Secret takeaways:

-

Heavy outflows from Bitcoin exchange-traded funds and enormous liquidations reveal that the marketplace is purging extremely leveraged purchasers.

-

Bitcoin alternatives metrics expose that professional traders are hedging for more rate drops amidst a tech stock sell-off.

Bitcoin (BTC) moved listed below $73,000 on Wednesday after briefly retesting the $79,500 level on Tuesday. This decline mirrored a decrease in the tech-heavy Nasdaq Index, driven by a weak sales outlook from chipmaker AMD (AMD United States) and frustrating United States work information.

Traders now fear even more Bitcoin rate pressure as area exchange-traded funds (ETFs) taped over $2.9 billion in outflows throughout twelve trading days.

The typical $243 million everyday web outflow from the US-listed Bitcoin ETFs because Jan. 16 almost accompanies Bitcoin’s rejection at $98,000 on Jan. 14. The subsequent 26% correction over 3 weeks activated $3.25 billion in liquidations for leveraged long BTC futures. Unless purchasers transferred extra margin, any take advantage of surpassing 4x has actually currently been erased.

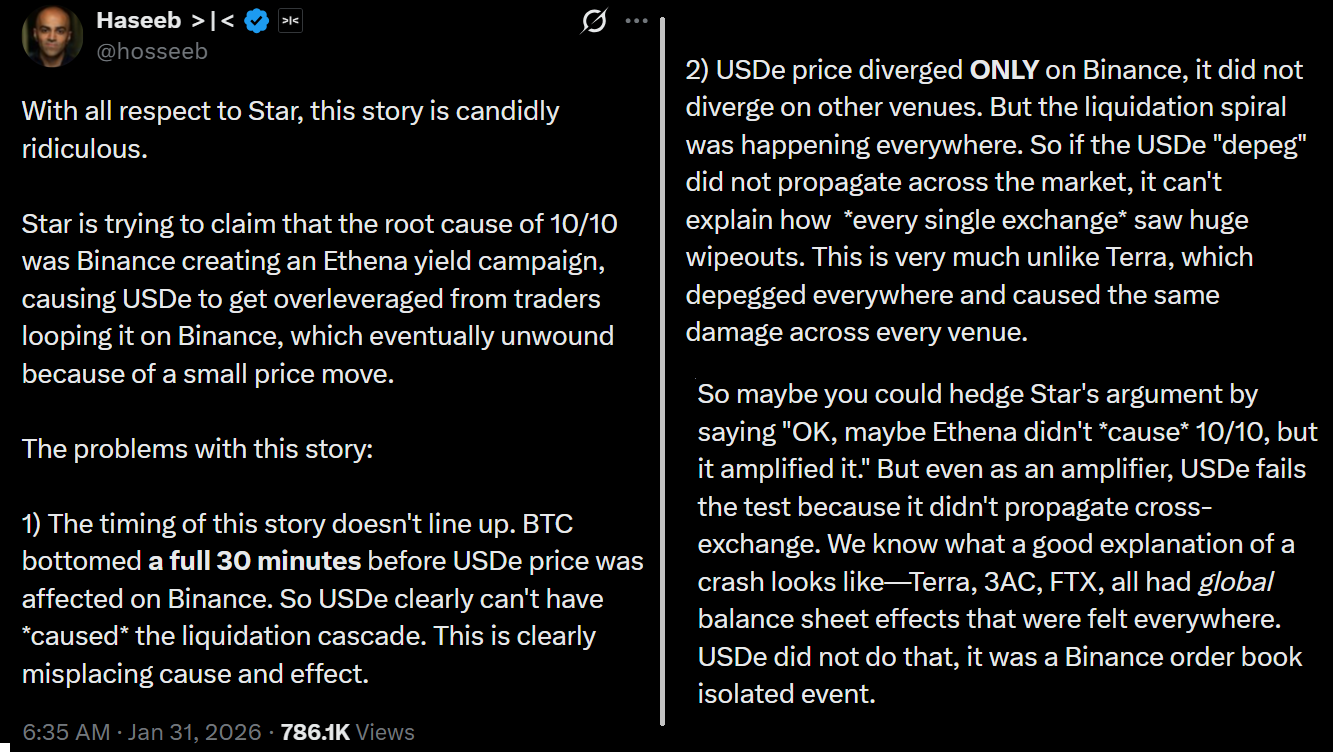

Some market individuals blamed the current crash on the remaining consequences of the $19 billion liquidation on Oct. 10, 2025. That occurrence was apparently activated by an efficiency problem in database inquiries at Binance exchange, leading to postponed transfers and inaccurate information feeds. The exchange confessed fault and paid out over $283 million in payment to impacted users.

