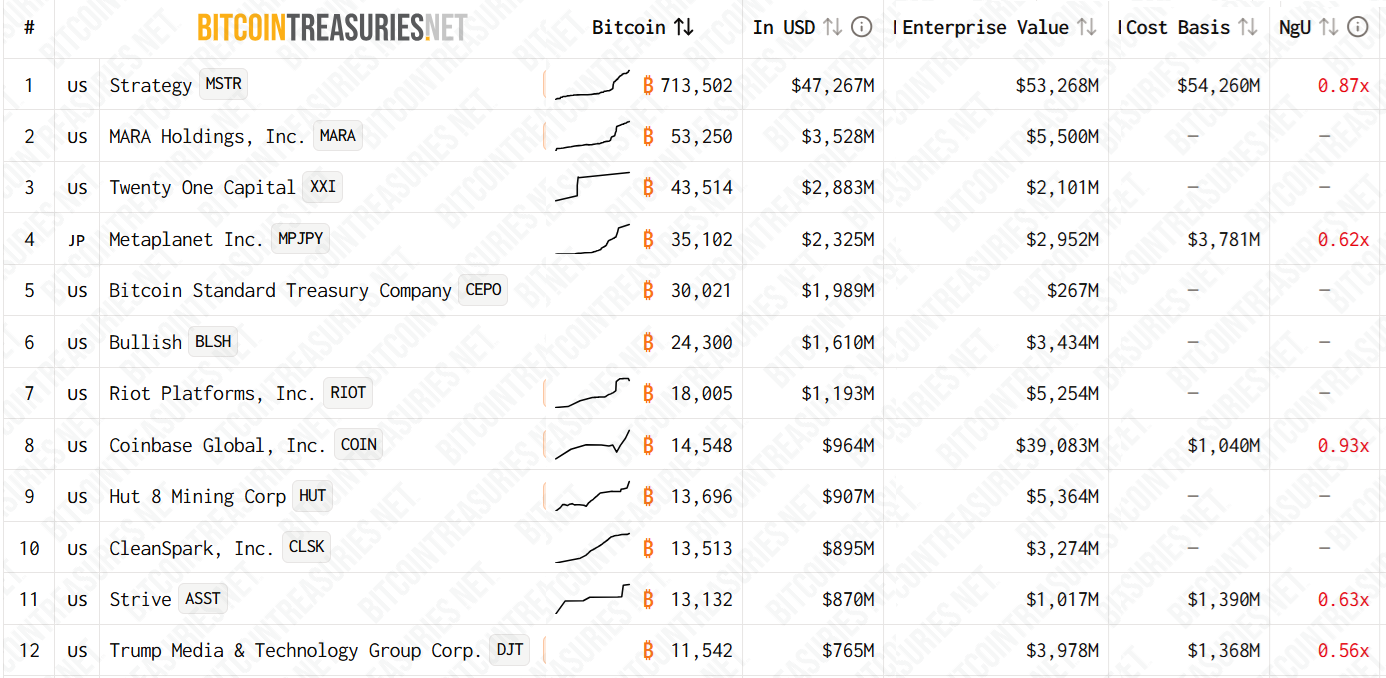

Method (MSTR United States), the biggest openly noted business with onchain BTC reserves, just recently saw its business worth dip to $53.3 billion, while its expense basis sat at $54.2 billion. Japan’s Metaplanet (MPJPY United States) dealt with a comparable space, valued at $2.95 billion versus a $3.78 billion acquisition expense. Financiers are fretted that an extended bearishness may require these business to offer their positions to cover financial obligation responsibilities.

