Bitcoin’s (BTC) battle to hold above $70,000 continued into Wednesday, raising issues that the a drop into the $60,000 variety might be the next stop. The sell-off was accompanied by futures market liquidations, a $55 billion drop in BTC open interest (OI) over the previous one month, and increasing Bitcoin inflows to exchanges.

The cost weak point has experts discussing whether crypto-specific elements or bigger macro-economic concerns are the driving element behind the sell-off and what it might imply for BTC’s short-term future.

Secret takeaways:

-

Around 744,000 BTC in open interest left significant exchanges in one month, equivalent to approximately $55 billion at existing rates.

-

BTC futures cumulative volume delta (CVD) fell by $40 billion over the previous 6-months.

-

Crypto exchange reserves have actually increased by 34,000 BTC given that mid-January, increasing the near-term supply threat.

BTC open interest collapse indicate massive deleveraging

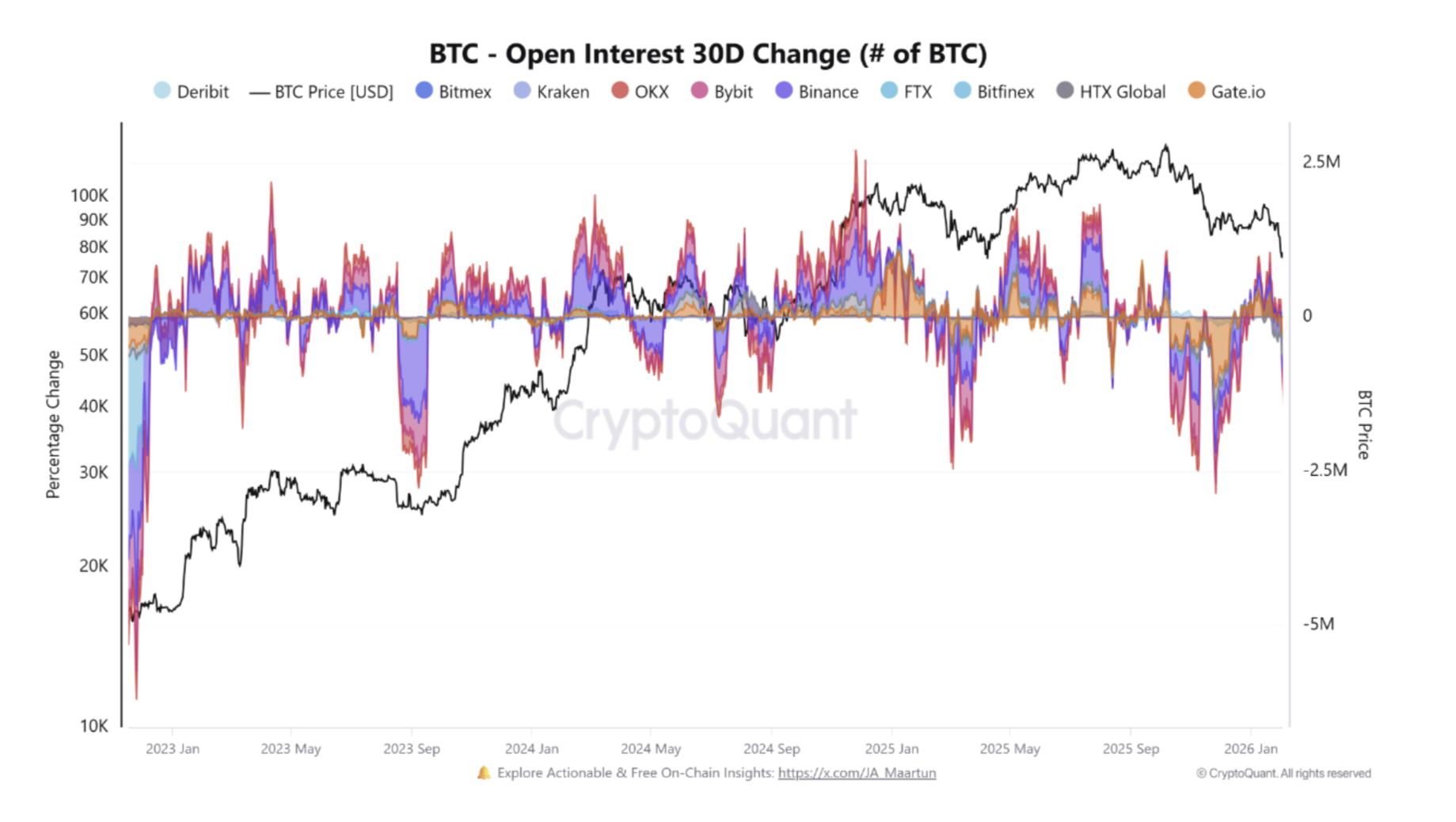

CryptoQuant information kept in mind that Bitcoin’s 30-day open interest modification reveals a sharp contraction throughout exchanges, showing prevalent position closures, not simply newly opened brief positions.

On Binance, the net open interest fell by 276,869 BTC over the previous month. Bybit tape-recorded the biggest decrease at 330,828 BTC, while OKX saw a decrease of 136,732 BTC on Tuesday.

In overall, approximately 744,000 BTC worth of employment opportunities were closed, comparable to more than $55 billion at existing rates. This drop in employment opportunities accompanied Bitcoin’s drop listed below $75,000, suggesting deleveraging as a driving element, not simply find selling.

Onchain expert Boris highlighted that the cumulative volume delta (CVD) information reveals market offer orders continue to control, especially on Binance, where derivatives CVD sits near -$ 38 billion over the previous 6 months.

Other exchanges reveal differing characteristics: Bybit’s CVD flattened near $100 million after a sharp December liquidation wave, while HTX supported at -$ 200 million in CVD as the cost combines near $74,000.