According to Haseeb Qureshi, handling partner at Dragonfly, substantial liquidations at Binance “might not get filled, however liquidation engines keep shooting regardless. This triggered market makers to get erased, and they were not able to get the pieces.” Qureshi included that the October 2025 crash did temporarily “break the marketplace,” however kept in mind that market makers “will require time to recuperate.”

The analysis recommends that cryptocurrency exchanges’ liquidation systems “are not developed to be self-stabilizing the manner in which TradFi systems are (breaker, and so on)” and rather focus exclusively on decreasing insolvency dangers. Qureshi keeps in mind that cryptocurrencies are a “long series” of “bad things” taking place, however traditionally, the marketplace ultimately recuperates.

BTC alternatives alter signals traders question $72,100 bottom

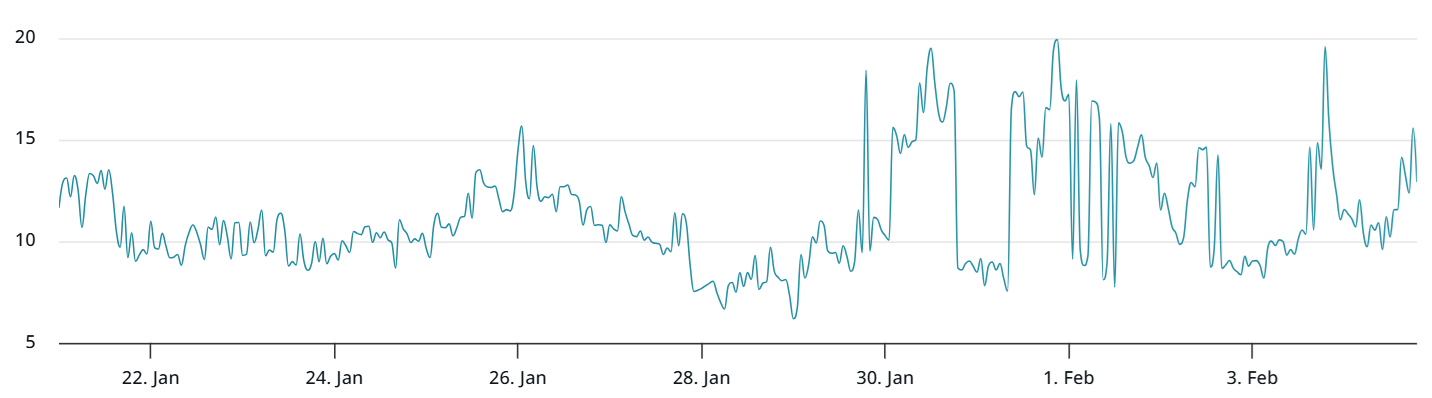

To figure out if expert traders turned bearish after the crash, one must evaluate BTC alternatives markets. Throughout durations of tension, need for put (sell) instruments rises, pressing the delta alter metric above the 6% neutral limit. Excess need for disadvantage security usually indicates an uncertainty from bulls.

The BTC alternatives delta alter reached 13% on Wednesday, a clear indicator that expert traders are not persuaded Bitcoin’s rate has actually discovered a bottom at $72,100. This hesitation stems partially from worries that the tech sector might struggle with increased competitors as Google (GOOG United States) and AMD present exclusive expert system chips.

Related: Bitcoin open interest falls by $55B in 1 month– What’s next for BTC rate?

Another source of pain for Bitcoin holders includes 2 unassociated and unproven reports. Initially, a $9 billion Bitcoin sale by a Galaxy Digital client in 2025 was formerly credited to quantum computing dangers. Nevertheless, Alex Thorn, Galaxy’s head of research study, rejected those reports in an X post on Tuesday.

The 2nd speculation includes Binance’s solvency, which got traction after the exchange dealt with technical problems that briefly stopped withdrawals on Tuesday. Existing onchain metrics recommend that Bitcoin deposits at Binance stay reasonably steady.

Offered the present unpredictability in macroeconomic patterns, lots of traders have actually decided to leave cryptocurrency markets. This shift makes it tough to anticipate whether Bitcoin area ETF outflows will continue to use down pressure on the rate.

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.