Bitcoin market observers think that the current cost depression might in fact show the property’s broader adoption by organizations, which still do not see it as a risk-off property.

It’s been draft there for crypto in current months. Because October, when Bitcoin’s cost reached a high of over $120,000, BTC has actually been slowly moving. In current weeks, it dropped dramatically, down over 25% on the month.

Amidst the sell-off, market observers have actually been trying to find descriptions. Bitwise primary financial investment officer Matt Hougan associated the fall to the infamous four-year cycles that have actually formerly specified crypto market value swings.

Others, consisting of one United States Federal Reserve guv, claim that the current cost motions reveal that organizations are risk-averse which Bitcoin itself hasn’t reached the status of digital gold– yet.

Bitcoin still viewed as dangerous, “not digital gold”

Institutional interest in Bitcoin and crypto might be one factor for the current sell-off. While significant banks have great deals of cash to put into the crypto market, their hunger for danger is much lower than retail financiers, and Bitcoin is still broadly viewed as a dangerous property.

Chris Waller, a guv of the United States Federal Reserve, talked to this impact at a current financial policy conference on Monday. He stated that much of the “ecstasy” around crypto that accompanied the brand-new administration of President Donald Trump is now fading.

” I believe there was a great deal of sell-off even if companies that entered into it from mainstream financing needed to change their danger positions.”

These beliefs were echoed by Galaxy Digital CEO Mike Novogratz on Tuesday, who stated in an interview with CNBC that the crypto market has actually generated “organizations where individuals have a various danger tolerance.”

” Retail individuals do not enter into crypto since they wish to make 11% annualized … They get in since they wish to make 30 to one, 8 to one, 10 to one.”

