Bitcoin (BTC) formed a brand-new weekly low at $65,500 on Thursday, and the cost has actually continued to trend lower over the previous 4 days. Derivatives information likewise show that traders are greatly placed to the drawback.

Experts stated that this setup might cause a sharp relocation higher that forces sellers to close their positions, even as other signs hint that the relocation might not be simple.

Secret takeaways:

-

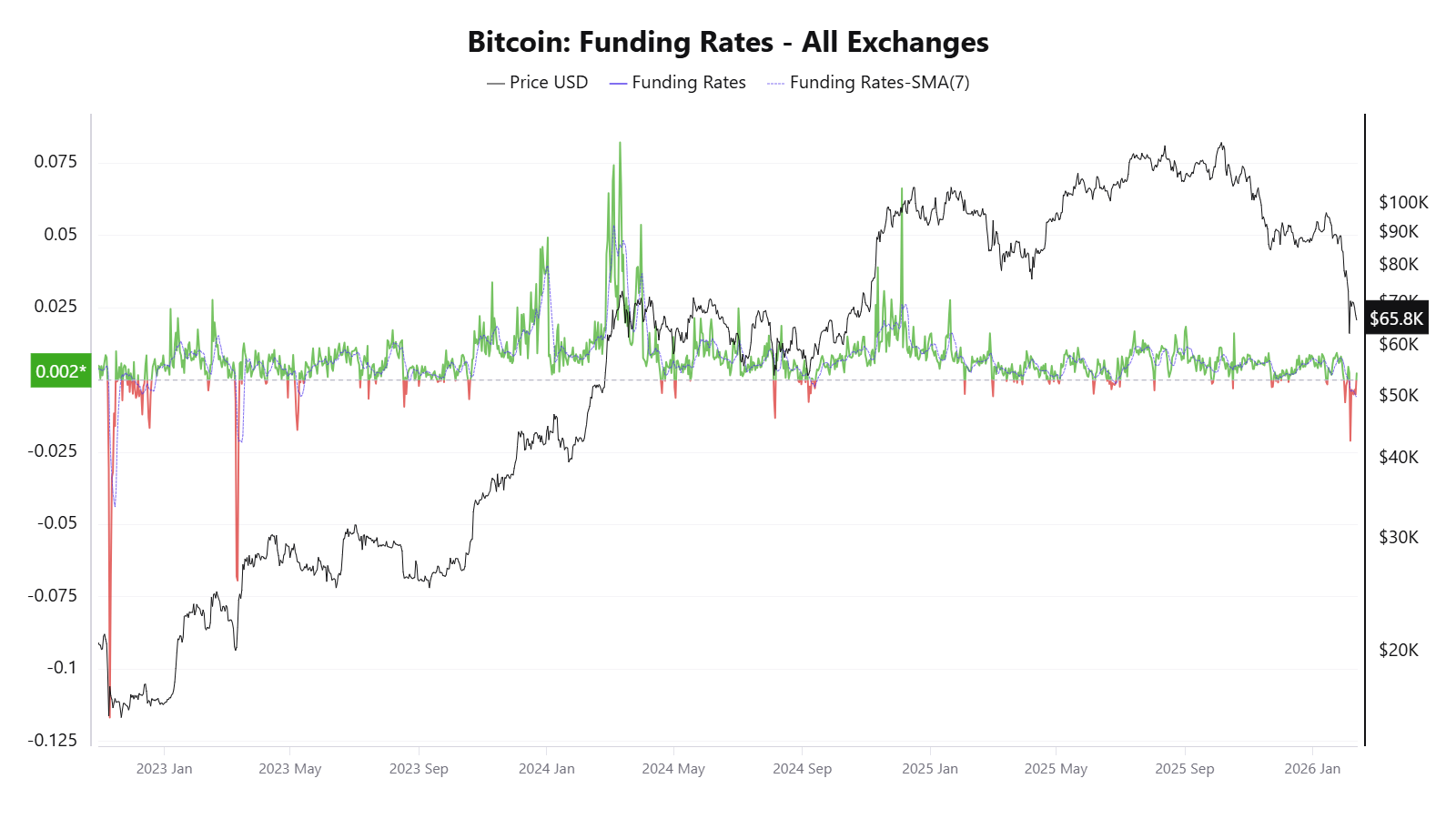

The seven-day average financing rate for Bitcoin has actually turned highly unfavorable for the very first time considering that March 2023 and November 2022.

-

Bitcoin liquidity and stablecoin circulation information reveal restored capital outflows, minimizing the chances of a continual capture.

Bitcoin financing remains red as brief positions increase

Bitcoin’s everyday financing rate has actually stayed in crimson area considering that the start of February, marking its most unfavorable duration considering that Might 2023. The seven-day basic moving average (SMA) has actually turned unfavorable for the very first time in almost a year.

The financing rate is a regular payment in between the traders in futures markets. When it is unfavorable, the brief sellers pay long traders, indicating that the bearish positions are crowded, and vice versa.

