Bitcoin bulls who still believe the cycle peak has yet to come as retail financiers have not stacked in yet may be utilizing an out-of-date playbook, according to a crypto executive.

” The concept that the cycle isn’t over even if onchain retail activity is missing requirements reconsideration,” CryptoQuant creator and CEO Ki Young Ju stated in a March 19 X post.

Ju stated that those tracking retail motions utilizing just onchain metrics will not have actually seen the complete image.

” Retail is most likely getting in through ETFs– the paper Bitcoin layer– which does not appear onchain,” Ju stated.

” This keeps the recognized cap lower than if the funds were streaming straight to exchange deposit wallets,” he included, keeping in mind that 80% of area Bitcoin (BTC) exchange-traded fund (ETF) streams originated from retail financiers– a pattern that Binance experts currently as soon as observed in October in 2015.

Given that the launch of area Bitcoin ETFs in January 2024, inflows have actually amounted to around $35.88 billion. Source: Farside

At the time, the experts stated the majority of the ETF purchasing most likely originated from retail financiers moving their holdings from wallets and exchanges into funds with more regulative security.

Ju was reacting to counter-arguments over his earlier forecast on X that the “Bitcoin bull cycle is over” on March 17.

” I have actually been requiring a booming market over the previous 2 years, even when indications were borderline. Sorry to alter my view, however it now looks quite clear that we’re getting in a bearish market,” he stated.

Ju described that particular indications are revealing an absence of brand-new liquidity, which is most likely being driven by macro aspects.

He likewise clarified when he stated the bull cycle was over, he implied Bitcoin might take “6-12 months” to break its all-time high, not that it will crash.

Related: Bitcoin is simply seeing a ‘regular correction,’ cycle peak is yet to come: Experts

Traders frequently take a look at retail financier activity to area indications of fatigue or as a signal to begin offering when the marketplace appears overheated.

There are a number of belief indications which assist market individuals comprehend the level of retail interest in the market. Among these is the Crypto Worry & & Greed Index, which determines total crypto market belief, checking out a “Worry” rating of 31, down 18 points from its “Neutral” rating of 49 the other day.

Other typical signals utilized to track the level of retail interest in the crypto market consist of Google search patterns for “crypto” and associated keywords and the appeal of crypto applications in significant app shops around the world.

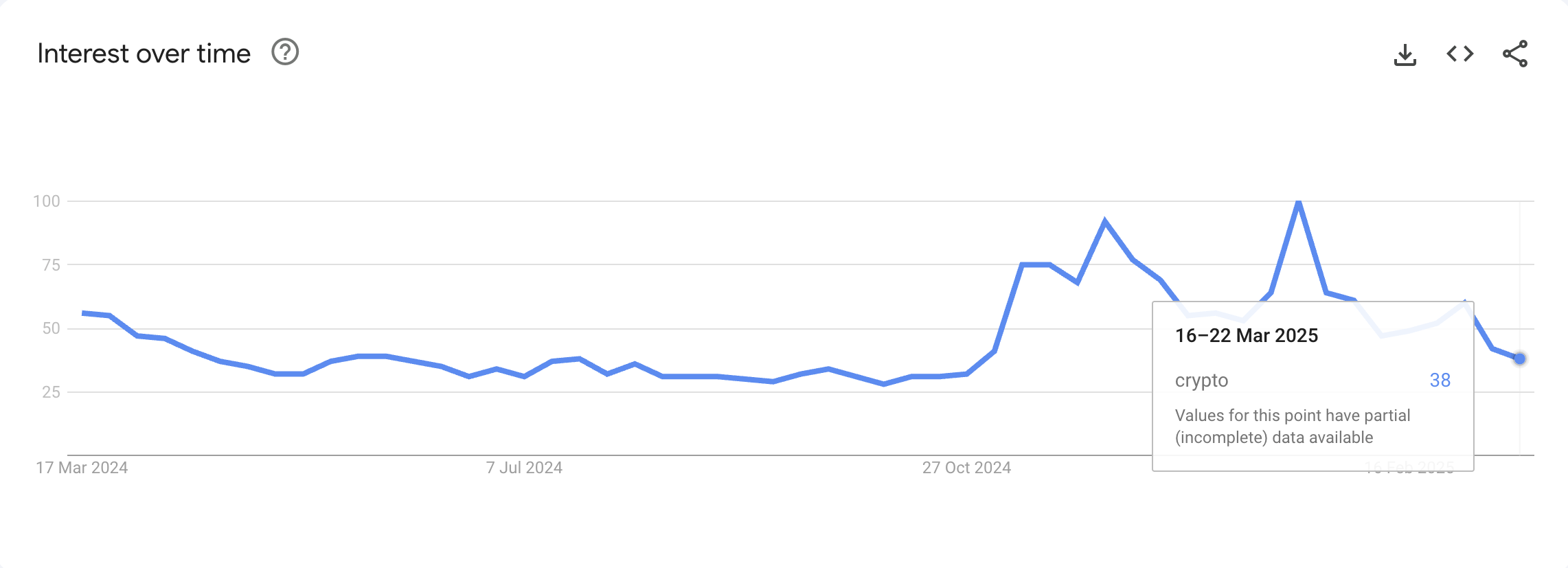

While the Google search rating for “crypto” worldwide was at a rating of 100 throughout the week of Jan. 19 – 25, when Bitcoin reached its all-time high of $109,000 and United States President Donald Trump’s inauguration, it has actually because decreased by nearly 62%.

The quantity of searches on Google for “crypto” has actually decreased nearly 62% because completion of January. Source: Google Trends

At the time of publication, the Google search rating for “crypto” stands at 38, with Bitcoin trading 22% listed below its January all-time high.

Publication: Memecoins are ded– However Solana ‘100x much better’ in spite of profits plunge

This post does not consist of financial investment suggestions or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.