Bitcoin (BTC) is bracing for a significant United States macro information week as crypto market individuals alert of severe volatility next.

-

Bitcoin retests $92,000 after an appealing weekly close, however traders still see a much deeper BTC rate correction to come.

-

A bumper week of United States macro information features the Federal Reserve under pressure on several fronts.

-

The Fed has its hands connected, analysis argues, anticipating rates of interest boiling down, liquidity thriving and BTC/USD reaching $180,000 within eighteen months.

-

Bitcoin short-term holders are back in the black, making existing rate levels specifically important for speculative financiers.

-

Belief remains in neutral area, however crowd-based FOMO might keep rate from increasing much greater, research study concludes.

Bitcoin traders wait on assistance retest

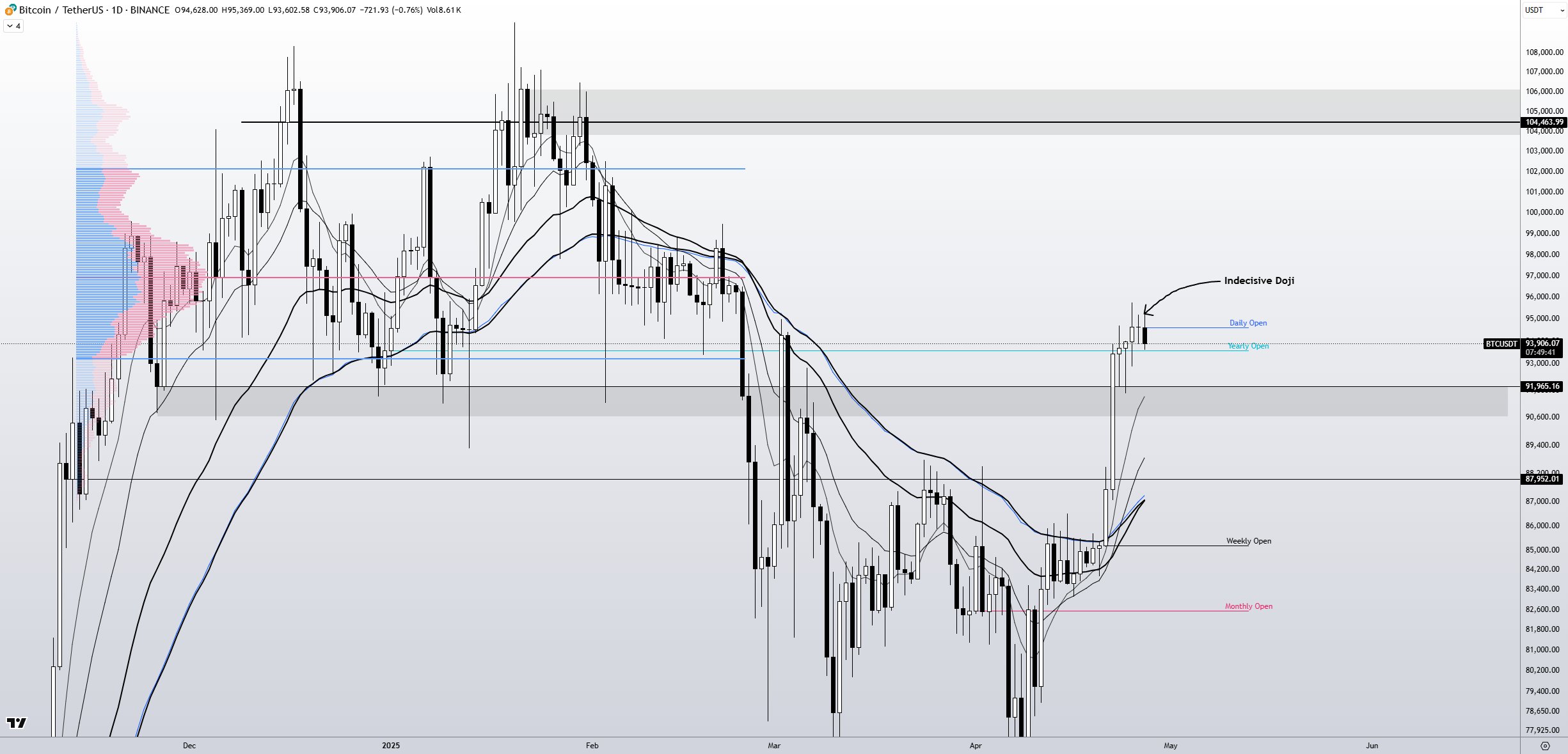

Bitcoin is circling around multimonth highs as the week gets underway, having actually checked $92,000 as assistance after the weekly close.

