Bitcoin (BTC) might recuperate from its continuous downturn and reach $150,000 by the year’s end, according to a current Bernstein outlook.

Secret takeaways:

-

Bitcoin should hold the 200-week SMA and see new-investor circulations turn favorable.

-

Sidelined capital should recede into crypto, and the quantum risk requires to be dealt with.

-

More rate cuts from the Fed in 2026 will bring risk-on financiers back to BTC.

Bitcoin need to hold above this crucial pattern line

One condition that has actually regularly specified Bitcoin’s shift from bearishness to brand-new bull cycles is the rate action around the 200-week basic moving average (200-week SMA, the blue wave).

Historically, this wave has actually functioned as a magnet throughout deep drawdowns and a strong flooring as soon as offering pressure subsides.

In both 2015 and 2018, Bitcoin bottomed near the 200-week SMA before getting in multiyear uptrends. The 2022 bearish market saw BTC rate briefly breaking listed below it, however the failure showed short-term.

Bitcoin holding above the 200-week SMA will lower the chances of an extended, 2022-style capitulation, while keeping the course open for a brand-new bull stage.

Bitcoin’s brand-new financier circulations need to return

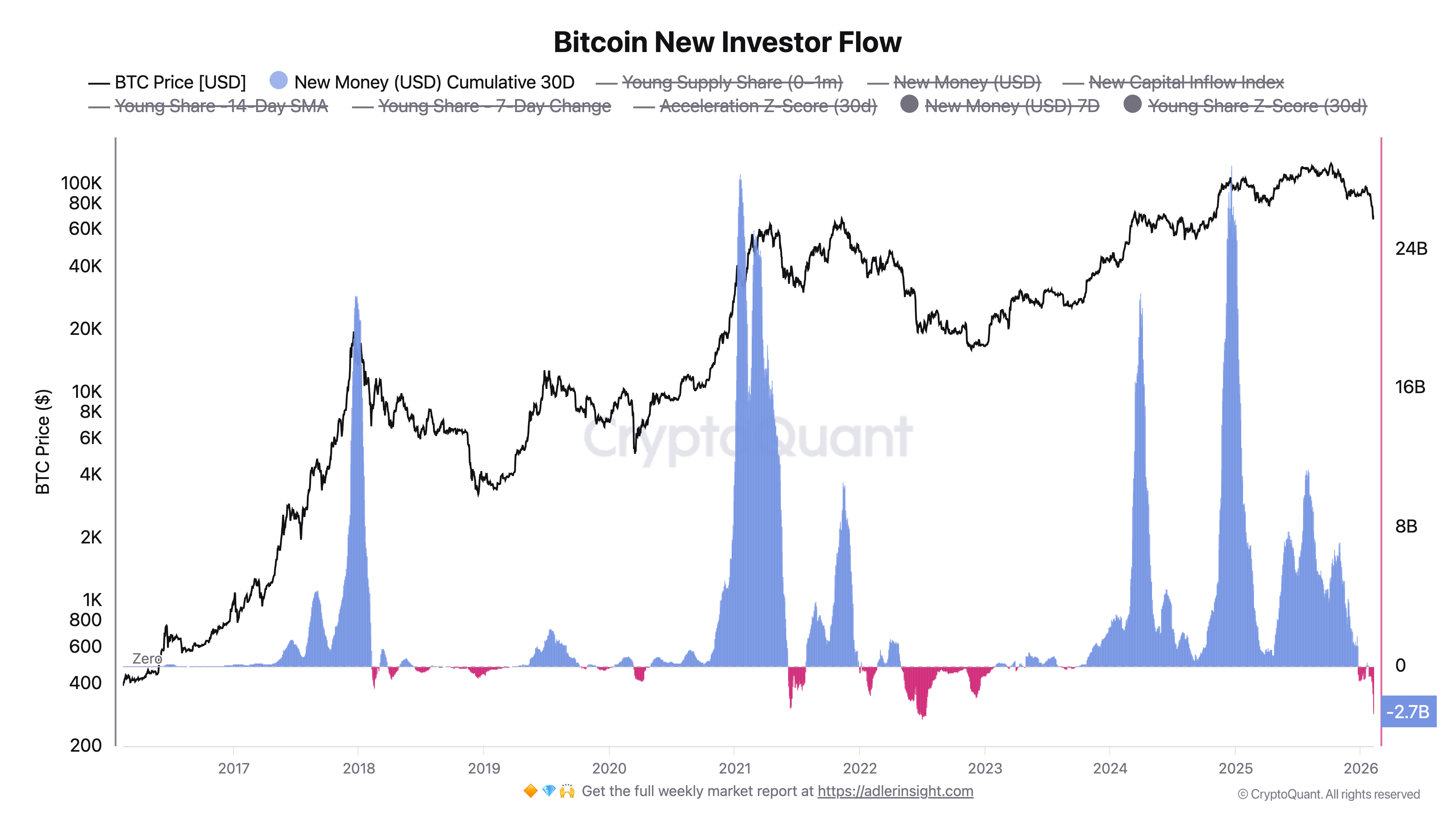

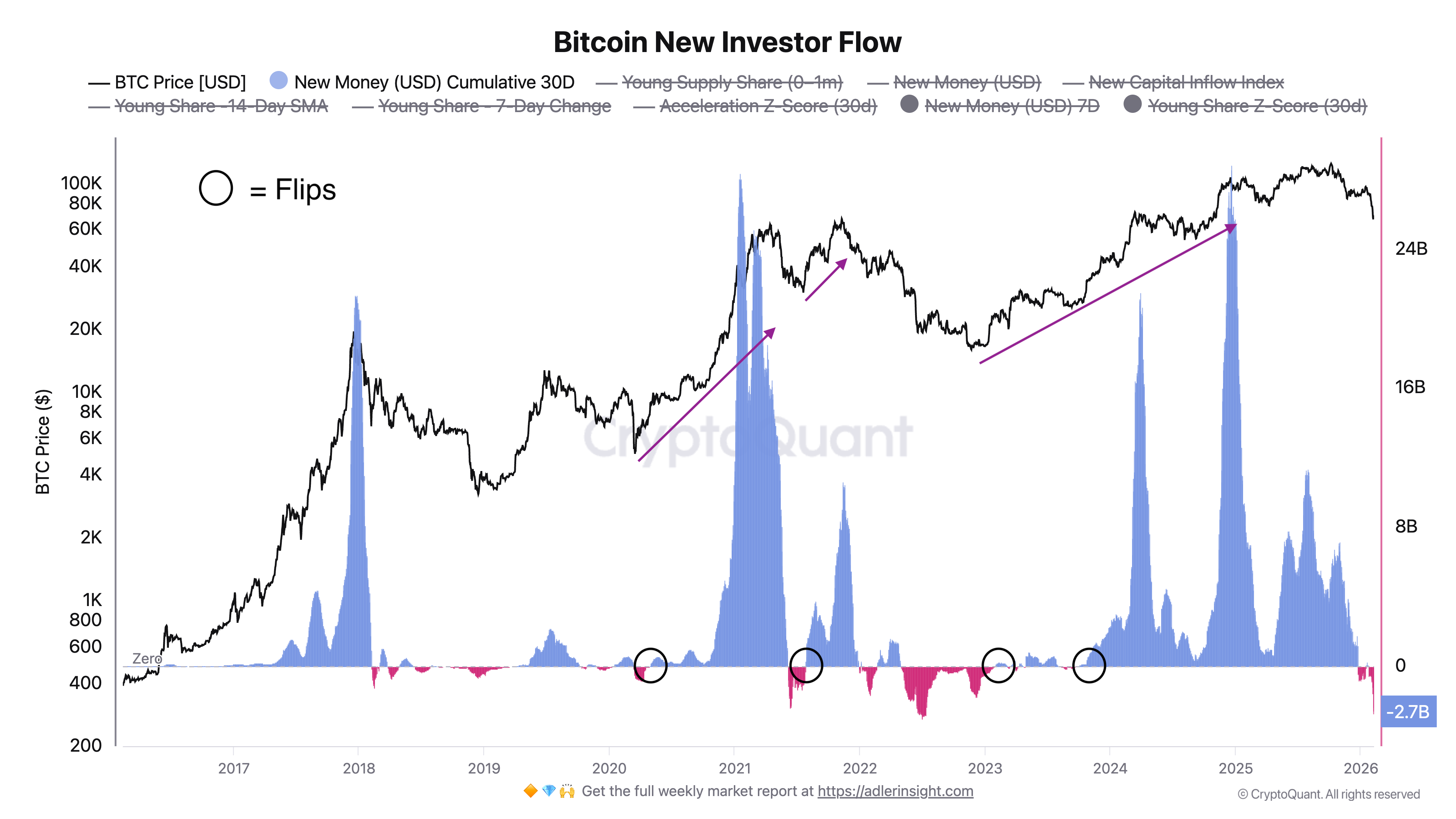

Another requirement for a continual bull run is a turnaround in brand-new financier circulations.

