Bitcoin (BTC) cost dropped from $87,241 to $81,331 in between March 28 and March 31, removing gains from the previous 17 days. The 6.8% correction liquidated $230 million in bullish BTC futures positions and mainly followed the decreasing momentum in the United States stock exchange, as the S&P 500 futures was up to their most affordable levels given that March 14.

In spite of having a hard time to hold above $82,000 on March 31, 4 essential signs indicate strong financier self-confidence and capacity indications of Bitcoin decoupling from conventional markets in the future.

S&P 500 index futures (left) vs. Bitcoin/USD (right). Source: TradingView/ Cointelegraph

Traders fear the worldwide trade war’s effect on financial development, specifically after the March 26 statement of a 25% United States tariff on foreign-made cars. According to Yahoo News, Goldman Sachs strategists cut the company’s year-end S&P 500 target for the 2nd time, reducing it from 6,200 to 5,700. Likewise, Barclays experts decreased their projection from 6,600 to 5,900.

No matter the factors behind financiers’ increased threat understanding, gold rose to a record high above $3,100 on March 31. The $21 trillion property is commonly thought about the supreme hedge, specifically when traders focus on options over money. On the other hand, the United States dollar has actually deteriorated versus a basket of foreign currencies, with the DXY index dropping to 104.10 from 107.60 in February.

Bitcoin metrics reveal strength, while long-lasting financiers are unfazed

Bitcoin’s stories of being “digital gold” and an “uncorrelated property” are being questioned, regardless of a 36% gain over 6 months while the S&P 500 index fell 3.5% throughout the very same duration. A number of Bitcoin metrics continued to reveal strength, suggesting that long-lasting financiers stay unfazed by the short-lived connection as reserve banks pivot to expansionist procedures to avoid a recession.

Bitcoin’s mining hashrate, which determines the computing power behind the network’s block recognition system, reached an all-time high.

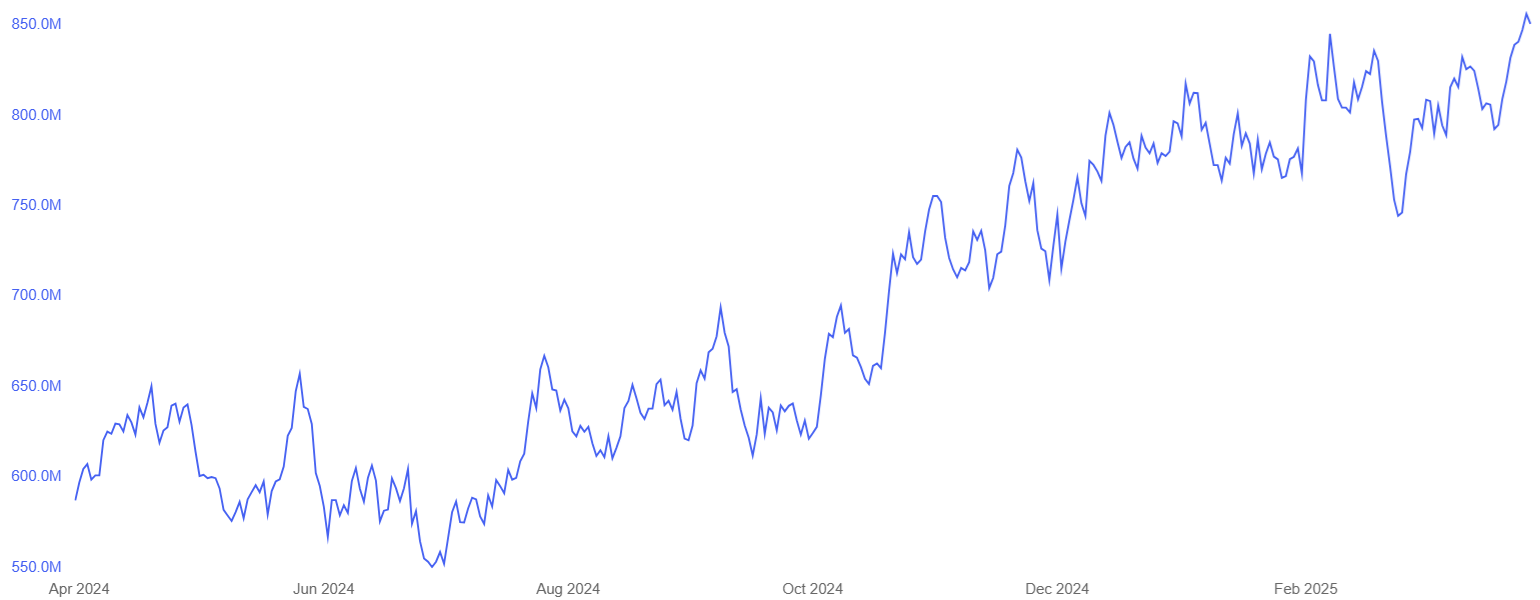

Bitcoin mining approximated 7-day typical hashrate, TH/s. Source: Blockchain.com

The 7-day hashrate reached a peak of 856.2 million terahashes per 2nd on March 28, up from 798.8 million in February. Thus, there are no indications of panic offering from miners, as revealed by the circulation of recognized entities to exchanges.