Related: Bitcoin bounces to $76K, however onchain and technical information signal much deeper drawback

Increased exchange streams include pressure as experts view essential levels

On the other hand, Bitcoin inflows to exchanges rose in January, amounting to approximately 756,000 BTC, led by Binance and Coinbase. Considering that early February, inflows have actually gone beyond 137,000 BTC, highlighting traders’ repositioning and not always leaving the marketplace.

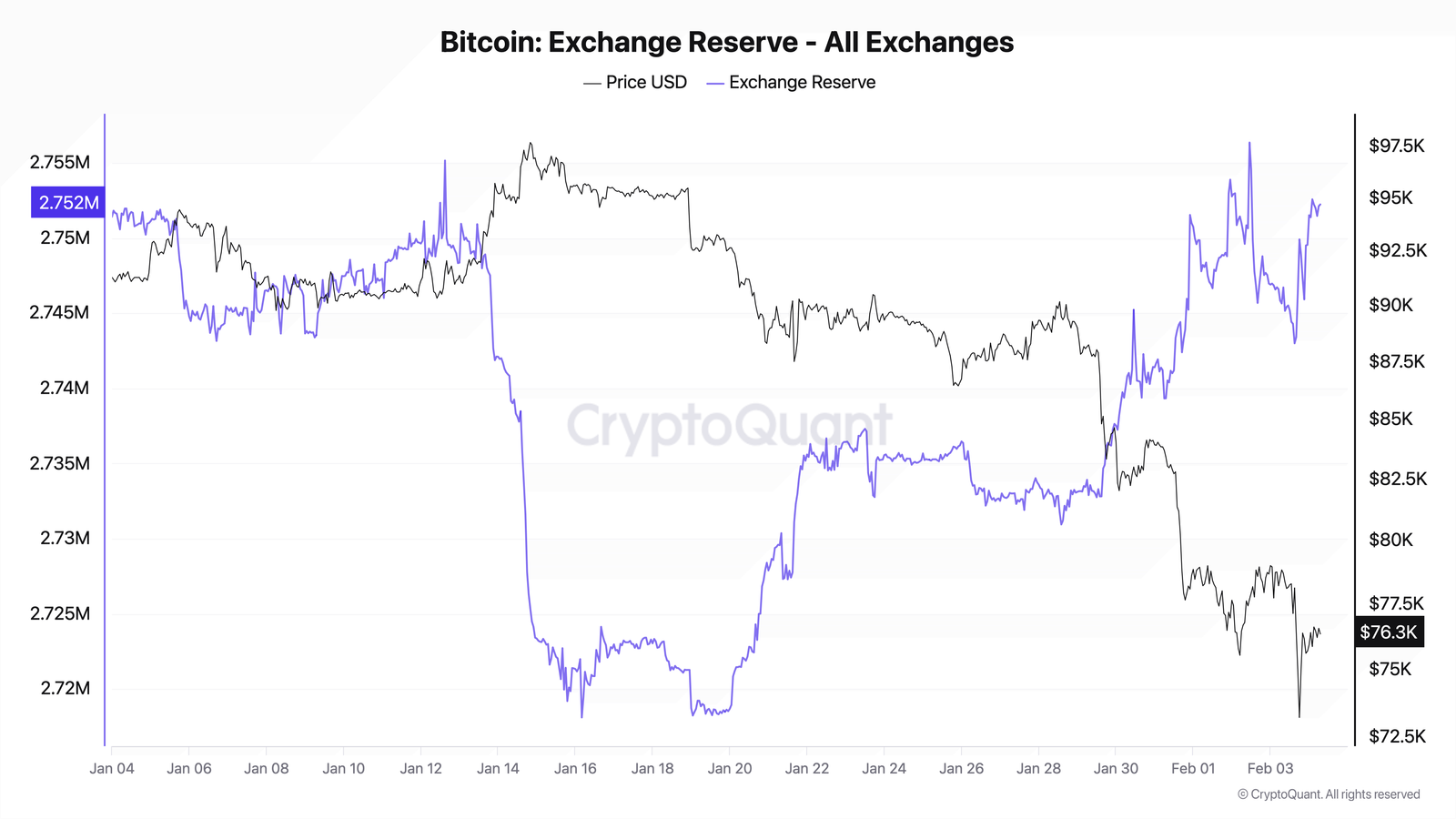

On the supply side, expert Axel Adler Jr. kept in mind that exchange reserves have actually increased from 2.718 million BTC to 2.752 million BTC given that Jan. 19. The expert alerted that continued development above 2.76 million BTC might increase offering pressure. The expert thought that a total capitulation is yet to occur, which might take place at lower cost levels.

Market expert Scient stated Bitcoin is not likely to form a bottom in a single day or week. Resilient market bottoms might establish through 2 to 3 months of debt consolidation near the significant assistance zones, with greater timespan indications. Scient kept in mind that whether this structure kinds in the high $60,000 variety or the low $50,000 level stays uncertain.

Bitcoin Trader Mark Cullen continues to see prospective drawback towards $50,000 in a more comprehensive macro situation, however anticipates a short-term reversion towards the regional point of control ($ 89,000 to $86,000) after BTC swept weekly lows listed below $74,000 on Tuesday.

Related: Bitcoin’s $68K pattern line viewed as prospective BTC cost flooring: Traders

This short article does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers need to perform their own research study when deciding. While we aim to supply precise and prompt details, Cointelegraph does not ensure the precision, efficiency, or dependability of any details in this short article. This short article might include positive declarations that undergo dangers and unpredictabilities. Cointelegraph will not be responsible for any loss or damage occurring from your dependence on this details.