Since February, wallets tracking novice and short-term holders reveal approximately $2.7 billion in cumulative outflows, the greatest because 2022.

In healthy booming market, pullbacks draw in fresh capital and speed up involvement. Nevertheless, in the existing market, the reverse is taking place, according to IT Tech, a CryptoQuant-associated onchain expert.

” Present readings look like post-ATH shifts, in which minimal purchasers exit and rate is driven by internal rotation, not net inflows,” the expert composed in a Tuesday post.

Related: Bitcoin holders offer 245K BTC in tight macro conditions: Did the marketplace bottom?

In prior cycles, consisting of 2020, 2021 and 2022, continual bullish turnarounds just emerged as soon as new-investor circulations turned decisively back into favorable area.

The very same should occur in 2026 to make a strong bull case for Bitcoin. Bitcoin ETF net circulations turned favorable on Monday, which might be a very first indication that these financier circulations are beginning to come back.

Sidelined Tether should recede into crypto

Tether’s (USDT) share of the overall crypto market has actually increased in current weeks to check a familiar 8.5%– 9.0% resistance zone.

Increasing USDT supremacy indicates financiers are parking cash in stablecoins and playing it safe. Falling supremacy generally indicates the reverse: capital turning back into Bitcoin and the more comprehensive crypto market.

Considering That November 2022, clear pullbacks from this 8%– 9% location have actually lined up with strong Bitcoin rebounds.

