United States Treasury Secretary Scott Bessent stated on Thursday that the United States would suspend constraints developed to restrict access to Chinese business purchasing innovation that the United States federal government thinks about delicate.

The relieved constraints were given up exchange for China accepting suspend its export manages on uncommon earth minerals utilized in electronic devices and military defense applications, according to Reuters.

Bessent’s statement follows a number of weeks of softening trade stress in between the 2 nations, which is usually a favorable driver for crypto costs.

Nevertheless, the current Federal Free market Committee (FOMC) conference and Federal Reserve Chair Jerome Powell’s remarks, consisting of that the FOMC members have “highly varying views” about a December rates of interest cut, triggered markets to find Thursday.

The Federal Reserve likewise indicated completion of quantitative tightening up, which limits liquidity in the monetary system, and greater liquidity is likewise a favorable driver for crypto costs.

In Spite Of this, there is usually a space in between completion of QT and the start of quantitative easing, when liquidity is actively pumped through the monetary system, indicating crypto costs can sink even more to the drawback till liquidity injections show up.

Related: United States Treasury chief Bessent states ‘considerable’ trade structure with China reached

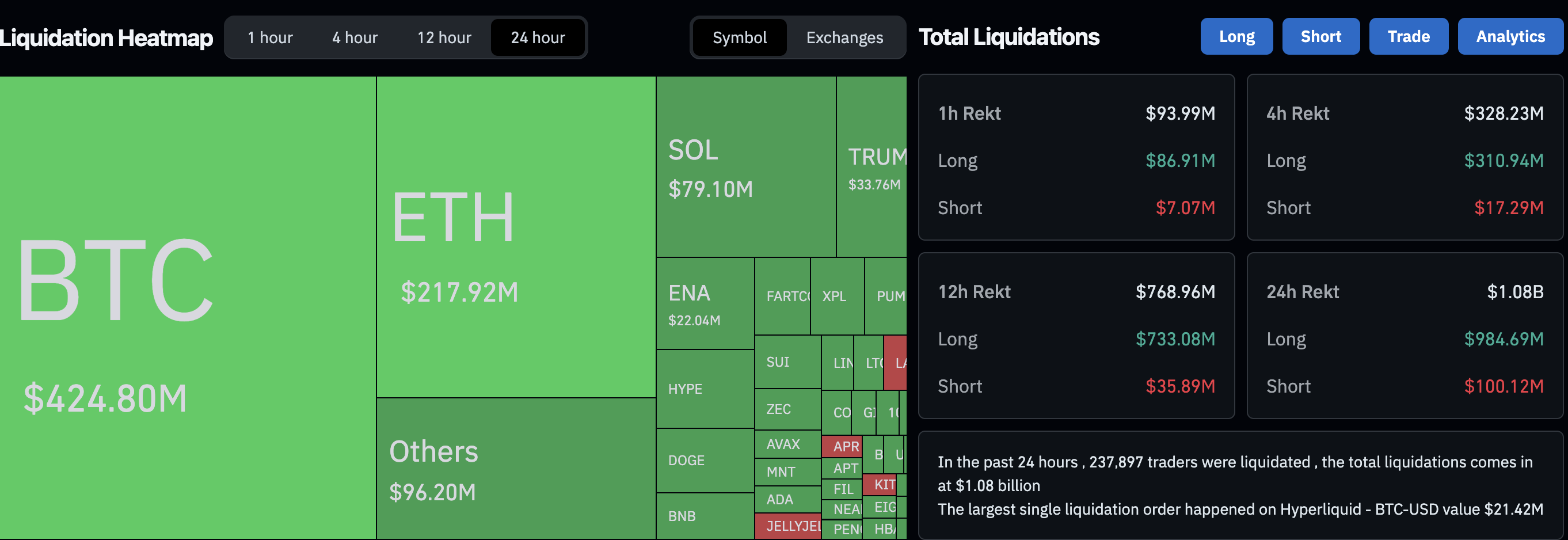

Crypto liquidations cross $1 billion following FOMC conference

The cost of Bitcoin (BTC) fell by 35% in 2019 after the Federal Reserve ended QT, triggering financier worries of a comparable situation throughout the existing market cycle.

Powell’s remarks at Wednesday’s FOMC interview likewise left financiers unsure about the instructions of financial policy, in spite of the Fed slashing rates of interest by 25 basis points.

” Inflation has actually relieved substantially from its highs in mid-2022, however stays rather raised relative to our 2% target objective,” Powell stated.

He likewise included that the FOMC is having problem stabilizing the Fed’s double required of optimum work and steady rates.

” There were highly varying views about how to continue in December. A more decrease in the policy rate at the December conference is not an inevitable conclusion– vice versa. Policy is not on a predetermined course,” he included.

Over $1.1 billion was liquidated from the crypto market in the following 24 hr, triggering the cost of BTC to fall listed below $107,000 and its 200-day rapid moving average (EMA), a crucial and vibrant level of assistance, according to information from Nansen.

Publication: Ether might ‘rip like 2021’ as SOL traders brace for 10% drop: Trade Tricks