Secret takeaways:

-

The Federal Reserve’s relocation far from quantitative tightening up and rate cuts produces liquidity, making fixed-income properties less appealing.

-

Rising tech credit dangers, as evidenced by high Oracle financial obligation defense expenses, timely financiers to look for option, scarcer properties like Bitcoin.

Bitcoin (BTC) fell 4% on Friday to a low of $88,140, extending its decrease to 19% because November. On the other hand, the S&P 500 is now less than 1% from its all-time high. This sharp divergence might quickly close with a strong upside move for Bitcoin, sustained by a significant shift in reserve bank policy and growing credit tension.

This best storm has the prospective to move Bitcoin to the emotionally crucial $100,000 barrier before the year concludes.

Set earnings’s fading appeal and tech credit scare might sustain Bitcoin rally

The most crucial element is the Federal Reserve’s pivot from quantitative tightening up, a procedure of draining pipes liquidity from the monetary system by enabling the maturity of Treasury securities and mortgage-backed securities without reinvesting the profits. The Fed formally stopped this program on Dec. 1.

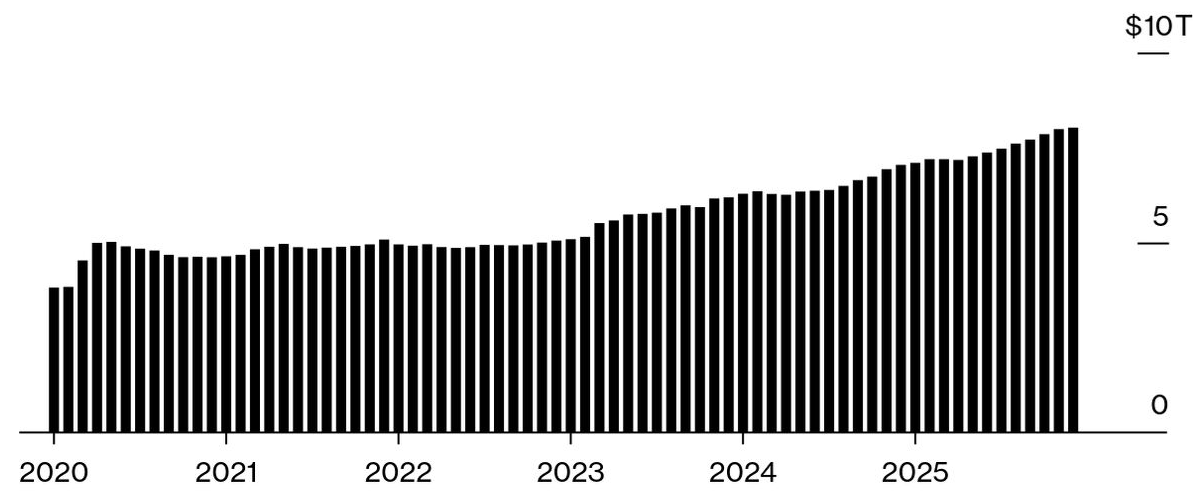

Over the last 6 months, the Fed’s balance sheet contracted by $136 billion, eliminating a substantial quantity of money. The marketplace is strongly preparing for the next stage based upon lower rate of interest. According to CME FedWatch Tool information, bond futures designate an 87% likelihood to a rate cut at the upcoming Dec. 10 Fed conference, with expectations completely pricing in 3 cuts by September 2026.

Lower rate of interest and increasing systemic liquidity basically deteriorate the need for fixed-income properties. As the Fed cuts rates, the returns on brand-new bond issuances likewise decrease, making them less appealing to institutional funds. According to Bloomberg, there is now a record-high $8 trillion in United States money-market funds.

The prospective capital rotation is more incentivized by structural dangers emerging in the equity markets, specifically in the tech sector. The expense of safeguarding Oracle’s (ORCL United States) financial obligation versus default utilizing Credit Default Swaps has actually risen to its greatest level because 2009. Oracle had $105 billion of financial obligation, consisting of leases, since completion of August.

Related: United States financiers think about crypto less as risk-taking drops– FINRA research study

Oracle is relying on numerous billions of dollars in profits from OpenAI, according to Bloomberg. The business is the biggest financial obligation provider beyond the banking market in the Bloomberg United States Business Bond Index. “Financiers are ending up being progressively worried about just how much more supply might be on the horizon,” according to a Citigroup credit method report.

Bank of America states consistent Fed rates increase financial downturn chances

Financiers fear this high-stakes push, that includes the United States Donald Trump administration’s Genesis Objective, a nationwide effort focused on doubling United States clinical efficiency through using AI and atomic energy. The rise in need for financial obligation defense signals severe market worry relating to the tremendous debt-fueled costs, which might not yield sufficient returns.

Bank of America strategist Michael Hartnett argued that if the Fed sends out a message of consistent rate of interest, the chances of a broader financial downturn considerably boost. This unpredictability, integrated with a desire for development less based on stimulus, enhances the appeal of Bitcoin’s deficiency as institutional capital seeks to de-risk its conventional tech direct exposures.

The Fed’s main end to its liquidity drain program and the marketplace’s aggressive rates of rates of interest cuts supply a significant tailwind. With tech credit dangers rising due to enormous AI-related financial obligation, capital is structurally primed to turn into limited properties. This merging develops a clear course for BTC to breach the $100,000 turning point over the next number of months.

This short article is for basic details functions and is not meant to be and need to not be taken as legal or financial investment guidance. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.

This short article does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.