That close itself was bullish, information from Cointelegraph Markets Pro and TradingView verifies, can be found in at simply above the essential annual open level of $93,500.

Can Bitcoin do it?

Can Bitcoin Weekly Close above $93500 to begin the procedure of gaining back the previous Variety?$BTC #Crypto #Bitcoin https://t.co/r5reRJ0HFy pic.twitter.com/5ga0gcSqX4

— Rekt Capital (@rektcapital) April 27, 2025

Forecasting an “fascinating week” to come, popular trader CrypNuevo considered the capacity for greater highs for BTC/USD.

” Pretty basic – I do not see momentum rolling over right now and it’s possible to see a 3rd upper hand up $97k where there is some liquidity,” he composed in a thread on X.

” Ultimately, we must see a 4H50EMA retest that can be a possible assistance.”

CrypNuevo described the 50-period rapid moving average (EMA) on 4-hour timeframes, presently at $91,850.

On the subject of most likely assistance retests, fellow trader Roman had a much deeper retracement in mind.

” Waiting to see what takes place at 88k,” he informed X fans.

” Not a follower in breaking 94k resistance at any time quickly.”

Roman restated that the stochastic relative strength index (RSI) metric stayed greatly overbought, an indication that a cooling-off duration for rate might follow.

Trader and analyst Alter on the other hand concentrated on the location in between $90,000 and $92,000, explaining “indecision” in the market leading to existing rate action.

GDP, PCE prints heading significant macro week

It’s crunch time for United States macroeconomic information and inflation development today, with a multitude of numbers coming thick and quick.

Q1 GDP, nonfarm payrolls and tech revenues are all due, however the emphasize will be the Federal Reserve’s “chosen” inflation gauge, the Personal Usage Expenses (PCE) index.

Set for release on April 30, both PCE and GDP precede the month-to-month candle light close, setting the phase for crypto and risk-asset volatility.

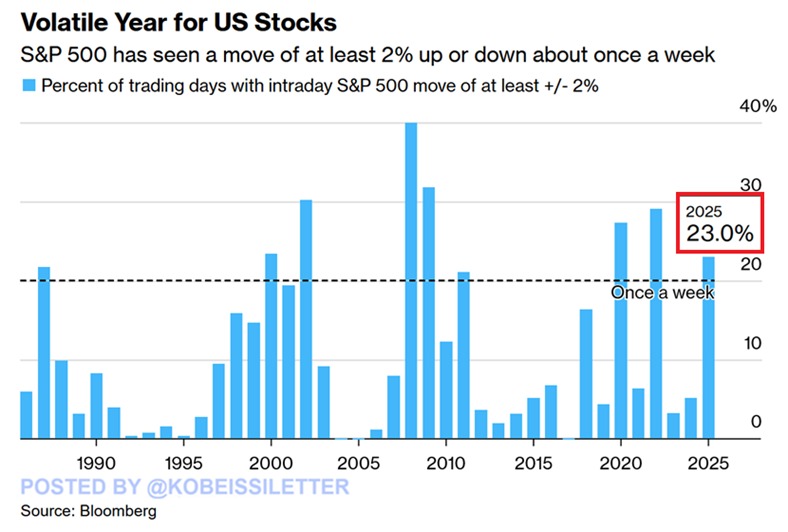

The stakes are currently high– United States trade tariffs have actually led to wild swings both up and down for crypto, stocks and products, with relatively no end in sight in the meantime.

” This has actually been among the most unstable years in history: The S&P 500 has actually seen a 2% relocation in either instructions on 23% of trading days, or a minimum of as soon as a week up until now this year,” trading resource The Kobeissi Letter kept in mind in part of continuous X analysis.

” This is the greatest reading considering that 2022, when the share struck 29% for the complete year. By contrast, the long-lasting average has actually been two times a month.”

