Australia’s nationwide monetary intelligence firm has actually presented brand-new operating guidelines and deal limitations for crypto ATM operators, as federal cops state rip-offs through the kiosks are on the increase.

The Australian Deal Reports and Analysis Centre (AUSTRAC) is implementing a 5,000 Australian dollar ($ 3,250) limitation on money deposits and withdrawals on crypto ATMs, rip-off indication, more robust deal tracking and improved consumer due diligence responsibilities, the firm stated in a June 3 news release shown Cointelegraph.

Presently, the limitations just use to crypto ATM suppliers; nevertheless, AUSTRAC anticipates crypto exchanges running in Australia to “think about enforcing comparable limitations if they accept money for crypto deals.”

AUSTRAC CEO Brendan Thomas stated the brand-new guidelines are not set in stone, and the “efficiency of these conditions” will stay under evaluation and be changed if required while the firm deals with police and ATM suppliers to suppress any suspicious activity.

” The conditions are created to assist secure people from rip-offs by discouraging crooks from directing them to a crypto ATM, in addition to to secure organizations from criminal exploitation,” he stated.

” Because of the dangers and damages, we consider it definitely essential to make sure the sector fulfills minimum requirements and lowers the criminal abuse of crypto ATMs.”

The crackdown was set off after an examination by an AUSTRAC job force taken a look at information from 9 crypto ATM suppliers and discovered that the majority of users are over 50 years of age and represent nearly 72% of all deals by worth.

The job force was established last September to examine whether crypto ATMs had the correct Anti-Money Laundering and counter-terrorism checks in location.

” It is a big issue that individuals in this market are overrepresented as consumers utilizing money to buy cryptocurrency and, as proof recommends, that a a great deal of 60-70 years of age users are victims of rip-off activity,” Thomas stated.

There are nearly 150,000 crypto ATM deals yearly in Australia, with about $275 million moving through them utilizing money to purchase Bitcoin (BTC), Tether (USDT) and Ether (ETH), according to AUSTRAC.

Millions lost to crypto ATM rip-offs simply “suggestion of the iceberg”

The Australian Federal Cops (AFP) stated on June 3 that the nation’s online cybercrime reporting system, ReportCyber, got 150 distinct reports of rip-offs including crypto ATMs in between January 2024 and January 2025.

It included that overall losses surpassed 3.1 million Australian dollars ($ 2 million), which it stated “might be simply the suggestion of the iceberg.”

Related: Australia’s financing guard dog to punish inactive crypto exchanges

AFP Leader Graeme Marshall stated much of those fooled through crypto ATMs do not understand they’re victims, do not understand how to report the rip-off or “feel ashamed since they were scammed.”

” Fraudsters frequently utilize advanced techniques to generate funds from victims. We would motivate individuals to share their stories with friends and family to raise awareness and assistance avoid others from falling victim,” he stated.

Australia was a sluggish market for crypto ATMs, however adoption increased greatly near completion of 2022 after personal companies started stacking into the marketplace.

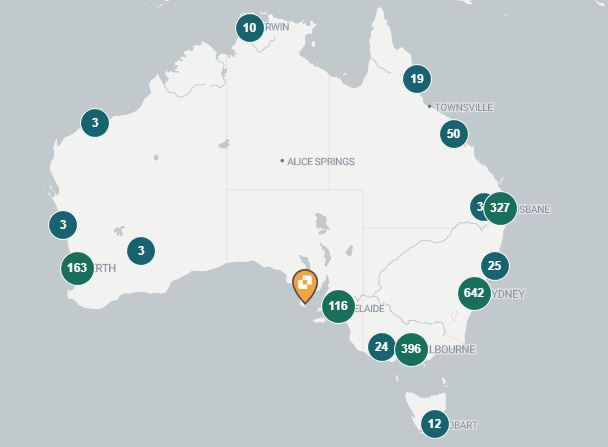

The nation is now the third-largest center for crypto ATMs, and Coin ATM Radar information reveals Australia presently has 1,819 ATMs, up from 67 in August 2022.

Leading crypto ATM suppliers in Australia consist of Localcoin, with 753 in its steady; Coinflip, with 700 ATMs; and Bitcoin Depot, with 182.

Publication: Wealthy, separated, and extraordinary beaches: Perth Crypto City Guide