Secret takeaways:

-

China’s reserve bank stimulus might reroute liquidity into cryptocurrencies.

-

Increasing United States Treasury yields recommend lower danger hostility, supporting prospective healing in altcoin markets.

Reserve banks promote development by minimizing rate of interest or making it possible for unique funding conditions, successfully increasing the cash supply. This vibrant advantages run the risk of possessions such as stocks and cryptocurrencies.

Traders now question if the Chinese reserve bank’s next relocation will supply the liquidity increase that lastly drives altcoins beyond their previous all-time highs.

Financial stimulus is helpful for the cryptocurrency market

A March 2025 21Shares report highlighted a striking 94% connection in between Bitcoin’s (BTC) cost and international liquidity, going beyond both the S&P 500 and gold.

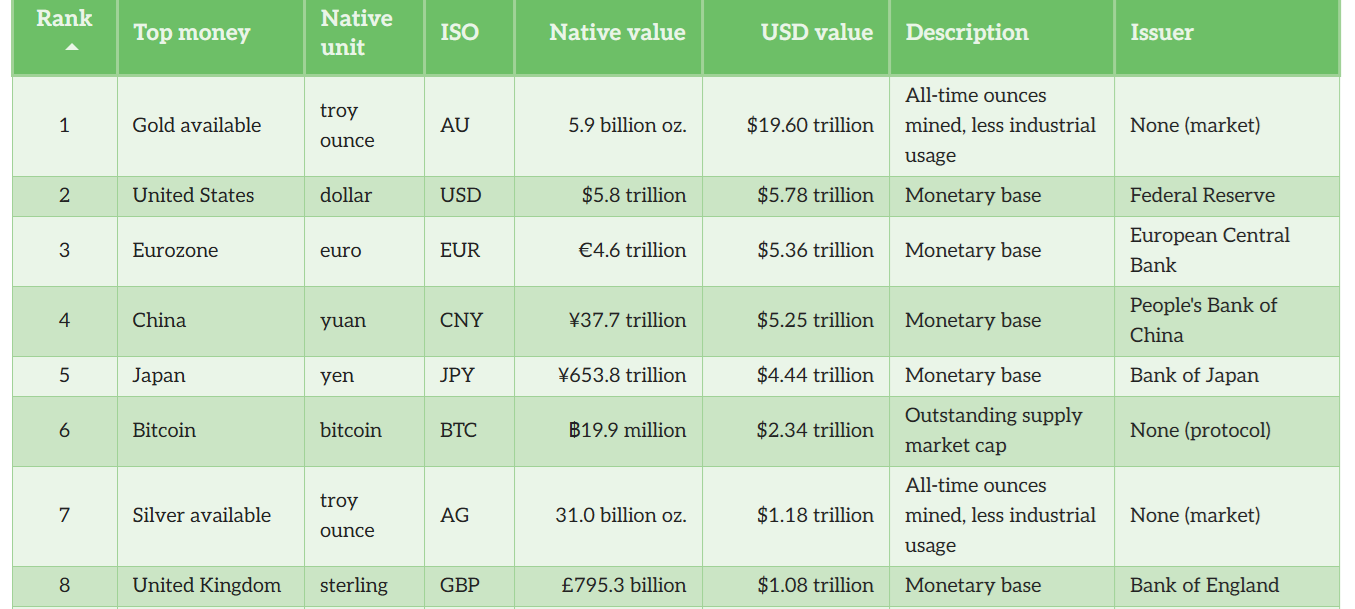

Presently, the United States M0 financial base is $5.8 trillion, followed by $5.4 trillion in the eurozone, $5.2 trillion in China, and $4.4 trillion in Japan, according to Porkopolis Economics. With China accounting for 19.5% of international domestic item, its financial policy choices stay vital, even when the United States Federal Reserve controls headings.

On Thursday, China reported a 0.1% decrease in July retail sales compared to the previous month. Goldman Sachs approximates program that in July alone, financial investments in set possessions fell 5.3% year-over-year, the steepest contraction because March 2020. On the other hand, commercial production increased by simply 0.4% throughout the month. China’s survey-based city joblessness rate likewise reached 5.2% in July, up from 5% in June.

Bloomberg Economics experts Chang Shu and Eric Zhu kept in mind that individuals’s Bank of China (PBOC) might present stimulus steps “as quickly as September.” Likewise, financial experts at Nomura and Commerzbank argued that it is just a matter of time before more powerful assistance policies show up.

Still, even if the PBOC embraces a more expansionist position, cryptocurrency financiers might think twice if international economic downturn worries heighten.

United States customer belief degrades, however traders are not afraid

The University of Michigan’s customer study, launched on Friday, revealed that 60% of Americans anticipate joblessness to get worse over the next year, a belief last tape-recorded throughout the 2008– 09 monetary crisis. Yet markets have actually stayed durable. The S&P 500 closed at a brand-new all-time high, while yields on 5-year Treasurys likewise moved higher, recommending financiers still lean towards optimism.

Related: Bitcoin’s all-time high gains disappeared hours later on: Here’s why

When economic downturn fears increase, need generally increases for possessions backed by the United States federal government, enabling financiers to accept lower yields. After dropping to 3.74% on Aug. 4, the most affordable level in more than 3 months, 5-year Treasury yields rebounded to 3.83% on Friday. The relocation suggests traders are ending up being less risk-averse, opening area for a rebound in altcoin market capitalization.

If China follows through with more powerful stimulus, that included liquidity might be the driver for a broad rotation into danger possessions. In such a circumstance, the push from the PBOC might suffice to move cryptocurrencies to fresh all-time highs.

This short article is for basic details functions and is not meant to be and ought to not be taken as legal or financial investment recommendations. The views, ideas, and viewpoints revealed here are the author’s alone and do not always show or represent the views and viewpoints of Cointelegraph.