Institutional financiers might turn their attention to altcoins as the next wave of cryptocurrency exchange-traded funds (ETFs) shows up in the United States, according to market experts.

The United States Securities and Exchange Commission (SEC) got a minimum of 5 brand-new altcoin ETF filings throughout the very first half of October, regardless of the continuous United States federal government shutdown stalling development.

Each approval might “unlock for the next wave of institutional purchasing,” stated Leon Waidmann, head of research study at Web3 analytics firm Onchain.

” Altcoin ETF inflows are the unavoidable next action after Bitcoin and Ethereum ETFs showed institutional need,” Waidmann informed Cointelegraph. “This is regulative self-confidence equating into capital circulations.”

Ether ETFs exceed Bitcoin ETF inflows in Q3

Area Ether (ETH) ETFs brought in $ 9.6 billion in inflows throughout the 3rd quarter of 2025, exceeding the $8.7 billion created by area Bitcoin (BTC) ETF inflows, according to information aggregator SosoValue.

That shift signals increasing institutional need for alternative crypto direct exposure.

The pattern might see the altcoin ETFs catalyzing the next wave of institutional altcoin adoption as brand-new regulated automobiles, leading to years of continual inflows, Waidmann stated.

” Organizations discovered Bitcoin by means of ETFs, now they’re moving into Ethereum, and other altcoins are following.”

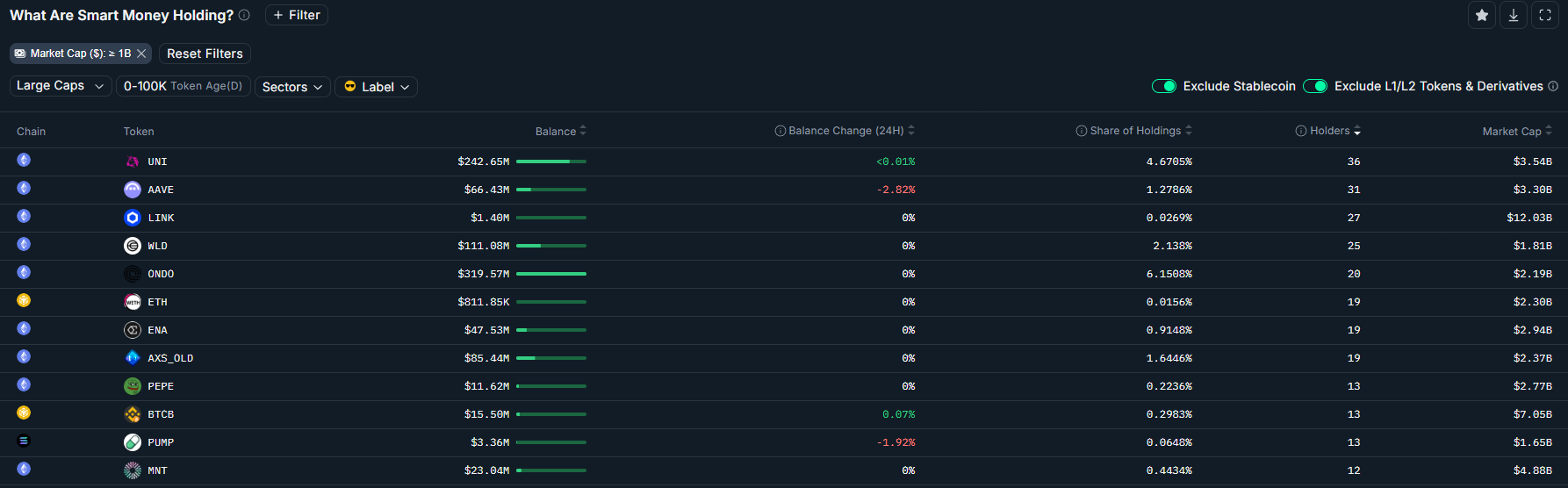

The market’s most effective traders, tracked as “clever cash” traders on Nansen’s blockchain intelligence platform, are likewise placing themselves for the approval of altcoin ETFs.

The Uniswap (UNI), Aave (AAVE) and Chainlink (LINK) were the 3 most held tokens by clever cash traders on Thursday, information from Nansen programs.

