Bitcoin (BTC) sellers resumed their activity on Thursday as the Bitcoin rate turned away from its intraday high of $68,300. Experts stated that Bitcoin stayed in capitulation, which might press the rate lower, possibly reaching a bottom throughout the last quarter of 2026.

Secret takeaways:

-

Numerous onchain indications recommend Bitcoin remains in deep capitulation as drawback threats stay.

-

Long-lasting holder net-position modification reveals severe circulation, matching previous corrections that preceded more drawback before bottoms.

-

Experts anticipate BTC rate to strike a bottom in Q4/2026 based upon numerous technical and onchain metrics.

Bitcoin’s capitulation continues

Bitcoin’s 46% drawdown from its all-time high of $126,000 has actually left a considerable part of holders undersea, and information programs they are now decreasing their direct exposure.

Glassnode’s long-lasting holder (LTH) net-position modification reveals that Bitcoin held by these financiers over thirty days reduced by 245,000 BTC on Feb. 6, marking a cycle-relative extreme in everyday circulation. Ever since, this financier associate has actually been decreasing its direct exposure by approximately 170,000 BTC, as displayed in the chart below.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto belief strikes record low

Comparable spikes in LTH net position modification appeared throughout the restorative stages in 2019 and mid-2021, resulting in BTC rate combining before extended drops.

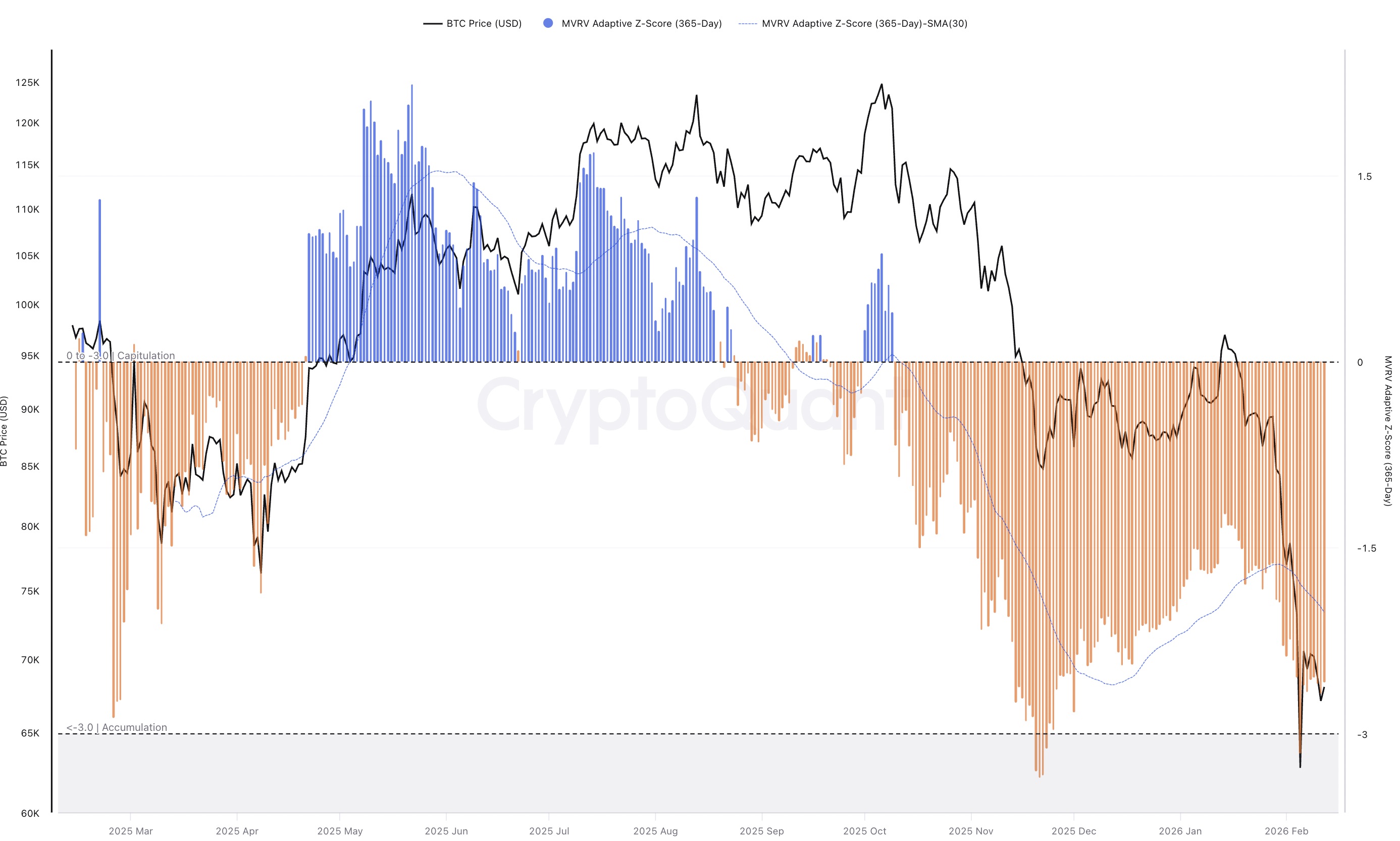

CryptoQuant information reveals that Bitcoin’s MVRV Adaptive Z-Score (365-Day Window) has actually been up to -2.66, enhancing the strength of the sell-side pressure.

” The existing Z-Score reading of -2.66 shows that Bitcoin stays constantly in the capitulation zone,” CryptoQuant factor GugaOnChain stated in a Thursday Quicktake post, including:

” The indication recommends that we are approaching the historic build-up stage.”

