Secret Takeaways:

-

BTC liquidation levels, onchain information, and chart setups assemble at the $100K target.

-

Success has actually risen, recommending a rebound in market self-confidence.

-

BTC breakout patterns indicate $100K as a short-squeeze and ecstasy magnet.

Bitcoin (BTC) is flashing numerous technical and onchain signals recommending that a rally to $100,000 is possible by Might. Here are 5 charts making the case for a near-term breakout.

BTC double-bottom mean $100,600 target

BTC’s everyday chart has actually formed a book double bottom, verifying a breakout above the neck line resistance at $87,643. The structure forecasts a determined transfer to $100,575 or above.

Momentum signs like the relative strength index (RSI) support this thesis, remaining in bullish area with more space to broaden. On the other hand, the 50- and 200-day rapid moving averages (EMAs) have actually turned into assistance, using extra tailwinds.

Volume has actually stayed consistent post-breakout, revealing that purchasers are still in control. This setup develops a strong structure for Bitcoin to press towards $100,600.

Bull pennant setup eyes six-figure BTC rate

On the per hour timeframe, BTC combines inside a bull pennant following a sharp rally. This pattern shows short-lived indecision before the next leg greater. The target sits near $100,900.

The pennant formed after a high increase, recommending that BTC rate is most likely coiling before resuming its up relocation. Regardless of the low volume, the structure stays undamaged and is supported by strong EMA positioning.

A breakout above the pennant’s upper trendline might activate fresh benefit momentum, bring in short-term traders and algorithms targeting round-number breakouts.

Bitcoin’s falling wedge breakout targets $102,000

The three-day chart reveals a finished falling wedge breakout, with the rate breaking an essential resistance zone near $94,000. The predicted relocation targets $102,270.

Falling wedges are normally bullish turnaround patterns, and BTC’s tidy breakout above the upper trendline includes technical conviction. Rate is likewise riding above the 50-3D EMA, an essential pattern signal.

Volume rose throughout the breakout, recommending strong purchaser conviction.

The $94,000-95,000 resistance is now topping Bitcoin’s benefit efforts. Breaking it suggests BTC might provide its total determined approach $100,000 rapidly.

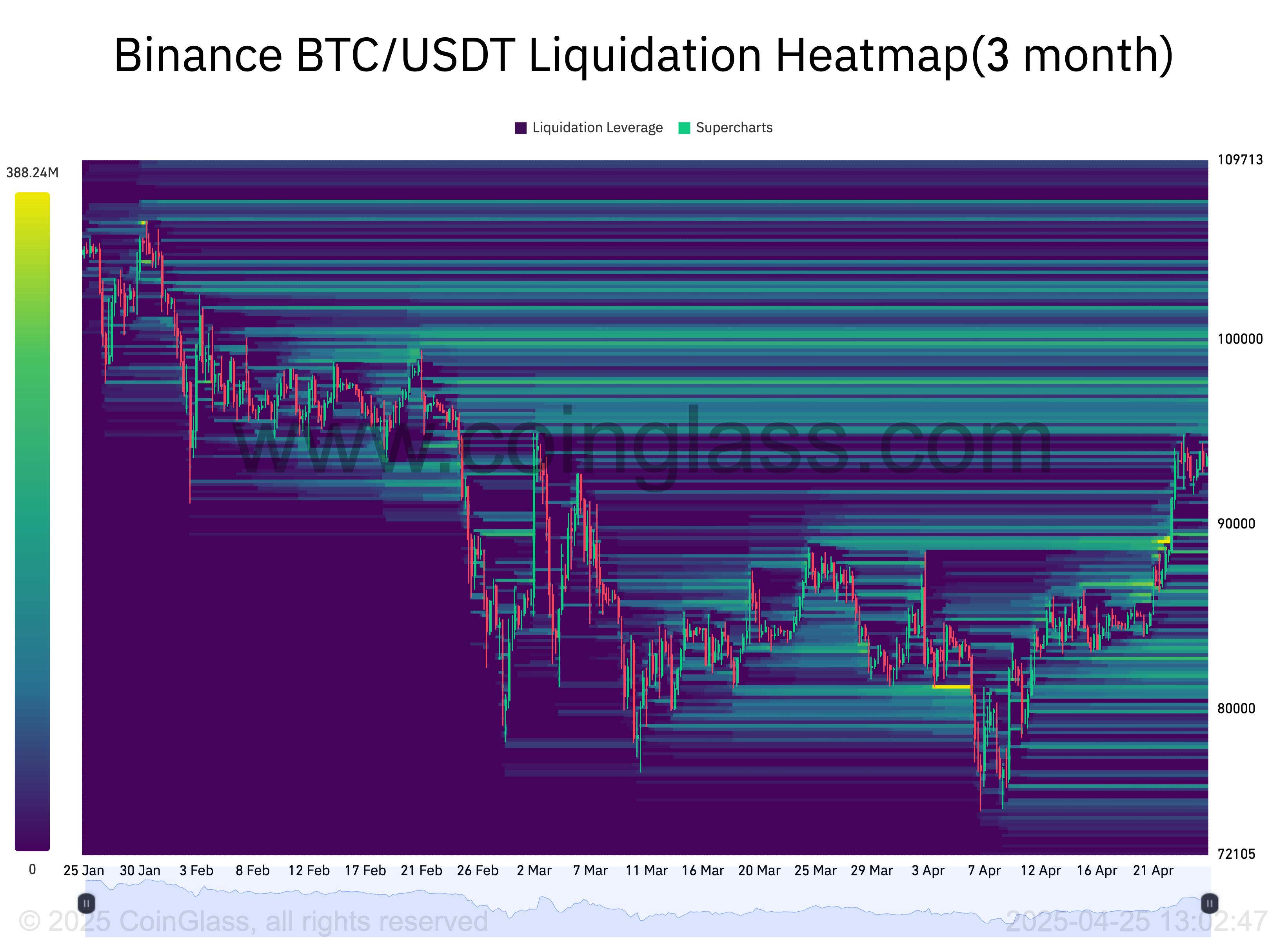

Binance heatmap reveals liquidity magnet at $100K

Liquidation information exposes a thick cluster of brief liquidations around the $100,000 level. These positions typically imitate a magnet, pulling the rate towards them as market makers hunt for liquidity.

