Digital property supervisor CoinShares has actually dismissed issues that quantum computer systems might quickly shock the Bitcoin market, arguing that just a portion of coins are kept in wallets worth assaulting.

In a post on Friday, CoinShares Bitcoin research study lead Christopher Bendiksen argued that simply 10,230 Bitcoin (BTC) of 1.63 million Bitcoin being in wallet addresses with openly noticeable cryptographic secrets that are susceptible to a quantum computing attack.

A little over 7,000 Bitcoin are kept in wallets with in between 100 and 1,000 BTC, while approximately 3,230 Bitcoin are kept in wallets with 1,000 to 10,000 BTC, relating to $719.1 million at present market value, which Bendiksen stated might even look like a regular trade.

The staying 1.62 million Bitcoin are kept in wallets with holdings under 100 BTC, which Bendiksen declared would each take a millennium to unlock, even in the “most outlandishly positive circumstance of technological development in quantum computing.”

The CoinShares scientist stated these “theoretical threats” originate from quantum algorithms such as Shor’s, which might break Bitcoin’s elliptic-curve signatures, and Grover’s, which might compromise the Secure Hash Algorithm 256-bit (SHA-256).

Nevertheless, he argued neither quantum algorithm might modify Bitcoin’s 21 million supply cap or bypass proof-of-work, 2 of the Bitcoin network’s most fundamental functions.

Quantum worries have actually been amongst the lots of motorists of Bitcoin FUD (worry, unpredictability, doubt) in current months, with critics alerting that any compromise of its cryptography might threaten a network that presently protects $1.4 trillion in worth.

The Bitcoin at threat are unspent deal output (UTXO) wallets, which are pieces of Bitcoin connected to wallet addresses that have actually not been invested. Much of these Bitcoin wallets at threat go back to the Satoshi age.

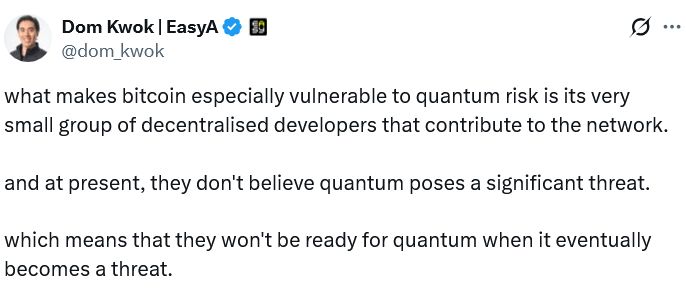

The problem has actually divided the Bitcoin neighborhood over whether to execute a quantum-resistant difficult fork or wait.

Related: Bitcoin ETFs ‘hanging in there’ in spite of BTC plunge: Expert

Some Bitcoiners, such as Technique executive chairman Michael Saylor and Blockstream CEO Adam Back, think quantum risks are overblown and will not interfere with the network for years.

Bendiksen shares those views, specifying that Bitcoin is “no place near hazardous area,” keeping in mind that splitting its cryptography would need countless fault-tolerant qubits– presently far beyond the 105 qubits attained by Google’s newest quantum computer system, Willow.

” Current developments, consisting of presentations by Google and others, represent development however fall brief of the scale required for real-world attacks on Bitcoin.”

Others, such as Capriole Investments creator Charles Edwards, view quantum computing as a possible “existential danger” to Bitcoin, arguing that an upgrade is required now to reinforce network security.

Edwards stated Bitcoin might be repriced considerably greater once an option is executed, which some, like Blockstream scientist Jonas Nick, recommend might include the adoption of post-quantum signatures.

Publication: South Korea gets abundant from crypto … North Korea gets weapons