Related: Crypto treasuries siphon $800B from altcoins, and it may be ‘permanently’

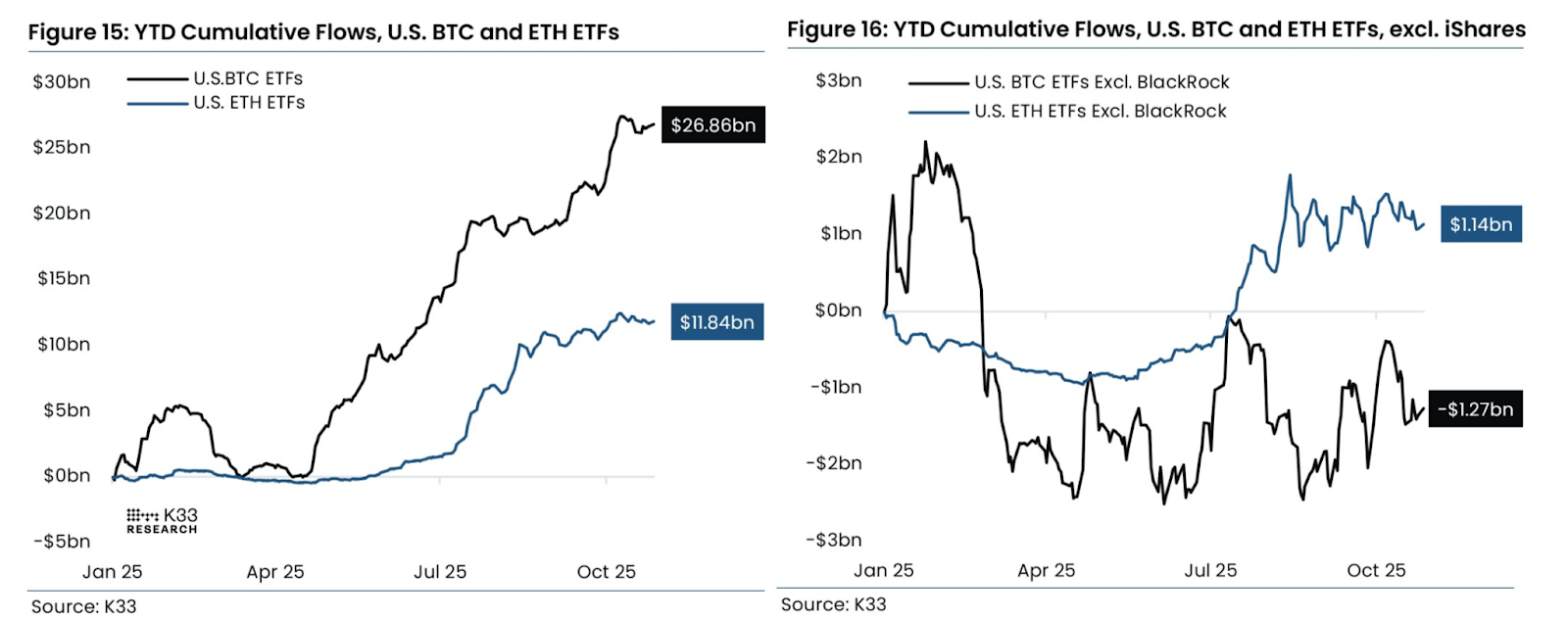

Nevertheless, some experts are worried that BlackRock’s lack from the altcoin ETFs will lead to restricted general inflows, as BlackRock’s Bitcoin ETF has actually accumulated $28.1 billion in financial investments up until now in 2025, making it the only fund to log favorable year-to-date (YTD) inflows.

Without BlackRock’s fund, the area Bitcoin ETFs taped a cumulative web outflow of $1.27 billion year-to-date, according to K33’s head of research study, Vetle Lunde.

Related: Arthur Hayes requires $1M Bitcoin as brand-new Japan PM orders financial stimulus

Based upon the characteristics seen in Bitcoin ETF financial investments, BlackRock’s lack from the altcoin ETF wave might restrict cumulative inflows and their possible tailwind impact on the underlying tokens, the scientist described.

Publication: Bitcoin to see ‘another huge thrust’ to $150K, ETH pressure develops