Bottom line:

-

Bitcoin financiers are maximizing the greatest rate levels in a number of months by squandering revenues.

-

These are balancing $1 billion daily, resulting in issues that the marketplace return might stall and even reverse.

-

Institutional involvement has actually not resulted in a modification in state of mind, CryptoQuant states.

Bitcoin (BTC) runs the risk of a “regional top or sharp correction” if present levels of profit-taking continue, brand-new research study cautions.

In a “Quicktake” post on Might 8, onchain analytics platform CryptoQuant flagged raised understood revenues amongst BTC financiers.

BTC profit-taking spikes to January highs

Bitcoin understood revenues have actually surged to multimonth highs today as BTC/USD reached near to $98,000.

For CryptoQuant, the marketplace is ending up being equivalent to late 2024, when the set broke through old all-time highs and struck $100,000 for the very first time.

” Even after favorable rate action after March-April drop in 2025, revenue taking is still aggressive. Perhaps not like November-December 2024 however still high,” factor Kripto Mevsimi composed.

” This is traditionally constant with late-stage booming market habits– where profit-taking controls, even as rate continues to increase.”

CryptoQuant information puts the present 7-day moving typical understood revenue throughout the hodler spectrum at roughly $1 billion daily.

” If we recall at comparable cycles (e.g. 2021), this stage frequently preceded a regional top or sharp correction, specifically when profit-taking remained high and constant,” it continued.

No hiding from Bitcoin “financier psychology”

As Cointelegraph reported, some market analysts have actually argued that the Bitcoin financial investment landscape has actually basically altered thanks to increased institutional involvement.

Related: Bitcoin promotes $98K as 2025 Fed rate cut chances turn ‘downhearted’

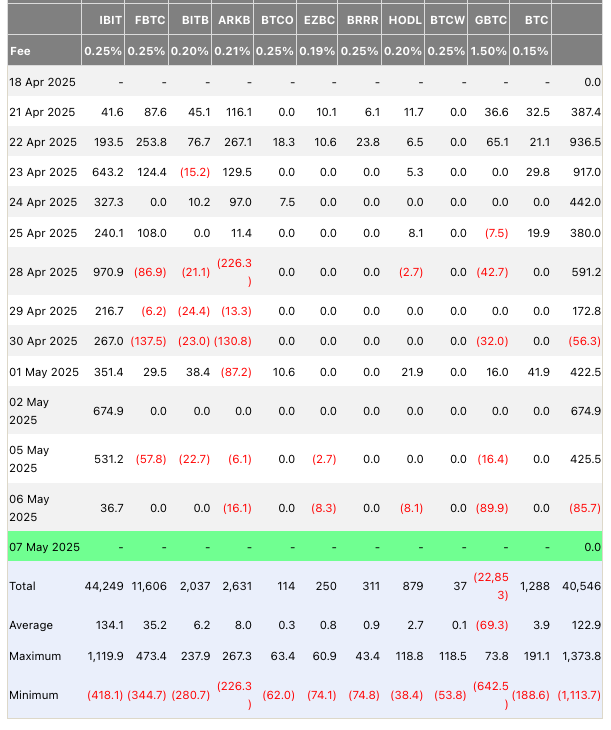

Chief amongst the brand-new gamers are the United States area Bitcoin exchange-traded funds (ETFs), the biggest of which, BlackRock’s iShares Bitcoin Trust (IBIT), has actually seen net inflows every day for more than 2 weeks.

Regardless Of this, Kripto Mevsimi competes that underlying responses to BTC rate modifications stay the very same.

” Given that area ETFs introduced in January 2024, market structure has actually altered– however financier psychology hasn’t,” he summed up.

This post does not include financial investment recommendations or suggestions. Every financial investment and trading relocation includes threat, and readers ought to perform their own research study when deciding.