Web3 business Animoca Brands signed a non-binding memorandum of understanding (MOU) with DayDayCook (DDC) Business, a meal-prep and packaged food business that just recently embraced a Bitcoin (BTC) treasury method, to handle Animoca’s BTC holdings and create a yield on those reserves.

Animoca will designate as much as $100 million in BTC as part of the offer, according to a joint statement from Thursday.

Animoca Brands co-founder and executive chairman Yat Siu informed Cointelegraph that DDC Business was picked in part due to the fact that of CEO Norma Chu and her capability to cultivate a “considerable non-crypto following,” presenting the possession sector to the public, which might not have had an interest in crypto otherwise. Siu likewise stated:

” Her background and her experience make it possible for Norma to bridge the East and West to effectively browse markets on both sides of the world; she has excellent appeal and connections to the Chinese market, among the biggest for crypto adoption, while likewise running a NASDAQ-listed business.”

DDC Business tipped its Bitcoin treasury strategies in Might, setting an objective to purchase 5,000 BTC over 3 years. That very same month, the business bought 21 BTC for its business treasury.

The Bitcoin treasury story continues to get traction, as corporations embrace the supply-capped possession as a hedge versus inflation, and, in many cases, reorient themselves to end up being Bitcoin holding business.

The expansion of Bitcoin treasury companies has actually left financiers divided about the results of these business on the marketplace, with some arguing it will enhance traditional adoption and others alerting that overleveraged BTC business might activate the next market disaster.

Related: Bitcoin treasury playbook deals with ‘far much shorter life-span’– Expert

Bitcoin Treasury Technique ends up being a leading pattern in 2025

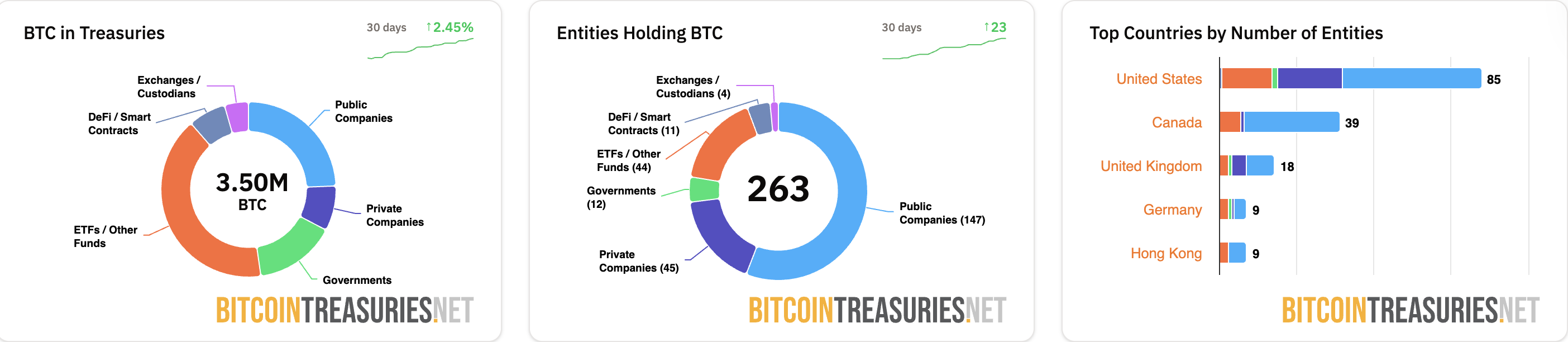

There are presently 268 organizations holding BTC on their balance sheets, consisting of public business, personal business, federal government companies, possession supervisors, and crypto companies, according to BitcoinTreasuries.

Public business represent 147 of these 268 organizations, making them the biggest classification of institutional Bitcoin holders by a large margin.

Bitcoin treasury business included 159,107 BTC in Q2 2025, valued at over $18.7 billion utilizing present rates, and representing a 23% quarter-over-quarter boost in acquisitions.

In June, cypherpunk and Blockstream CEO Adam Back stated the Bitcoin treasury pattern is the brand-new altseason for crypto traders and short-term cost speculators. “Time to dispose ALTs into BTC or BTC treasuries,” the CEO composed in a June 22 X post.

In spite of the development of BTC treasury alternatives and the marketplace buzz, some market experts and crypto companies caution that the majority of treasury business will not make it through the next market slump and will capitulate as quickly as BTC rates start to drop and inexpensive business funding alternatives vanish.

Publication: NBA star Tristan Thompson misses out on $32B in Bitcoin by taking $82M agreement in money