One rejection was followed by a 76% rally over 140 days, while another preceded 169% gains over 180 days. A comparable setup happened from 2020 to 2022, when the crucial ceiling sat near 4.5%– 5.75%.

USDT supremacy broke above that variety in Might 2022, and Bitcoin then fell by 45%, additional showing the inverted connection in between the 2.

As an outcome, Tether supremacy need to be up to begin a brand-new Bitcoin bull run.

Quantum worries need to decrease

Another headwind to get rid of for Bitcoin is the possible quantum risk. These are theories that future quantum computer systems might break Bitcoin’s cryptography, putting BTC wallets at danger.

Some keep in mind that 25% of Bitcoin addresses are currently at danger.

A number of security-focused sources frame this as a hazard that is still away in the future.

For instance, in November 2025, cryptographer and Blockstream CEO Adam Back stated Bitcoin deals with no significant quantum risk for “20 to 40 years,” including the network can be “quantum prepared” well before it ends up being a genuine issue.

Bitcoin Optech likewise kept in mind that near-term quantum danger would be focused in edge cases, such as reused addresses, instead of the whole network simultaneously.

For Bitcoin to develop a bull case in 2026, this risk should be dealt with for purchasers to restore self-confidence.

Doing simply that, Coinbase and Technique have actually introduced efforts, generating professionals and drawing up a roadmap for Bitcoin security upgrades.