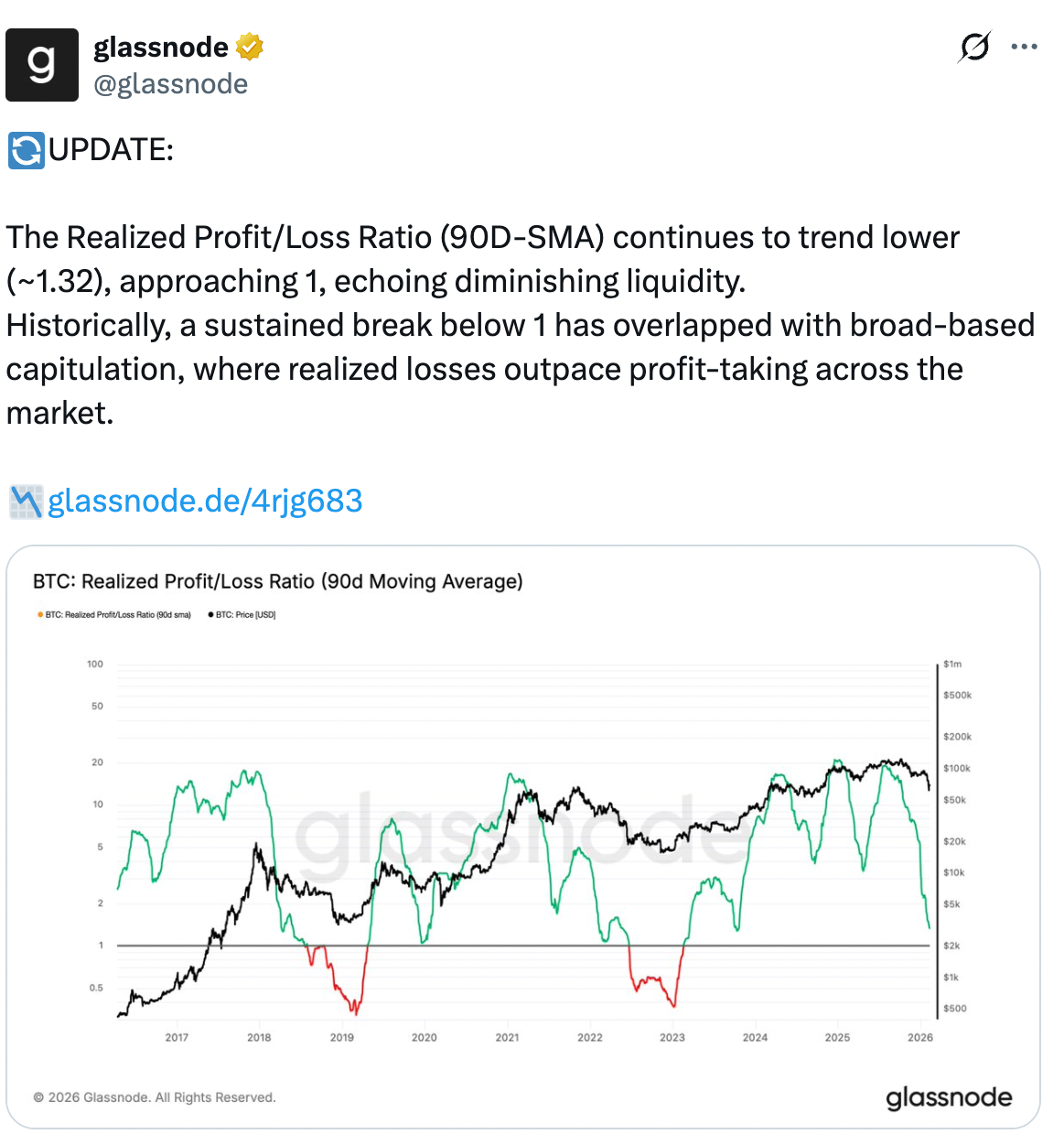

Bitcoin’s Understood Profit/Loss Ratio will break listed below 1, levels that have actually traditionally lined up with “broad-based capitulation, where understood losses surpass profit-taking throughout the marketplace,” Glassnode stated.

Experts state Bitcoin will bottom out towards completion of 2026

According to numerous analyses, Bitcoin might extend its sag, potentially reaching as low as $40,000 to $50,000 throughout the last quarter of the year.

The “last capitulation on $BTC is still ahead,” Crypto expert Tony Research study stated in a current post on X, including:

” My take is, $BTC will bottom at $40K– 50K, probably forming in between mid-September and late November 2026.”

Fellow expert Titan of Crypto stated that previous bear cycles in 2018 and 2022 printed their lows 12 months after the booming market top.

Bitcoin’s existing all-time high of over $126,000 was reached on Oct. 2, 2025.

” If this cycle follows the exact same rhythm, that puts the low around October,” the expert included.

On-Chain College shared a chart revealing that Bitcoin’s Net Understood Loss levels struck severe levels at $13.6 billion on Feb. 7, levels last seen throughout the 2022 bearishness.

” The 2022 loss peak took place 5 months before the real bearishness bottom was printed,” the expert stated, recommending that BTC might form a bottom in July 2026.

As Cointelegraph reported, numerous experts anticipate 2026 to be a bearish market year, and numerous projections anticipate the BTC rate dropping to as low as $40,000.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we make every effort to offer precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might consist of positive declarations that go through threats and unpredictabilities. Cointelegraph will not be responsible for any loss or damage emerging from your dependence on this details.