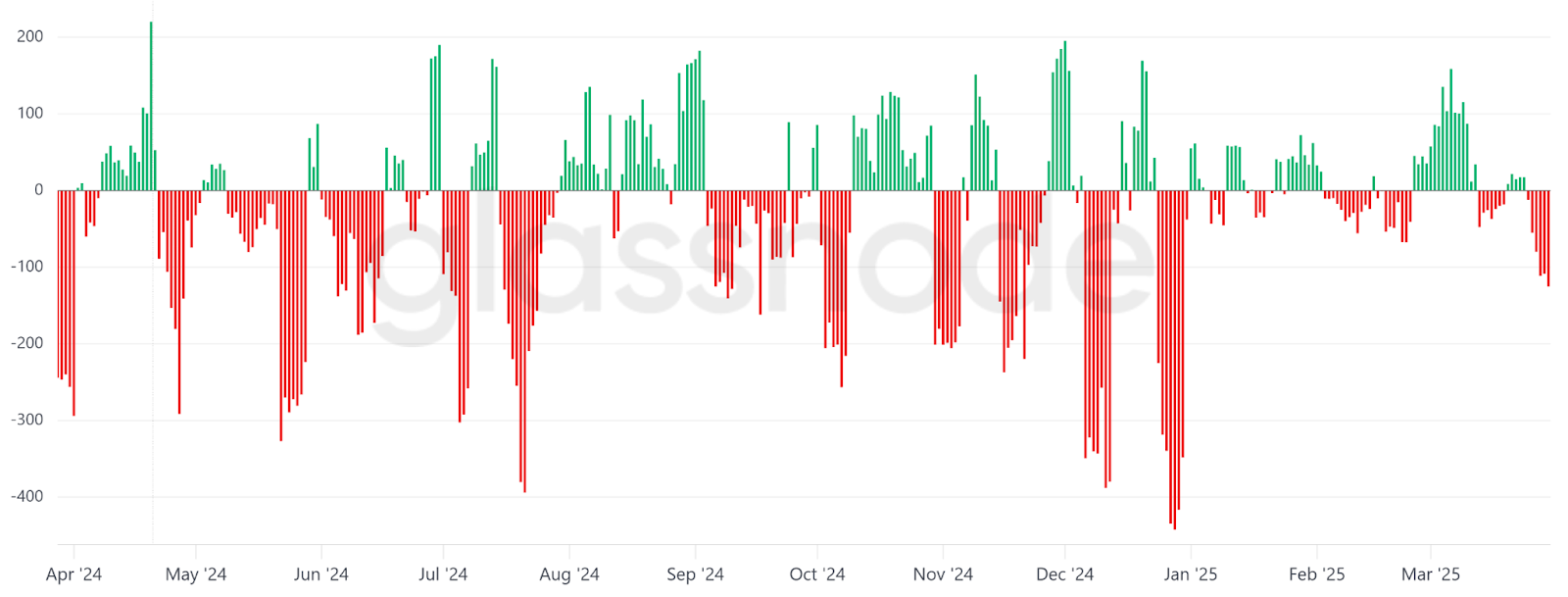

In the past, BTC cost slumps were related to durations of FUD concerning the “death spiral,” where miners were required to offer when ending up being unprofitable. Furthermore, the 7-day average of net transfers from miners to exchanges on March 30 stood at BTC 125, according to Glassnode information, much lower than the BTC 450 mined daily.

Bitcoin 7-day typical net transfer volume from/to miners, BTC. Source: Glassnode

Bitcoin miner MARA Holdings submitted a prospectus on March 28 to offer up to $2 billion in stocks to broaden its BTC reserves and for “basic business functions.” This relocation follows GameStop (GME), the US-listed videogame business, which submitted a $1.3 billion convertible financial obligation offering intend on March 26 while upgrading its reserve financial investment method to consist of prospective Bitcoin and stablecoin acquisitions.

Related: Trump boys back brand-new Bitcoin mining endeavor with Hut 8

Crypto exchange reserves drop

Cryptocurrency exchanges’ reserves dropped to their most affordable levels in over 6 years on March 30, reaching BTC 2.64 million, according to Glassnode information. The decreased variety of coins readily available for instant trading generally suggests that financiers are more likely to hold, which is especially considerable as Bitcoin’s cost decreased 5.1% in 7 days.

Finally, near-zero net outflows in United States area Bitcoin exchange-traded funds (ETFs) in between March 27 and March 28 signal self-confidence from institutional financiers.

Simply put, Bitcoin financiers stay positive due to the record-high mining hashrate, business adoption, and 6-year low exchange reserves, which signify long-lasting holding.

This post is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.