More rate cuts by the Fed

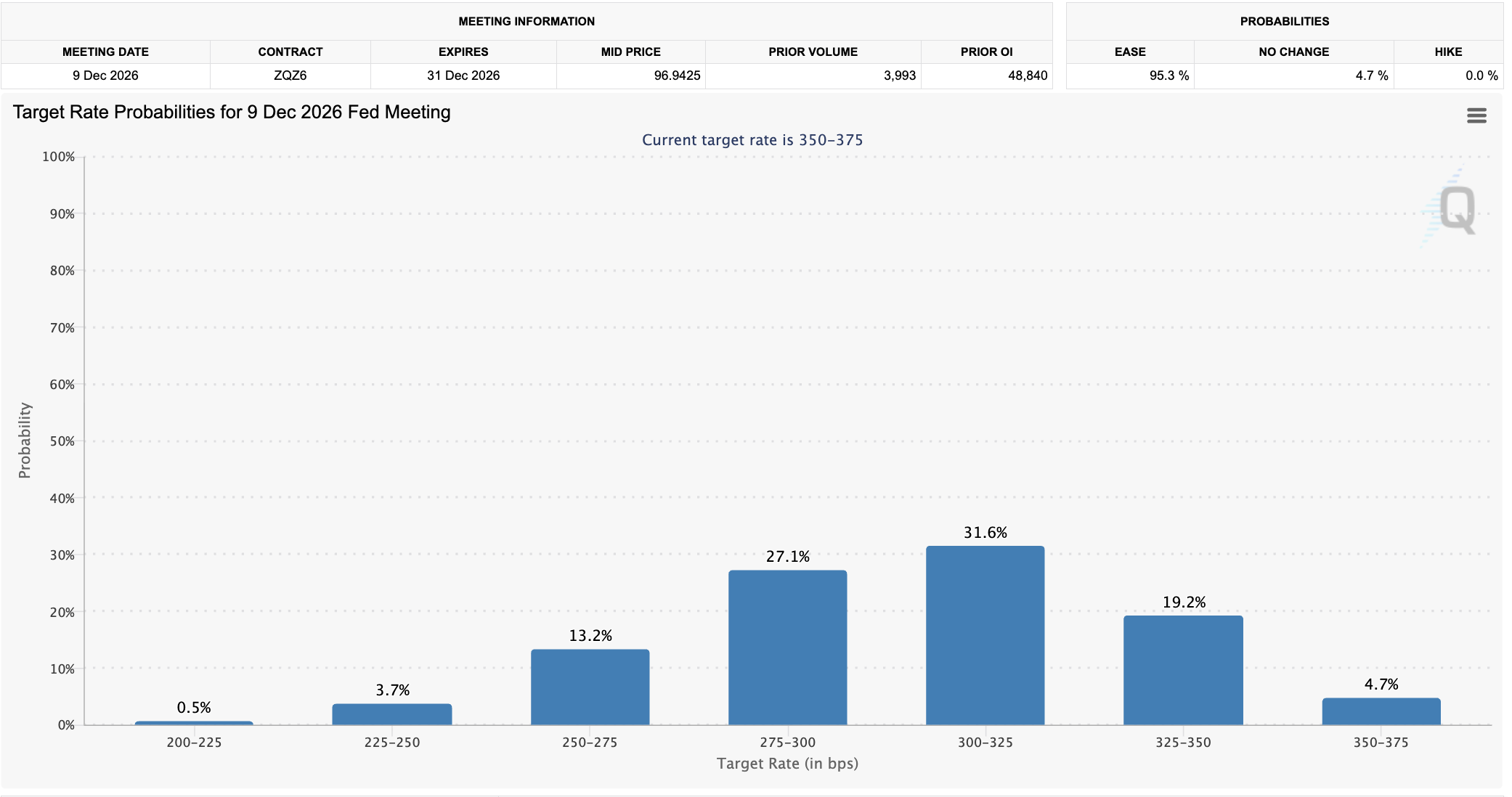

Bitcoin’s opportunities of returning to a bull cycle in 2026 enhance if the United States Federal Reserve provides a minimum of 2 rate cuts next year, which is what CME futures rates was presently indicating since February.

Lower rates usually lower the appeal of yield-bearing possessions like U.S. Treasurys, pressing financiers to look for greater returns somewhere else. That shift tends to prefer danger possessions, consisting of equities and cryptocurrencies.

Donald Trump might press the brand-new Fed chair for 3 rate cuts in 2026, according to Lee Ferridge, strategist at State Street Corp.

3 rate cuts this year might even more increase Bitcoin’s appeal amongst danger traders.

This post does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes danger, and readers ought to perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this post. This post might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this info.