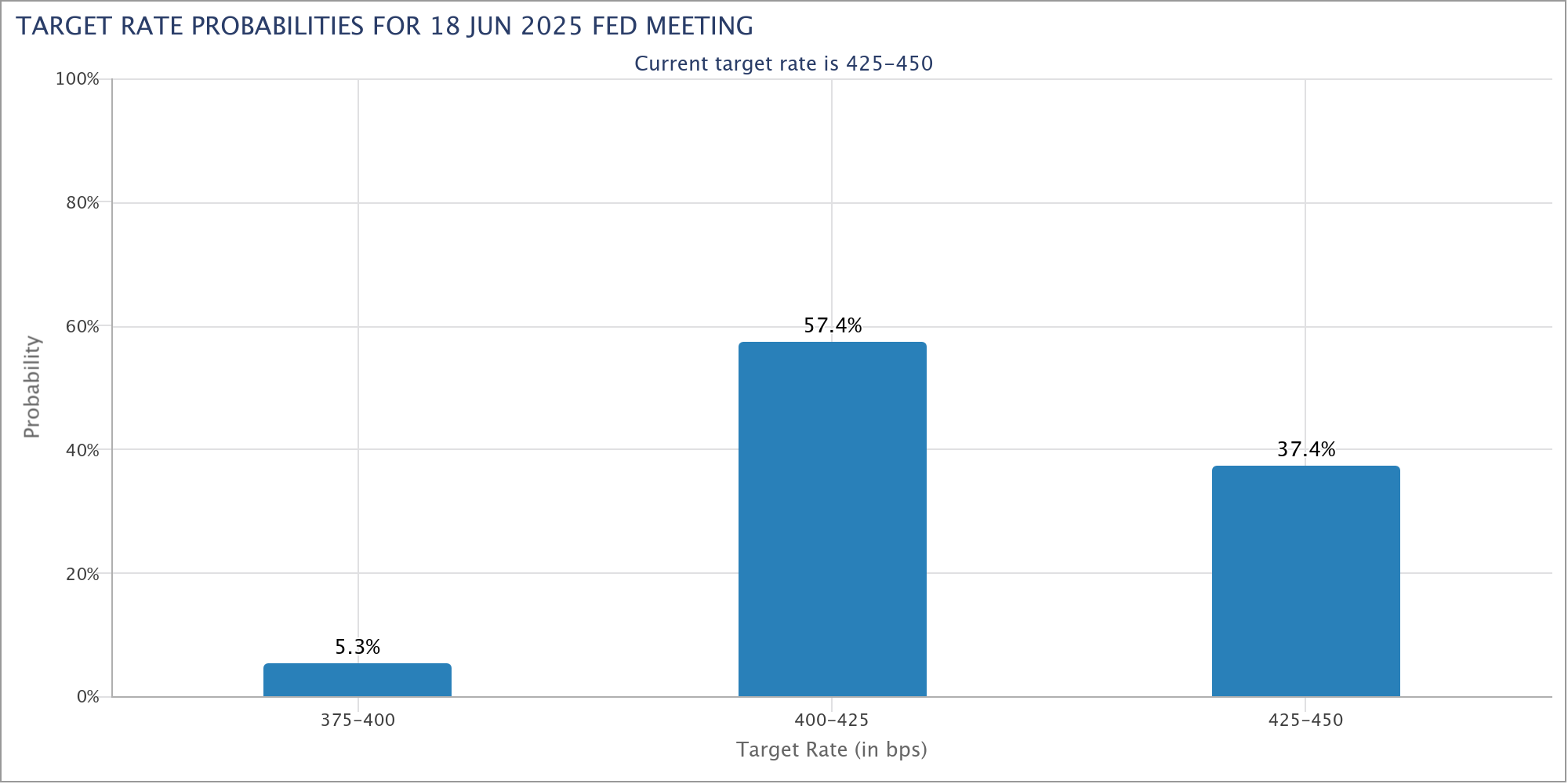

Inflation expectations are an essential subject, on the other hand, with markets seeing rate of interest cuts starting in June in spite of the Fed itself remaining hawkish.

The most recent information from CME Group’s FedWatch Tool reveals diverging viewpoints over what will arise from the June conference of the Federal Free Market Committee (FOMC).

By contrast, May’s FOMC event is practically all anticipated to provide a freeze on the existing Fed funds rate.

” Proof of a strong labor market and issues over how tariffs might affect the inflation outlook is keeping the Fed on hold when it pertains to rates of interest,” trading company Mosaic Property composed in the most recent edition of its routine newsletter, “The marketplace Mosaic,” on April 27.

Referencing FedWatch, Mosaic kept in mind that “market-implied chances are beginning to move in favor of more rate cuts through year-end.”