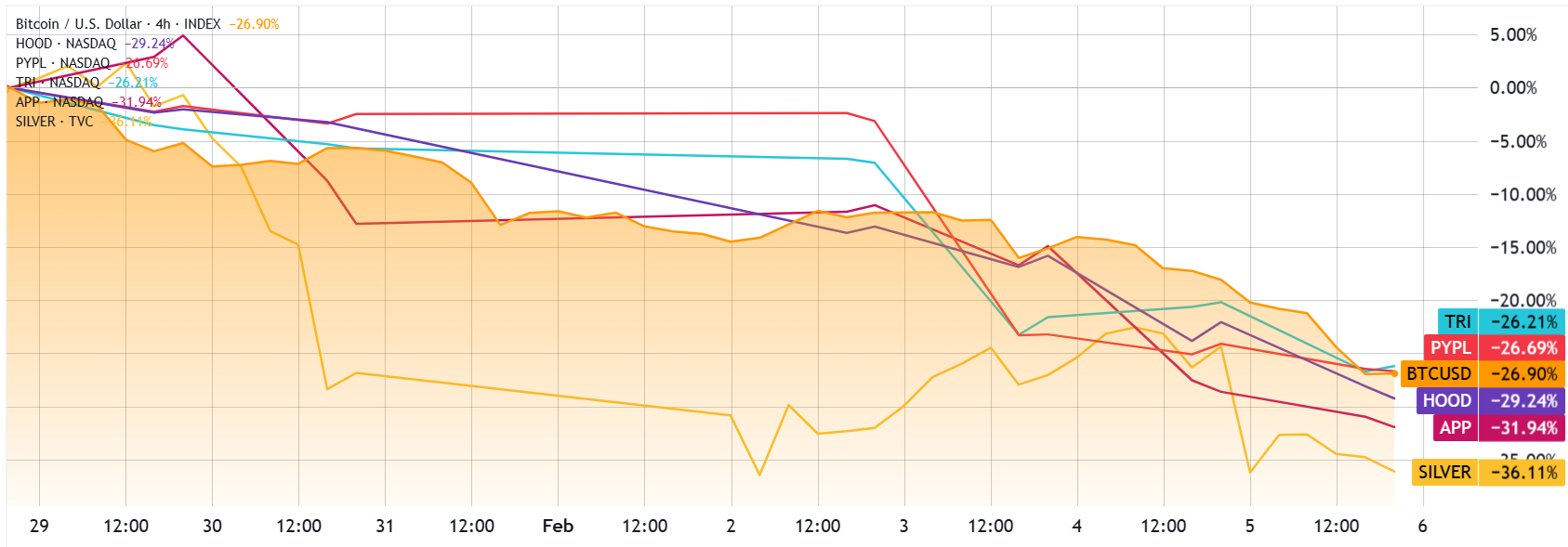

External elements most likely added to the increase in danger hostility, and even silver, the second-largest tradable property by market capitalization, suffered a 36% weekly cost drop after reaching a $121.70 all-time high up on Jan. 29.

Bitcoin’s 27% weekly decrease carefully mirrors losses seen in numerous billion-dollar noted business, consisting of Thomson Reuters (TRI), PayPal (PYPL), Robinhood (HOOD) and Applovin (APP).

United States companies revealed 108,435 layoffs in January, up 118% from the exact same duration in 2025, according to outplacement company Opposition, Gray & & Christmas. The rise marked the greatest variety of January layoffs considering that 2009, when the economy was nearing completion of its inmost slump in 80 years.

Related: Next Bitcoin build-up stage might depend upon credit tension timing– Information

Market belief had actually currently compromised after Google (GOOG United States) reported on Wednesday that capital investment in 2026 is anticipated to reach $180 billion, up from $91.5 billion in 2025. Shares of tech huge Qualcomm (QCOM United States) fell 8% after the business provided weaker development assistance, mentioning that provider capability has actually been rerouted towards high-bandwidth memory for information centers.

Traders anticipate financial investments in expert system to take longer to settle due to increasing competitors and production traffic jams, consisting of energy restraints and scarcities of memory chips.

Bitcoin’s slide to $62,300 on Thursday shows unpredictability around financial development and United States work, making a rebound towards $90,000 in the near term progressively not likely.

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.