Secret takeaways:

-

Bitcoin ETF outflows and a 31% drawdown from the peak have actually raised doubts, however metrics suggest that institutional financiers are not deserting Bitcoin.

-

Bitcoin’s moving connection with gold and constant volatility recommend rate habits stays undamaged regardless of the short-term market pressure.

Bitcoin (BTC) got 3% on Tuesday after selling to the $85,000 level on Monday. An uptick in outflows from the area Bitcoin exchange-traded funds appears to reveal institutional financier need softening given that the Oct. 10 crash. This decreases the possibility of Bitcoin trading above $100,000 by year-end.

The area Bitcoin ETFs taped $358 million in net outflows on Monday, marking the biggest day-to-day withdrawal in over 3 weeks. The relocation sustained speculation that institutional financiers may be lowering their direct exposure after the mental $90,000 assistance level was breached.

More notably, Bitcoin is presently trading 31% listed below its all-time high of $126,219, a pullback that might signify completion of the bullish stage that extended into October.

According to X user ‘forcethehabit’, Bitcoin’s decrease does not represent a pattern modification, as rate of interest cuts have actually been postponed and the United States Federal Reserve (Fed) has actually decreased its balance sheet for longer than anticipated. The analysis likewise keeps in mind that institutional capital gotten in mainly through ETFs and business reserves, while rotation into riskier and more illiquid properties has yet to emerge.

Bitcoin reveals irregular connection relative to gold

Bitcoin’s connection with gold costs can be utilized to evaluate whether the cryptocurrency is considered as an alternative shop of worth or merely a proxy for higher-risk properties. The digital gold story has actually been an essential motorist of Bitcoin’s advantage throughout 2025.

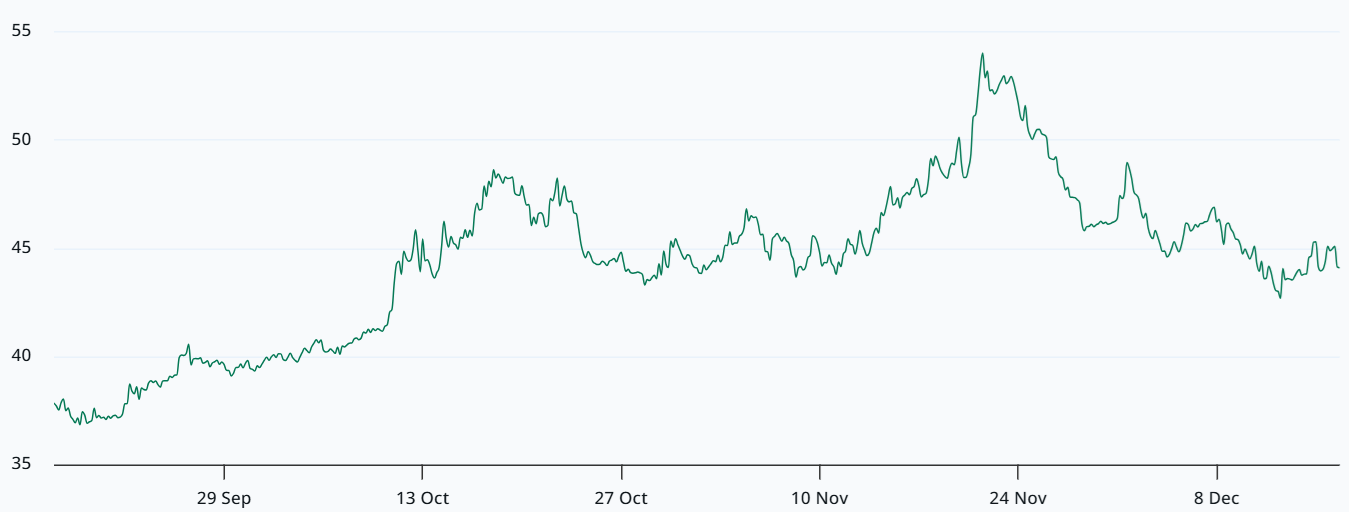

How Bitcoin tracks weekly relocations in the gold rate is more vital than its 48% underperformance relative to gold given that July. The 60-day connection metric has actually oscillated in between favorable and unfavorable given that Might, suggesting little consistency in between Bitcoin and gold rate patterns. Still, there is no doubt that Bitcoin traders are dissatisfied by the rejection that followed the loss of the $110,000 level.

While such information might appear bearish in the beginning glimpse, the 31% Bitcoin rate drop given that October had no influence on the connection metric. This deteriorates the argument that institutional financiers have actually moved their threat understanding. Bitcoin might still prosper as an independent and decentralized monetary system, even as gold stays the world’s biggest shop of worth, with an approximated $30 trillion market capitalization.

It likewise appears early to conclude that institutional cash has actually deserted Bitcoin based exclusively on a 10-week correction, particularly given that Bitcoin has actually exceeded the S&P 500 index by 7% over the previous 18 months. Although that distinction might appear modest, Bitcoin’s choices threat profile carefully matches Nvidia (NVDA United States) and Broadcom (AVGO United States), 2 of the world’s 8 biggest business by market price.

Bitcoin choices’ indicated volatility peaked at 53% in November, approximately in line with the existing level for Tesla (TSLA United States). When traders prepare for sharp rate swings, this metric increases to show the greater premiums charged on call (buy) and put (sell) choices. Market makers tend to decrease threat direct exposure when surprise rate relocations are most likely; nevertheless, this does not always indicate financiers have actually turned bearish.

There is presently no sign that institutional financiers have actually deserted expectations for Bitcoin to reach $100,000 in the near term. Connection and volatility metrics recommend that Bitcoin’s rate habits has actually not materially altered following the 30% decrease, implying a couple of days of ETF net outflows need to not be overstated. The results of the current liquidity injection from the United States Fed have yet to be shown in markets, making it early to evaluate Bitcoin’s efficiency.

This short article is for basic details functions and is not meant to be and need to not be taken as, legal, tax, financial investment, monetary, or other recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.

This short article does not consist of financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we make every effort to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might consist of positive declarations that go through dangers and unpredictabilities. Cointelegraph will not be accountable for any loss or damage occurring from your dependence on this details.