Crypto officer doubles down on $180K BTC rate target

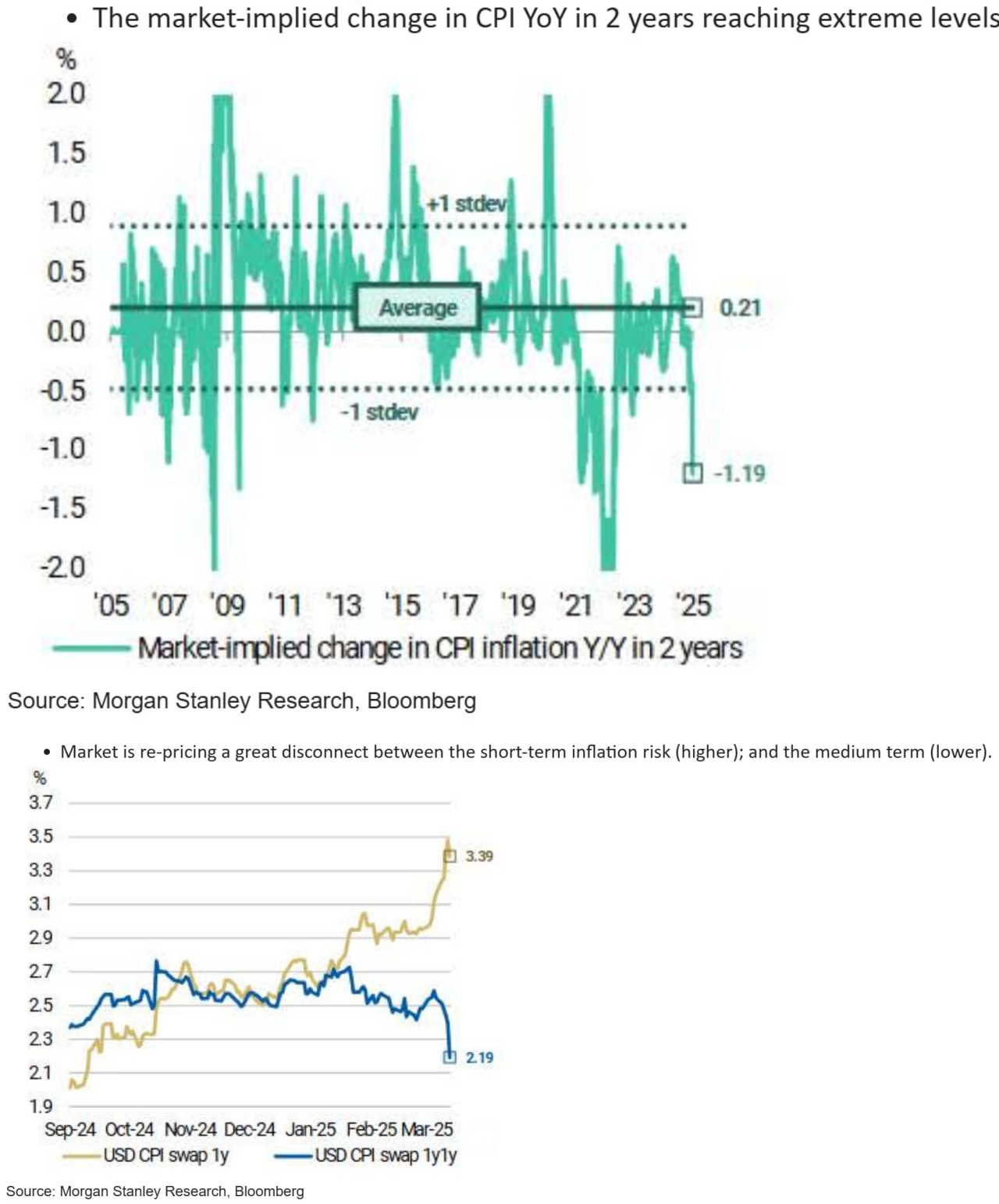

Existing macro information is currently triggering a stir for crypto market individuals considering the long-lasting ramifications of existing Fed policy.

In his most current X analysis, hedge fund creator Dan Tapiero had a strong BTC rate forecast in shop for the coming eighteen months.

” Btc to 180k before summertime ’26,” he summed up.

Tapiero indicated a current Fed study revealing production expectations, degrading at a record speed, calling the outcomes “difficult for them to overlook.”