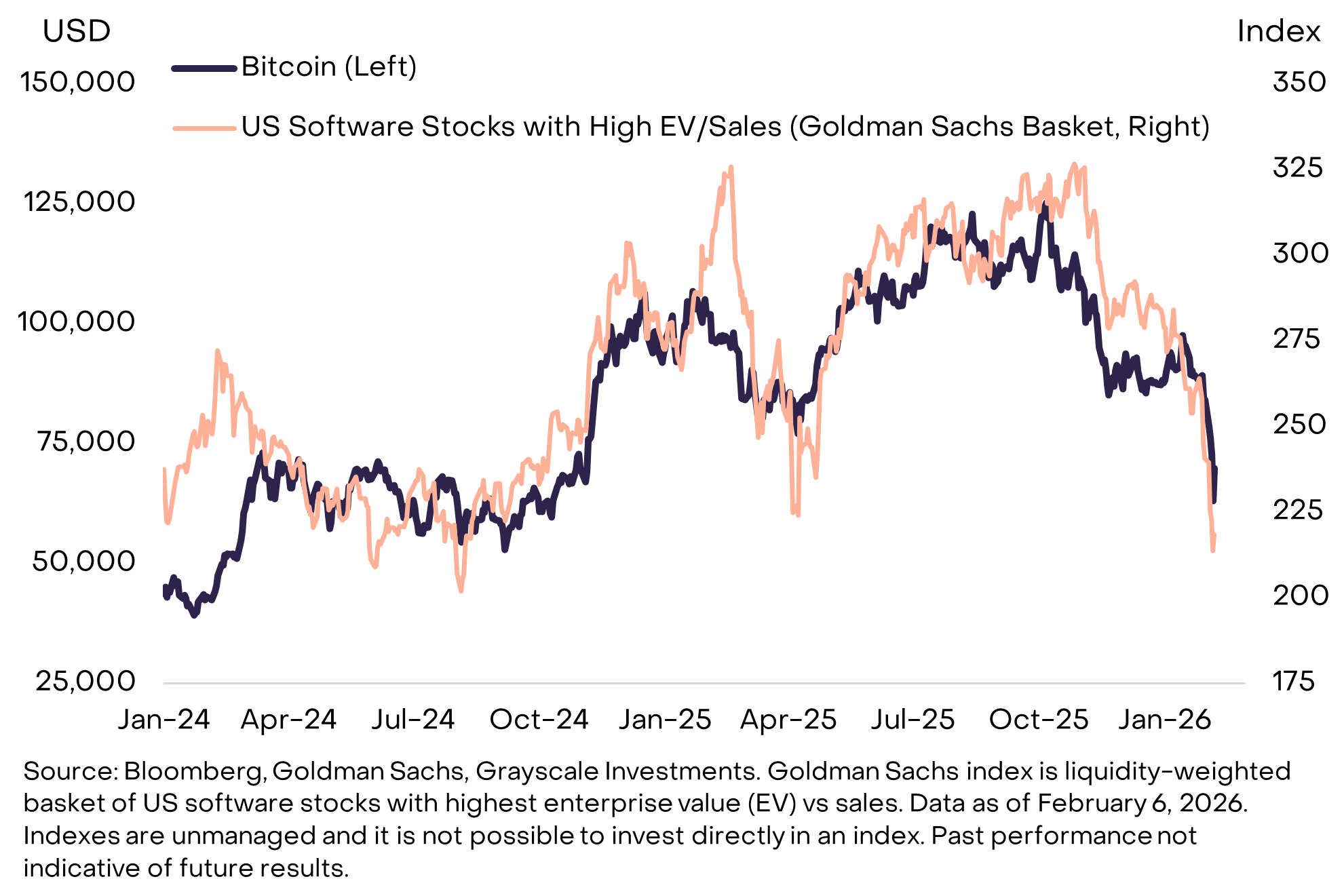

Crypto property supervisor Grayscale kept in mind in a report that current Bitcoin cost action more carefully associates to software application stocks with high business worths than to traditionally steady possessions like gold. The investment firm specified that short-term cost motions have actually not been firmly associated with gold or other rare-earth elements.

Bloomberg product strategist Mike McGlone, likewise a kept in mind Bitcoin bear, declared that Bitcoin is still extremely speculative. “[Bitcoin] has actually shown it’s neither digital gold nor leveraged beta,” he stated, including, “It’s an extremely speculative [number]- on-the-screen tracking absolutely nothing with unrestricted competitors.”

Grayscale stayed more positive about Bitcoin’s long-lasting potential customers. “The network will likely continue running well beyond our life times and the property might keep its worth in genuine terms … in a large range of results for the economy and society,” it stated.

The business likewise highlighted the main function organizations will have in the future success of the property, which it kept in mind depended on regulative clearness, something the United States hasn’t yet attained.

Absence of development on clearness signals danger

The Clearness Act, which is presently under dispute in the senate, would upgrade how crypto is managed in the nation, from the companies that supervise guidelines for decentralized financing (DeFi).

The costs has actually stalled for weeks as crypto bigwigs like Coinbase and the bank lobby are at loggerheads over stablecoin interest: a core element of the exchange’s organization design that banks feel might threaten monetary stability.

Related: United States crypto market structure costs in limbo as market pulls assistance

Failure for Congress to provide rapidly on a crypto market structure costs has actually contributed to this insecurity, according to Waller. “The absence of death of the clearness Act I believe has type of put individuals off on this,” he stated.

Novogratz likewise highlighted the impact the costs might have on markets. He stated that both Democrats and Republicans wish to pass the costs which “we require it for spirit back in the crypto market.”

Grayscale highlighted the significance of clearness and the GENIUS Act in its report, the latter of which passed in July 2025. It specified that “enhancing regulative clearness for the crypto market is a structural pattern much larger than one piece of legislation.”

More beneficial guidelines will drive a boost in usage cases in “stablecoins, tokenized possessions, and other applications of public blockchain innovation,” which in turn will “drive worth to blockchain networks and their native tokens.”

Top-level talks to clear the obstructions on clearness are presently underway. On Tuesday, executives from the crypto and banking markets fulfilled at the White Home for another closed-door conference.

Ripple legal chief Stuart Alderoty stated, “Compromise is in the air. Clear, bipartisan momentum stays behind reasonable crypto market structure legislation.”

On the other hand, experts discuss simply how low the Bitcoin bearish market can go. Kaiko Research study shared a research study note with Cointelegraph, which declared that the $60,000 mark might be a “middle.”

” Analysis of on-chain metrics and relative efficiency throughout tokens exposes a market approaching vital technical assistance levels that will figure out whether the four-year cycle structure stays undamaged,” Kaiko stated.

McGlone stated that $60,000 is simply a “speedbump en route pull back” to $10,000, mentioning a variety of factors. These consist of interest in crypto apparently moving from digital possessions to stablecoins and the possibility that “cheer-leader and primary, President Trump, will be a lame duck this time next year.”

A lame-duck president who is likewise pro-crypto might discover it hard to effect the modification they desire in Congress. It stays to be seen whether crypto will protect the regulative clearness it desires for organizations to completely leap in.

Publication: Is China hoarding gold so yuan ends up being worldwide reserve rather of USD?

Cointelegraph Functions and Cointelegraph Publication release long-form journalism, analysis and narrative reporting produced by Cointelegraph’s internal editorial group and chosen external factors with subject-matter knowledge. All posts are modified and examined by Cointelegraph editors in line with our editorial requirements. Contributions from external authors are commissioned for their experience, research study or viewpoint and do not show the views of Cointelegraph as a business unless clearly specified. Material released in Functions and Publication does not make up monetary, legal or financial investment guidance. Readers ought to perform their own research study and seek advice from certified experts where proper. Cointelegraph keeps complete editorial self-reliance. The choice, commissioning and publication of Functions and Publication material are not affected by marketers, partners or business relationships.