Crypto expert Leo Ruga stated the present “red financing rate for days” signals that the bearish or brief trade might be getting overcrowded. Ruga included:

” This is the type of unfavorable financing that normally appears throughout bottoming stages. Not since shorts are incorrect, however since extended unfavorable financing typically marks fatigue of offering pressure.”

Likewise, market expert Pelin Ay highlighted that the financing rate just recently dropped near -0.02 last Friday, with sharp unfavorable spikes. Ay included that when sharp cost decreases accompany unfavorable financing, it can set the phase for a brief capture, especially if $58,000 holds as the regional assistance.

Related: Bitcoin should close week at $68.3 K to prevent ‘bearish velocity:’ Expert

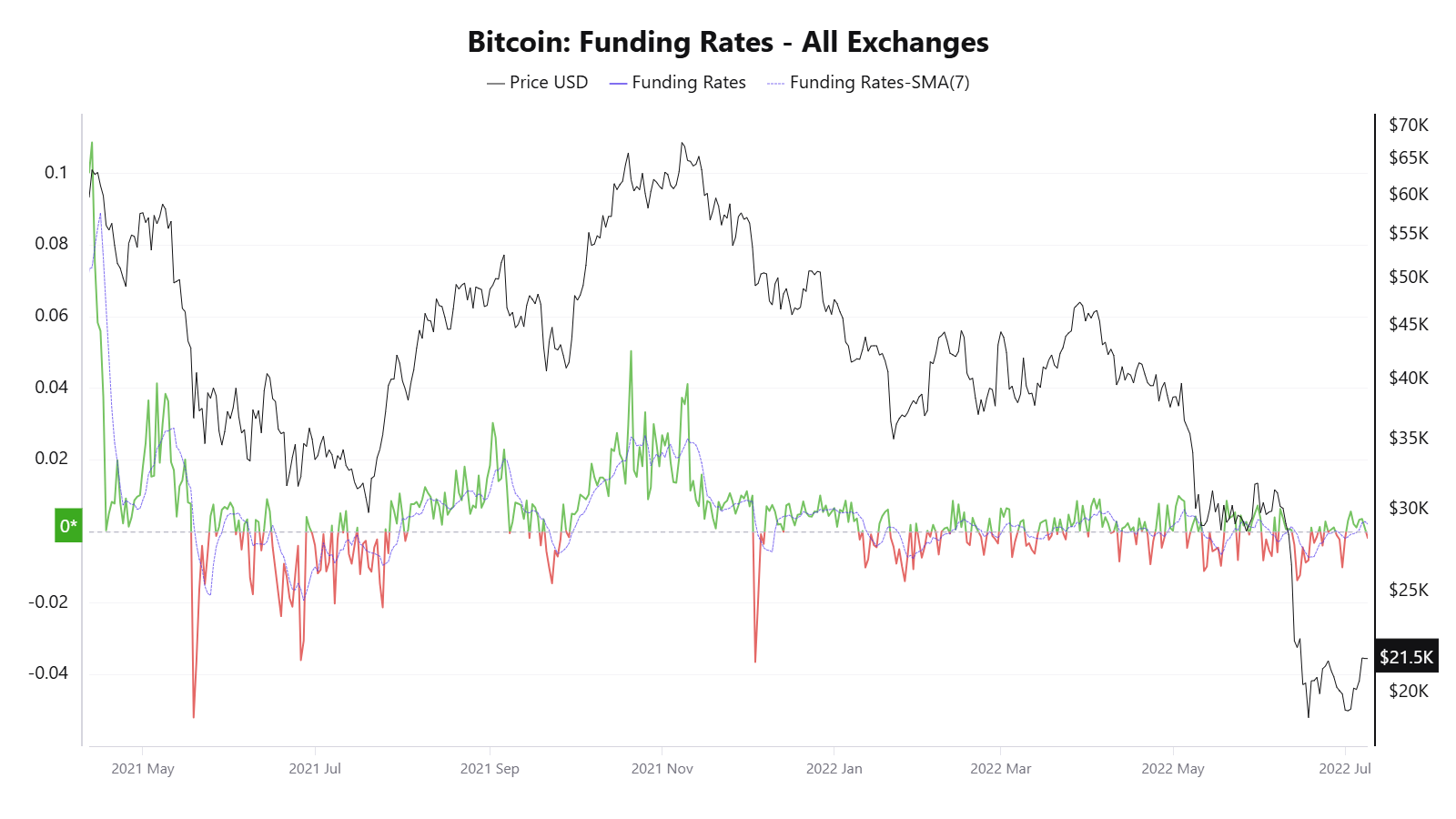

The last time Bitcoin’s everyday financing rate remained deeply unfavorable for 10 to 20 days after a bullish stage remained in May 2021 and January 2022. In Might 2021, BTC fixed for almost 2 months before breaking out to brand-new highs. In January 2022, the unfavorable stretch preceded a wider bearish cycle. Hence, a prolonged unfavorable financing has actually not produced an instant turnaround in the past.