” Forward market inflation indications collapsing into risk zone,” he continued in a different post on the outlook for the United States Customer Cost Index (CPI).

In both cases, Tapiero concluded that Bitcoin and run the risk of possessions will take advantage of increasing market liquidity– a currently popular theory versus the background of record M2 cash supply.

” Liquidity spigot coming as genuine rates too limiting provided financial tightening up,” he included about existing rates of interest.

Bitcoin speculators make a profit

Bitcoin short-term holders (STHs) are back under the microscopic lense at existing costs thanks to the impact of their aggregate expense basis on market trajectory.

As Cointelegraph frequently reports, the expense basis, likewise referred to as understood rate, shows the typical rate at which speculative financiers got in the marketplace.

This level, which covers purchasers over the previous 6 months however which is likewise broken down into different subcategories, is especially crucial in Bitcoin booming market.

” Today, when we take a look at the existing scenario, we can see that the rate has actually reached the STH-Realized Cost,” CryptoMe, a factor to onchain analytics platform CryptoQuant, composed in among its “Quicktake” article on the subject.

CryptoQuant reveals that the combined STH expense basis presently sits at around $92,000, making the level secret to hold as assistance moving forward.

” Among the essential On-Chain conditions for a bull run is that the rate stays above the STH-Realized Cost. If the rate is listed below the Understood Rates, we can not genuinely discuss a bull run,” CryptoMe describes.

” If this bull run is to continue, it needs to satisfy these conditions.”

The STH expense basis was lost as assistance in March, with the current BTC rate rebound having a near-instant influence on its newest purchasers.

STH-owned coins moving onchain previously this month on the other hand caused forecasts of fresh market volatility.

Research study alerts of greed-induced “regional top”

After striking its greatest in almost 3 months recently, greed within crypto is on the radar as a cost impact today.

Related: New Bitcoin rate all-time highs might happen in Might– Here is why

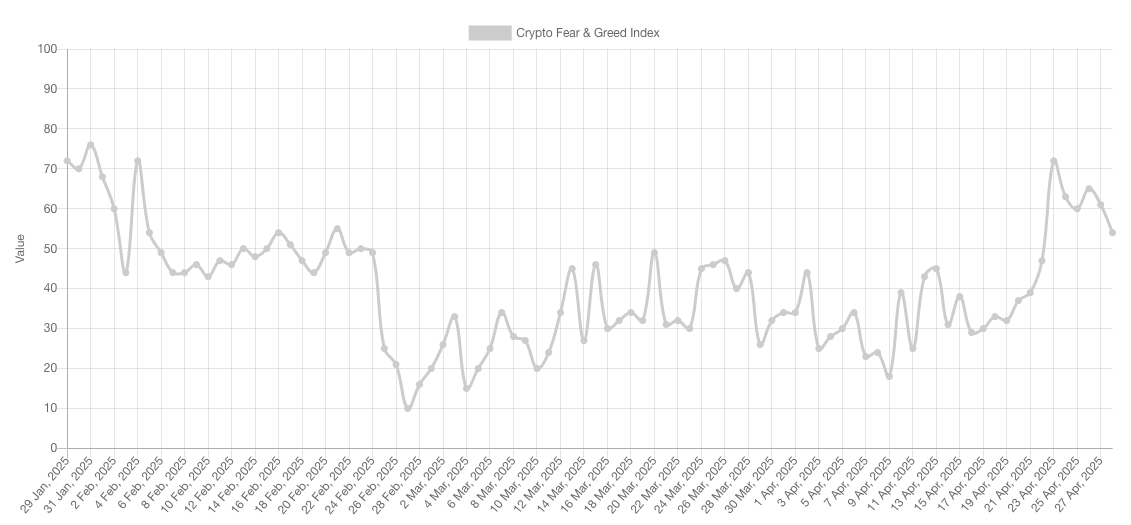

The most recent information from the Crypto Worry & & Greed Index verifies a spike to 72/100 on April 25, suggesting that crypto market belief came close to “severe greed.”

Now back in “neutral” area, the Index has actually however led research study company Santiment to alert of a possible regional rate top.

