Bitcoin’s (BTC) rally above $97,000 was supported by rising inflows to the area Bitcoin ETFs, and one expert states that the need needs to continue for BTC to break through the $100,000 barrier.

Secret takeaways:

-

United States area Bitcoin ETFs taped $1.8 billion in weekly net inflows, the greatest considering that early October 2025.

-

Overall net possessions under area ETFs stay 24% listed below their Q4 2025 peak.

-

Long-lasting supply-demand characteristics continue to prefer ETFs, as institutional financier gain access to is anticipated to broaden in 2026.

Bitcoin ETF are just one part of the image

United States area Bitcoin ETFs logged $1.8 billion in net inflows today, marking the biggest weekly consumption considering that the very first week of October 2025. The relocation comes as BTC once again checks resistance near the $98,000 level, indicating restored institutional interest.

In spite of the rebound, ETF positioning stays well listed below previous highs. The overall net possessions under management throughout United States area Bitcoin ETFs peaked at $164.5 billion in Q4 2025 however presently stand near $125 billion. This represents a drawdown of approximately 24%, highlighting that current inflows have actually just partly balanced out earlier outflows.

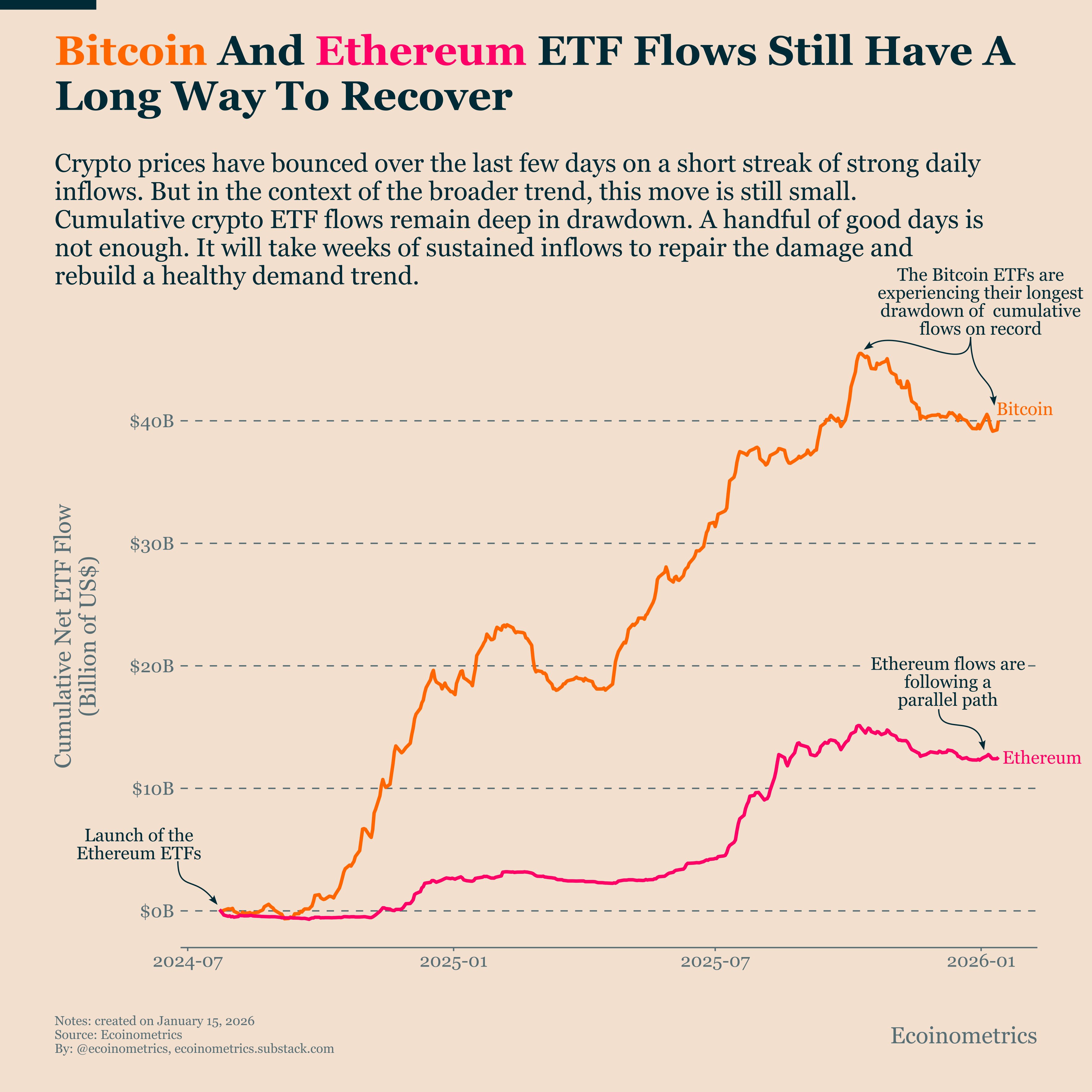

According to the Bitcoin macro intelligence newsletter, Ecoinometrics, brief bursts of ETF inflows have actually consistently caused quick cost bounces followed by fading momentum.

” Bitcoin does not require a couple of great days. It requires a couple of great weeks,” the newsletter stated, keeping in mind that cumulative ETF streams stay in a deep drawdown. A handful of favorable sessions hardly signs up versus extended durations of selling. Up until inflows cluster over several weeks, rallies are most likely to support the cost than reboot a long lasting uptrend.

Related: Bitcoin whale balances see 21% bounce after fastest sell-off considering that 2023 ends

BTC supply-demand imbalance prefers ETFs in the long-run

From a structural viewpoint, area ETF need continues to outmatch brand-new Bitcoin supply. According to Bitwise, considering that United States Bitcoin ETFs released in January 2024, they have actually acquired roughly 710,777 BTC, while the network has actually produced simply 363,047 BTC over the very same duration. Bitcoin’s cost has actually increased about 94% ever since, showing that imbalance.

Looking ahead, brand-new supply is reasonably foreseeable, while need might broaden even more as institutional financier access to Bitcoin expands. Significantly, 2026 might be the year most institutional allocators continue to broadly access crypto ETFs, as Bitwise forecasted,

” ETFs will buy more than 100% of the brand-new supply of Bitcoin as institutional need speeds up.”

In 2025, Bitwise anticipated that Bitcoin inflows into openly noted business developing BTC treasuries, sovereign wealth funds, ETFs, and nation-states might reach $300 billion in 2026.

The business highlighted that United States area Bitcoin ETFs drew in $36.2 billion in net inflows in their beginning year, reaching $125 billion in AUM far much faster than SPDR Gold Shares performed in its early development stage.

Related: Bitcoin traders forecast ‘strong run-up’ as traditional chart targets $113K

This short article does not include financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to offer precise and prompt info, Cointelegraph does not ensure the precision, efficiency, or dependability of any info in this short article. This short article might include positive declarations that undergo threats and unpredictabilities. Cointelegraph will not be accountable for any loss or damage emerging from your dependence on this info.