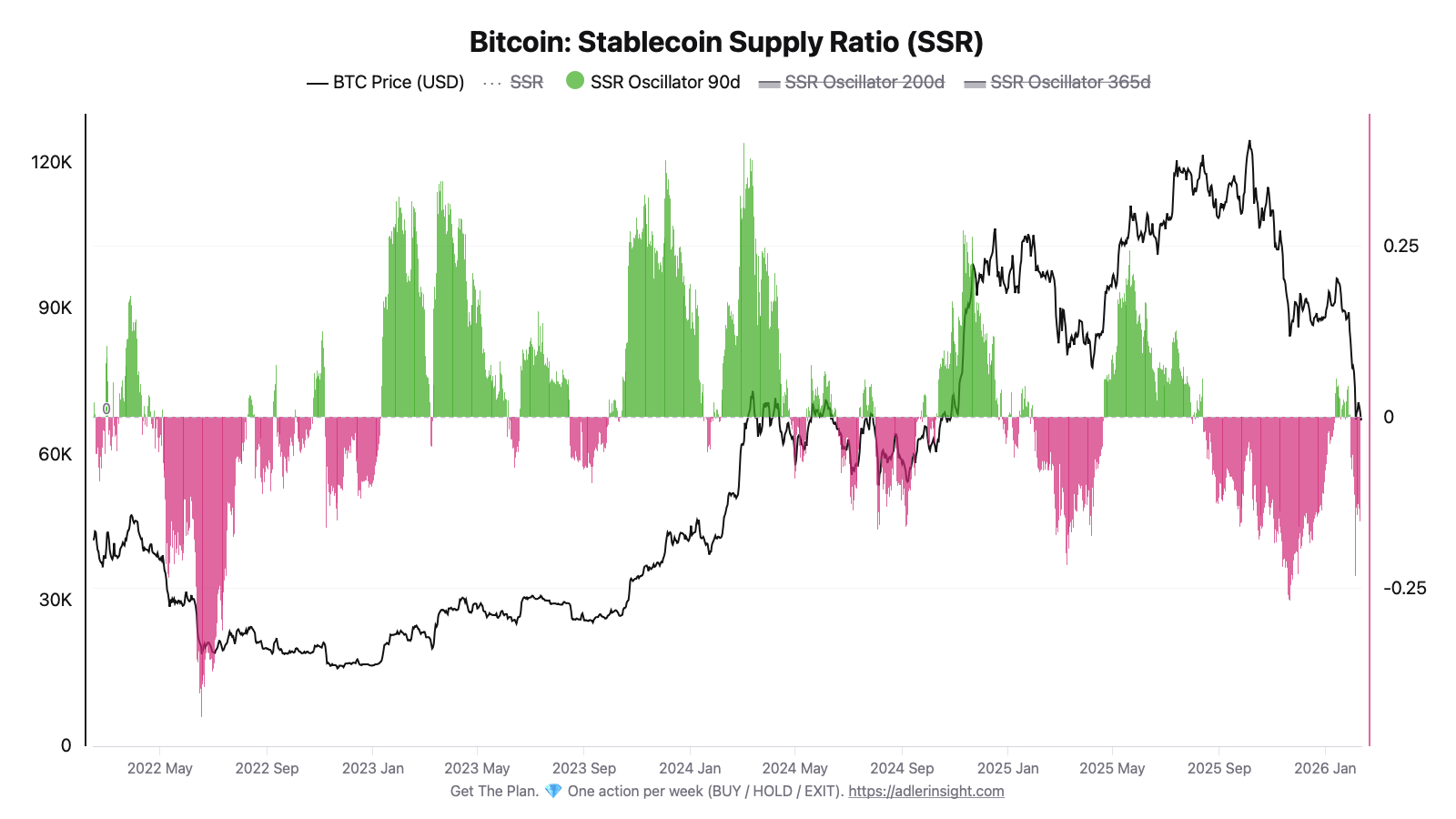

Onchain information supports a mindful view. Bitcoin scientist expert Axel Adler Jr. kept in mind that the SSR oscillator, which determines Bitcoin’s strength relative to stablecoins, has actually mainly remained in unfavorable area considering that August 2025.

A quick relocation into favorable area in mid-January (+0.057) accompanied a rally above $95,000, however the oscillator has actually considering that dropped to -0.15 as the cost drew back towards $67,000.

Stablecoin streams inform a comparable story. The 30-day modification in USDt (USDT) market cap turned favorable in early January (+$ 1.4 billion), however it has actually considering that reversed to -$ 2.87 billion, indicating a duration of capital outflows.

Till liquidity patterns and the SSR oscillator turn sustainably favorable, Adler Jr. stated that the BTC market stays in a “risk-off” stage.

Related: Binance finishes $1B Bitcoin conversion for SAFU emergency situation fund

This short article does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might consist of positive declarations that go through threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage developing from your dependence on this info.