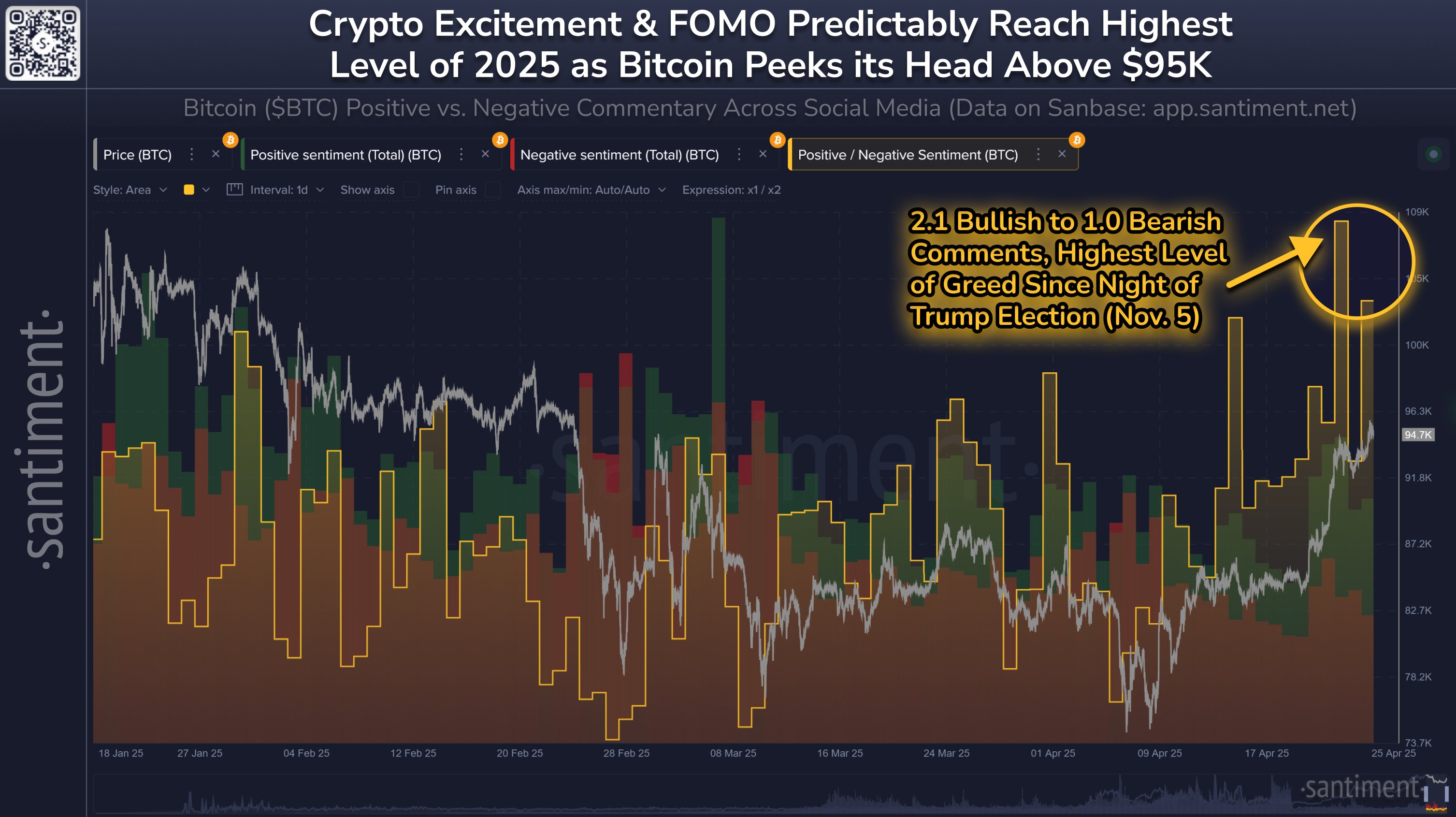

” Data reveals a rise in optimism from the crowd as $BTC rebounded above $95K for the very first time considering that February,” it informed X fans.

” When it comes to the level of greed being determined throughout social networks, this is the greatest spike in bullish (vs. bearish) posts considering that the night Trump was chosen on November 5, 2024.”

An accompanying chart covered what Santiment refers to as “enjoyment and FOMO” peaking as an outcome of the BTC rate rebound.

” The crowd’s level of greed vs. worry is most likely going to affect whether a regional leading types (due to the fact that the crowd gets too greedy), or if crypto can continue to decouple from the S&P 500 (due to the fact that the crowd attempts to too soon take earnings),” it included.

This post does not include financial investment guidance or suggestions. Every financial investment and trading relocation includes danger, and readers must perform their own research study when deciding.