If BTC continues climbing up, it will push brief sellers who might be required to leave, activating a waterfall of buy orders.

Related: $ 635M liquidated in 24H as trader forecasts $100K Bitcoin brief capture

Liquidity maps typically front-run rate. With such thick activity near 6 figures, the course of least resistance appears up in the near term.

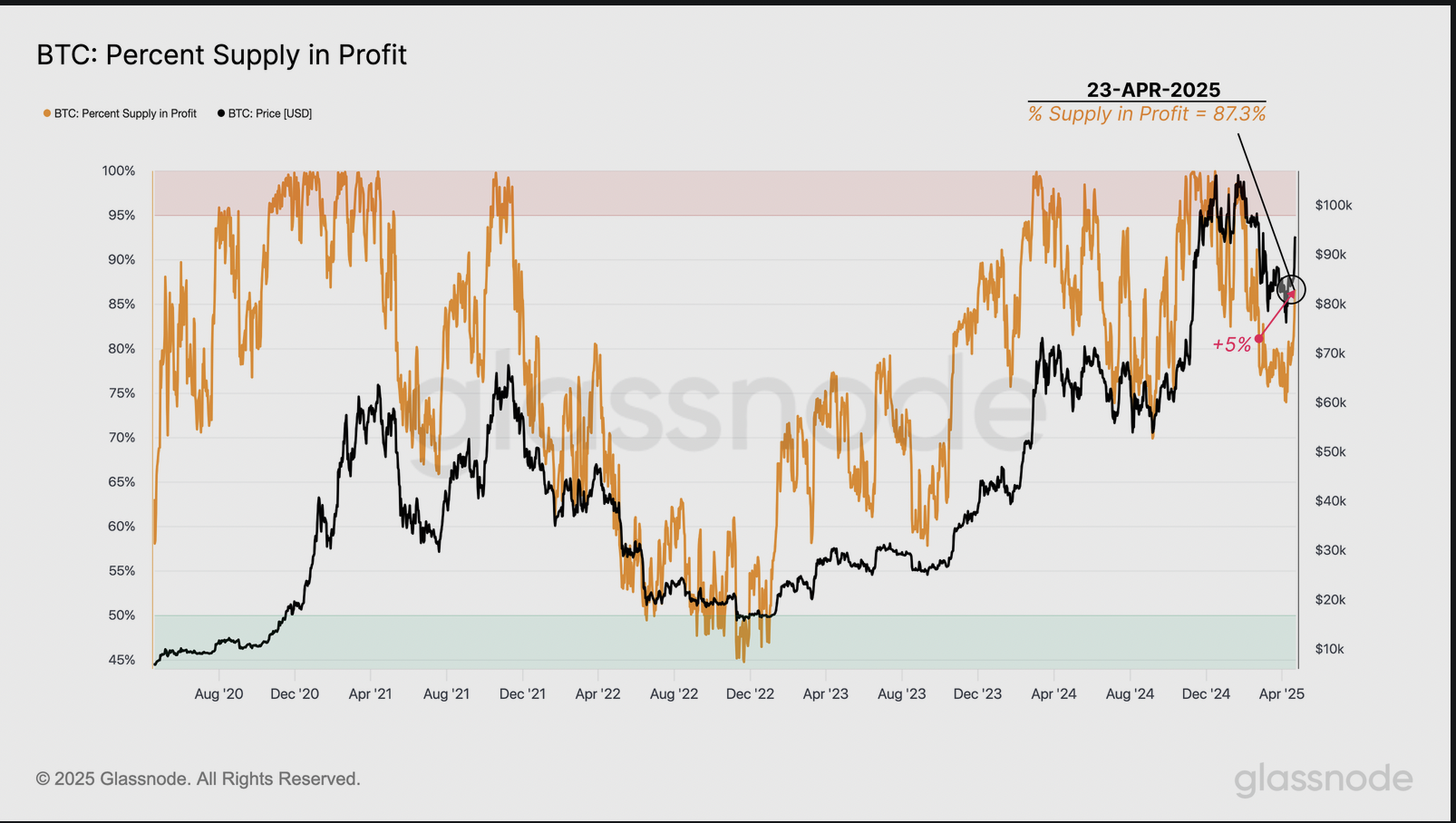

Bitcoin success increases post-breakout

Since April 23, 87.3% of Bitcoin’s distributing supply remained in revenue, up from 82.7% when BTC last traded near $94,000 in early March, according to Glassnode information.

The boost shows that a substantial part of the Bitcoin supply altered hands at lower levels throughout the March correction, showing a fresh wave of build-up.

Historically, when the Percent Supply in Earnings stays above 90% for a prolonged duration, markets tend to get in a blissful stage. With success now nearing that limit, bullish belief continues to construct.

Integrated with bullish chart structures and focused brief liquidity overhead, BTC stays located for a prospective approach $100,000 by May.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes threat, and readers must perform their own research study when deciding.