Cryptocurrency is ending up being a monetary preparation top priority, with 99% of primary monetary officers at billion-dollar companies anticipating to utilize it for service in the long term, according to Deloitte’s Q2 2025 study of CFOs.

The study, carried out amongst 200 CFOs at business with over $1 billion in profits, exposed that 23% anticipate their treasury departments to utilize crypto for financial investments or payments within the next 2 years. This figure reaches almost 40% amongst CFOs at companies with profits over $10 billion.

Regardless of the momentum, financing chiefs stay careful. Issues about cost volatility top the list, with 43% of participants mentioning it as the main barrier to embracing non-stable cryptocurrencies like Bitcoin (BTC) and Ether (ETH).

Other significant issues consist of accounting intricacy (42%) and regulative unpredictability (40%), the latter of which has actually been intensified by moving United States policy.

Related: Crypto tops fixed-income on ETF financier wishlist: Schwab Study

CFOs prepare to purchase crypto within 2 years

Regardless of some issues, a growing variety of CFOs are considering direct exposure to cryptocurrencies. Fifteen percent stated they anticipate to purchase non-stable cryptocurrencies within 24 months, increasing to 24% for large-cap business.

” Participants at companies with profits of US$ 10 billion and up were a lot more most likely to tick package,” the report stated. “Almost 1 in 4 (24%) stated their financing departments will likely purchase non-stable cryptocurrencies over the next 2 years.”

Adoption isn’t restricted to investing. Stablecoins are likewise getting traction for payments. Fifteen percent of CFOs stated their business are most likely to accept stablecoins within 2 years, with that number striking 24% amongst the biggest companies.

Personal privacy and payment performance were leading chauffeurs, with 45% mentioning client personal privacy and 39% highlighting quicker, lower-cost cross-border deals as essential advantages.

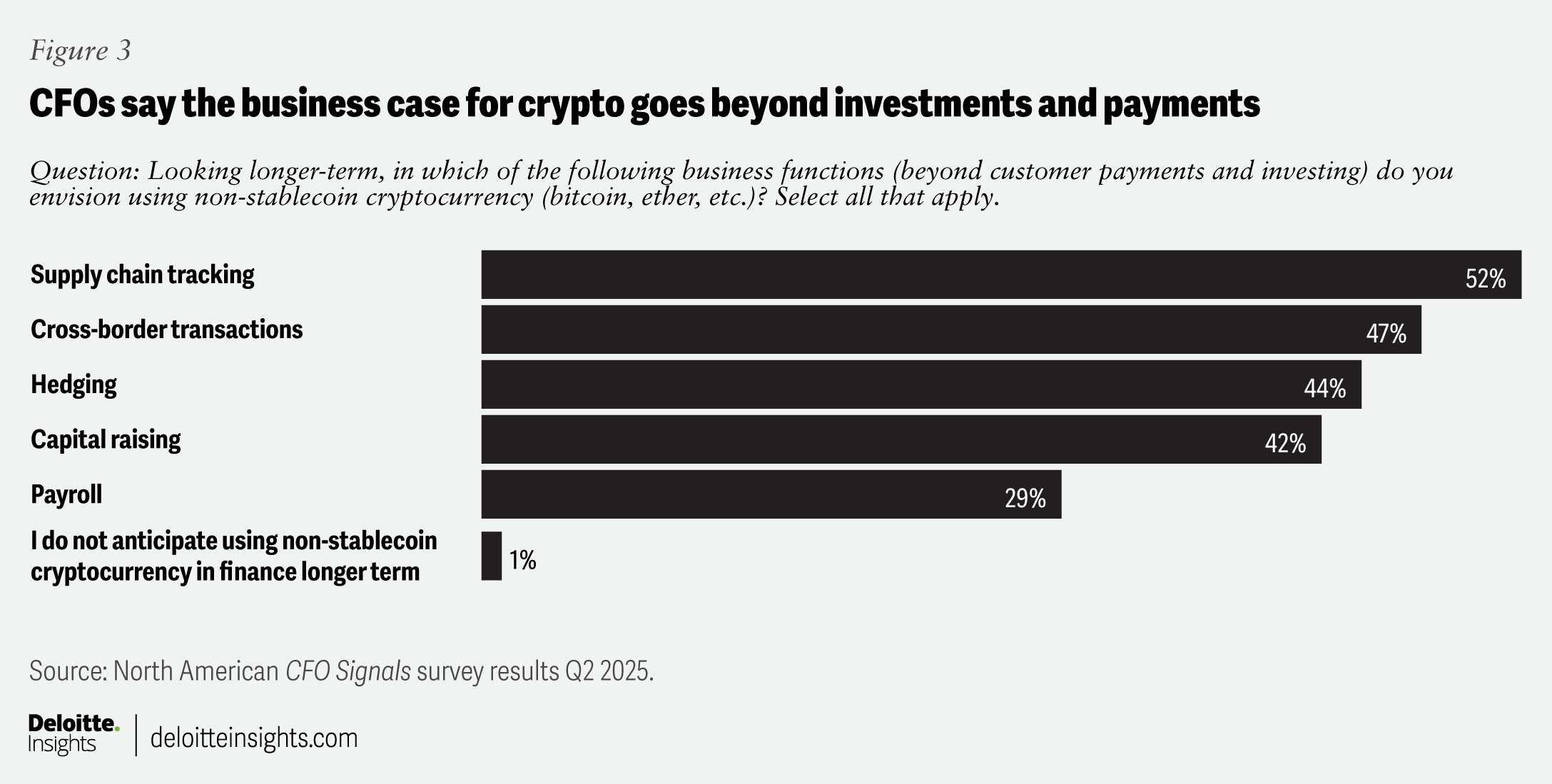

CFOs are likewise taking a look at blockchain-based possessions for functional enhancements. Over half of the participants stated they visualize utilizing crypto for supply chain management and tracking. Blockchain’s transparent, immutable recordkeeping might enhance payment confirmation.

Internal discussions about crypto are currently underway. Thirty-seven percent of CFOs stated they ‘d talked about digital possessions with their boards, 41% with primary financial investment officers, and 34% with banks or lending institutions. Just 2% reported no crypto-related conversations.

Related: Trump Media partners with Charles Schwab, broadens into crypto monetary services

Institutional hunger for crypto grows

A March study by Coinbase and EY-Parthenon exposed that 83% of institutional financiers prepare to increase their crypto direct exposure in 2025, with lots of broadening beyond Bitcoin and Ether.

XRP (XRP) and Solana (SOL) became leading choices amongst participants, while the bulk stated they anticipate to assign a minimum of 5% of their portfolios to digital possessions this year.

Publication: Bitcoin OG Willy Woo has actually offered the majority of his Bitcoin– Here’s why